Investors seeking exposure to emerging markets generally consider broadly diversified exchange-traded funds like Vanguard MSCI Emerging Markets ETF (VWO) or iShares MSCI Emerging Markets ETF (EEM).

A few regional ETFs are available offering exposure to emerging markets in different geographic regions. They include iShares MSCI Emerging Markets Eastern Europe ETF (ESR) and iShares S&P Latin America 40 ETF (ILF).

The rapid economic growth of Brazil, Russia, India, and China has made investing in the BRIC theme highly popular. iShares MSCI BRIC ETF (BKF) is an example of this thematic ETF. Another thematic ETF is iShares S&P Emerging Markets Infrastructure ETF (EMIF) to profit from infrastructure build-out programs in emerging markets.

Now a new option has become available for investment specifically in ASEAN countries … the Global X ASEAN ETF (ASEA). This ETF seeks to match the performance of stocks included in the FTSE ASEAN 40 Index.

What is ASEAN

ASEAN, an acronym for Association of Southeast Asian Nations, is a group of countries seeking to accelerate economic growth through mutual free trade. The association includes Indonesia, Malaysia, the Philippines, Singapore, and Thailand as the founding members along with Brunei, Cambodia, Laos, Myanmar and Vietnam.

|

Global X ASEAN ETF (ASEA) invests in Indonesia, Malaysia, the Philippines, Singapore, and Thailand, the founding members of the Association of Southeast Asian Nations. |

Investments in the Global X ASEAN ETF

The Global X ASEAN ETF invests in the 40 largest companies in the founding members of ASEAN. The current weightings for these countries are as follows: Singapore 41.2%, Malaysia 32.8%, Indonesia 14.8%, Thailand 10.6%, and the Philippines 0.6%.

Why invest in Global X ASEAN ETF

Singapore features in the MSCI Developed Markets Index. The other four founding members of ASEAN are among the fastest growing emerging nations, benefiting from foreign direct investments, low labor costs, and strengthening relationship with China. A rapidly expanding affluent middle class, that is estimated to touch 300 million by 2015, is driving demand for a variety of consumer goods and services.

How to invest in Global X ASEAN ETF

The Vanguard MSCI Emerging Markets ETF and the iShares MSCI Emerging Markets ETF invest in a broad range of emerging market countries from Brazil to Turkey. As such, only 6% to 7% of assets are invested in Indonesia, Malaysia, Thailand, and the Philippines, the emerging economies of ASEAN.

To increase exposure to the ASEAN block, investors can take a core and satellite approach with Vanguard MSCI Emerging Markets ETF or the iShares MSCI Emerging Markets ETF as the core and Global X ASEAN ETF as the satellite part of their emerging market ETF portfolio. For more on ETF portfolio construction, see: Best ETFs to Build Your ETF Portfolio

Alternative to Global X ASEAN ETF

In lieu of investing in Global X ASEAN ETF, investors can also invest in ETFs specific to individual countries in the FTSE ASEAN 40 Index. They are iShares MSCI Indonesia ETF (EIDO), iShares MSCI Malaysia ETF (EWM), iShares MSCI Philippines ETF (EPHE), iShares MSCI Singapore ETF (EWS), and iShares MSCI Thailand ETF (THD).

Risk of Investing in Global X ASEAN ETF

Over 40% of Global X ASEAN ETF’s assets are invested in Singapore and nearly 75% of the ETF’s assets are invested in Malaysia and Singapore, posing country concentration risk. Another risk is the dependence of ASEAN countries on China. Like other emerging markets ETFs, Global X ASEAN ETF carries foreign currency, inflation, and political risks.

AlphaProfit ETF Model Portfolios and ETF Investment Newsletter

AlphaProfit’s proven ETF selection process enables thousands of investors to thrive in turbulent markets.

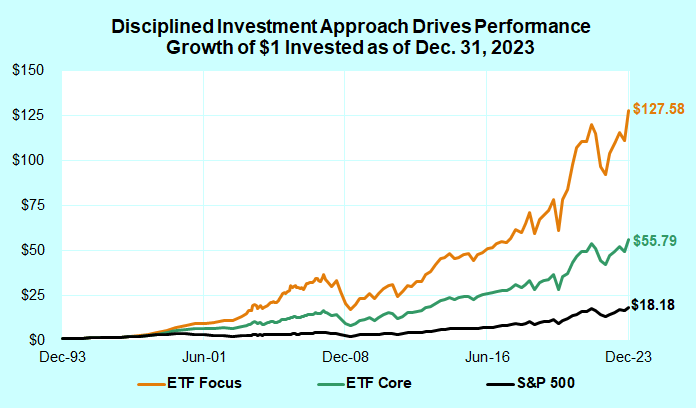

A dollar invested in the AlphaProfit’s Aggressive Growth (ETF-Focus) and Capital Appreciation (ETF-Core) model portfolios is worth $47.59 and $24.57, respectively. This implies annualized returns of 19.9% and 16.3%, respectively.

Performance of ETF model portfolios as of March 31, 2015.

Comparable investments in the Dow Jones Wilshire 5000 and S&P 500 benchmarks are worth $6.85 and $6.70, respectively implying annualized returns of 9.5% and 9.4%, respectively.

The ETF model portfolios use AlphaProfit’s proven ValuM investment process for selecting investments. This process has enabled AlphaProfit model portfolios to bag Hulbert Financial’s #1 rank numerous times.

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023