Take Charge of Your Investments

Sign up for FREE investment newsletter AlphaProfit MoneyMatters

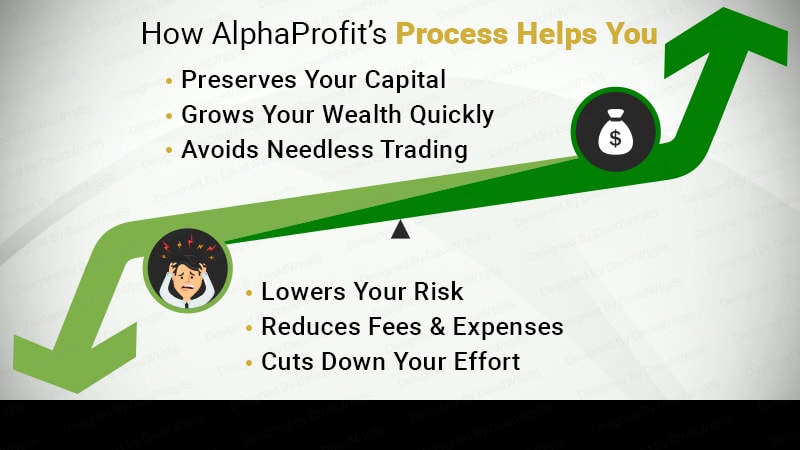

Put Your Investments on the Right Track

You will own the best ETFs, best mutual funds, and best stocks chosen by AlphaProfit’s prescient investment selection system for strong performance in the market ahead.

Read More

Minimize Your Risk

You will use three proven risk reduction strategies to minimize losses during bearish periods without reducing your returns in bull markets.

Read More

Minimize Your Costs

You will keep a tight lid on your investing expenses.

You will invest in low-cost ETFs.

You will invest in no-load, no-transaction-fee mutual funds without incurring short-term redemption fees.

You will stop paying hefty fees or commissions to your investment advisor (if you currently have one).

Read More

Minimize Your Effort with AlphaProfit Investment Newsletter

Investment research is a full-time activity. Part-time dabbling often leads to frustration and financial losses. By outsourcing your investment research to AlphaProfit Premium Service investment newsletter, you will free up your time for more important and pleasurable activities.

Read More

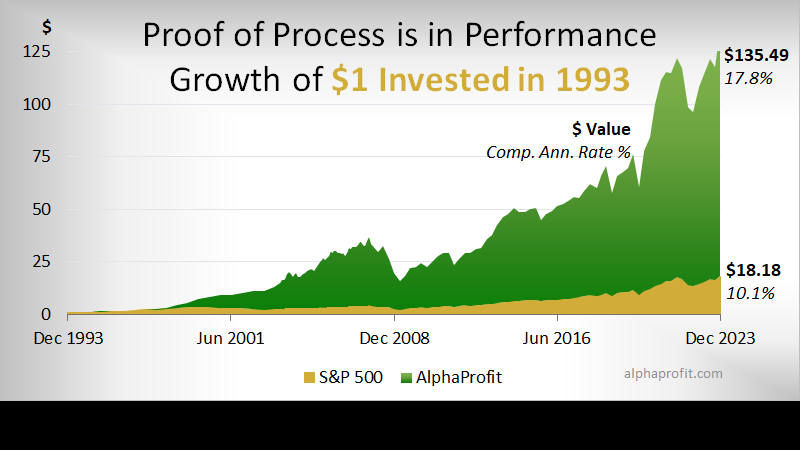

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023