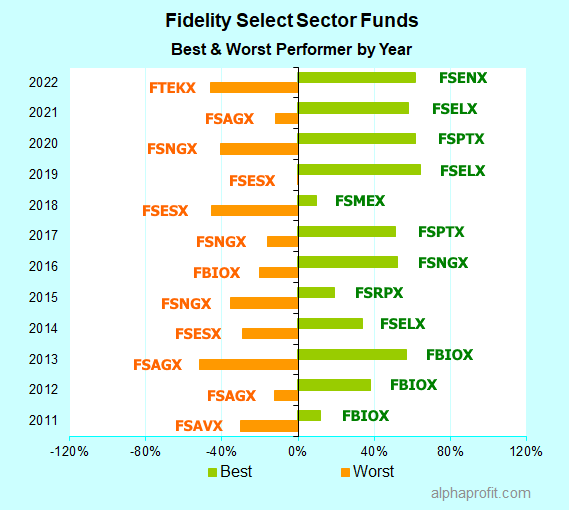

Each year, best Fidelity Select Sector funds, on average, beat the S&P 500 by 42%, that is 4,200 basis points. Fidelity Select Energy leads the performance table in 2022 with a year-to-date return of 62%. The Fidelity 500 Index Fund is down 17% in comparison. Which funds will stake their claim as the best Fidelity Select Sector Funds in 2023?

Worries of high inflation and rising interest rates have weighed on stocks through 2022.

The core personal consumption expenditures price index, the Federal Reserve’s preferred inflation measure, has averaged an annual gain of 5.0% this year. That is over twice the Fed’s long-term inflation goal of 2%.

After being late in recognizing the non-transient forces driving inflation, the Fed changed its interest rate policy this year.

The central bank rapidly ramped up its federal funds benchmark interest rate from close to 0% at the start of 2022 to the 4.25-4.50% range by year-end.

Financial assets lost value as the central bank tightened interest policy and drained liquidity.

As of December 21, the Fidelity 500 Index Fund (FXAIX), which tracks the S&P 500 index ($SPX), is down 17% for the year.

According to Bespoke Investment Group, the U.S. stock market has lost nearly $12 trillion in market capitalization from its January 3 high. The mega-cap club members Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), and Tesla (TSLA) account for nearly $5 trillion of these losses.

Best Fidelity Select Funds of 2022

Funds focused on commodity-oriented sectors dominate the list of top performers among Fidelity sector funds, including Fidelity Select Funds and Fidelity Thematic Funds.

Fidelity Select Energy (FSENX) leads the performance table with a year-to-date return of 62%. Oil prices and energy stocks surged over 60% in the first five months of 2022. Energy stocks managed to hold on to these gains even though oil prices retreated in the last seven months of the year.

Funds owning commodity stocks, Fidelity Natural Resources Fund (FNARX), Fidelity Global Commodity Stock Fund (FFGCX), and Fidelity Agricultural Productivity Fund (FARMX), take spots two through four with gains of 40%, 22%, and 15%, respectively.

Fidelity Select Insurance (FSPCX) is the sole non-commodity fund to rank among the top five. It claims the fifth spot with a gain of 8%.

Only 11 of the 47 Fidelity sector and thematic funds are in the black for the year.

Stubborn inflation and rising interest rates have raised fears of a recession. Investors’ appetite for owning stocks diminished in 2022. Thirty-six of the 47 Fidelity sector and thematic funds are in the red this year. Fidelity Select Energy (FSENX) leads the pack with a 62% gain, while Fidelity Disruptive Technology Fund (FTEKX) is the biggest loser.

Get timely market insights by signing up for the Fidelity Newsletter

Story stocks, or stocks of companies offering the promise of large profits far into the future, have suffered the most. Rising interest rates have lowered the present value of profits well into the future.

The funds that own such companies, Fidelity Disruptive Technology Fund (FTEKX), Fidelity Disruptive Communications Fund (FNETX), and Fidelity Select Communication Services (FBMPX) are at the bottom of the return table after losing 46%, 39%, and 38%, respectively.

Fidelity Select Funds: The Market Milieu in 2023

Inflation remains stubbornly high. In December, the year-over-year change in the core PCE was 4.7%, compared to the high of 5.4% set in March.

Fed Chair Powell acknowledged this fact, saying recent signs of inflation are not enough to convince the central bank that the battle against rising prices is over.

In December, the Fed’s interest rate policy committee forecasted the federal funds rate to rise above 5% in 2023.

The Fed’s focus on bringing inflation down to 2% has investors worried. Many investors believe the Fed is overdoing interest rate increases to tame inflation and could start a new U.S. recession.

Several economic indicators signal a recession. They include the steeply inverted bond yield curve, 10 straight months of decline in existing home sales, and 9 consecutive months of drop in the Conference Board’s U.S. Leading Economic Index.

Although job creation has stayed strong, giving hope that the economy will avoid a recession, investors fear the Fed will raise interest rates even more if the job market remains robust.

As the odds of a recession rise, investors have turned more pessimistic about earnings growth prospects in 2023.

Analysts have whittled down earnings forecasts for the S&P 500 members. They now expect S&P 500 companies to grow earnings by 5.3% in 2023, lower than their forecasts for 8.2% and 9.4% growth on September 30 and June 30, respectively.

There are a few positives worth noting amidst this gloom.

First, China is looking to increase its growth rate by easing COVID restrictions and boosting its real estate sector. Global economic growth should get a lift if China succeeds in this effort.

Second, headwinds to U.S. company earnings from a rising dollar should ease in 2023 if the peak in inflation has passed and the economy weakens.

Best Sectors for 2023

AlphaProfit uses its multi-dimensional sector evaluation and selection process to select industries and sectors with superior return potential. These selections help subscribers to protect and grow their assets with low volatility.

See Fidelity Select Funds: Choose the Best Fidelity Sector Fund Consistently.

The consumer discretionary and healthcare sectors rank high in AlphaProfit’s sector evaluation and selection process.

Consumer Discretionary Sector: The year 2022 was challenging for many companies in the consumer discretionary sector. The consumer discretionary stocks in the S&P 500 are down 35%, nearly twice as much as the S&P 500.

High inflation and falling real wages sapped consumer spending. Retailers bore the brunt as inventories bulged and forced stores to discount merchandise. Travel-related businesses fared better as consumers preferred spending on services and experiences over goods.

Consumer discretionary stocks are attractively valued. A challenging 2022 also sets up easy year-over-year profit comparisons. Although prolonged inflation and a deep recession can hurt consumer discretionary stocks further, they can be among the leaders when inflation moderates and the Fed pivots to cut interest rates.

Healthcare Sector: Consumer demand for healthcare products and services tends to be resilient to economic vagaries. Healthcare stocks stayed true to their promise of being a defensive play in 2022. Healthcare stocks in the S&P 500 have held up much better than the broad benchmark, losing just 2%.

Healthcare companies have a few things going for them in 2023. One, healthcare companies are consolidating as mature ones with robust cash flow look to acquire smaller companies with innovative technologies and higher growth potential. Second, the U.S. Food & Drug Administration is approving promising therapies at an accelerated rate. Third, a divided Congress and the recent extension of healthcare subsidies through the Inflation Reduction Act mitigate legislative risk.

At a minimum, the above factors should help healthcare stocks outperform the broad market until investors’ risk appetite improves.

Best Fidelity Select Funds for 2023

Investors can invest in Fidelity Select funds with the latitude to invest across the entire sector, such as Fidelity Select Consumer Discretionary (FSCPX) and Fidelity Select Health Care (FSPHX), to profit from the above trends.

However, investors can earn higher returns with lower volatility by targeting specific consumer discretionary and healthcare industries.

On December 30, AlphaProfit will reconstitute its Fidelity Core and Fidelity Focus model portfolios with a mix of Fidelity Select funds and Fidelity Thematic funds to help Premium Service subscribers protect and grow their assets.

To get timely recommendations of best Fidelity funds in AlphaProfit’s Fidelity Core and Fidelity Focus model portfolios, subscribe to AlphaProfit Premium Service now.

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023