Driving Performance with Disciplined Investment Process

AlphaProfit’s proven Fidelity mutual fund selection process enables thousands of investors to thrive in turbulent markets.

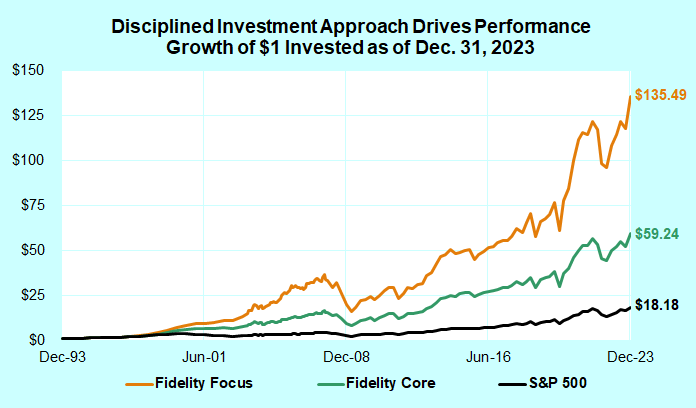

A dollar invested in the Fidelity Aggressive Growth (Focus) and Fidelity Capital Appreciation (Core) model portfolios is worth $135.49 and $59.24, respectively. This implies annualized returns of 17.8% and 14.6%, respectively.

A comparable investment in the S&P 500 benchmark is worth $18.18, implying an annualized return of 10.1%.

Performance of Fidelity Focus and Fidelity Core mutual fund model portfolios as of December 31, 2023. Sign up for Fidelity Newsletter.

Exemplifying the resiliency of AlphaProfit's disciplined Fidelity mutual fund selection process, the AlphaProfit No-Fee Growth model portfolio (No-Load, No-Transaction Fee Growth or NL-NTF Growth) is up 523% since the start of 2009, compared to the 431% gain for its benchmark.

Performance of AlphaProfit NL-NTF Growth model portfolio as of December 31, 2023. Sign up for Fidelity Newsletter.

The Fidelity mutual fund model portfolios use AlphaProfit's proven ValuM investment process for selecting investments. This process has enabled AlphaProfit model portfolios to bag Hulbert Financial's #1 rank multiple times. Hulbert Financial tracks the performance of the Fidelity Focus and Core model portfolios from January 1, 2004.

Here are just a few examples of returns earned by individual mutual funds selected by AlphaProfit from Fidelity FundsNetwork:

- 272.9% gain from Fidelity Select Technology (FSPTX)

- 125.7% gain from Fidelity Select Biotechnology (FBIOX)

- 102.1% gain from Fidelity Select Retailing (FSRPX)

- 71.5% gain from Fidelity Select Insurance (FSPCX)

- 71.0% gain from Fidelity Select Natural Gas (FSNGX)

- 78.9% gain from Yacktman Fund (YACKX)

Fully 75% of individual mutual funds selected gained during the period that included the 2008 crash and the dot-com bust.

In addition to the Fidelity mutual fund model portfolios, AlphaProfit also provides short-term Fidelity fund trading recommendations. These trades on average have netted 7% per month.

Related Links:

Fidelity Newsletter

AlphaProfit Core Model Portfolio: The Right Choice for Rollover and SEP-IRA

Turning Five, AlphaProfit Trounces the Titans!

The Dow Jones Wilshire 5000 serves as the benchmark for the Aggressive Growth and Capital Appreciation models portfolios. The Growth model portfolio’s benchmark consists of U. S. stocks (56%), foreign stocks (24%), and cash (20%). Low cost index funds Fidelity Total Market Index Fund (FSKAX) and Fidelity International Index Fund (FSPSX) are used as proxies for U. S. stocks and foreign stocks, respectively.

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023