Last week, investors looked for signs of weakening demand and profit pressures in first-quarter earnings reports as companies found it more challenging to outperform analysts’ revenue forecasts than profit forecasts. Investors did not reward companies for outperforming low-bar EPS estimates, preferring to wait for mega-cap earnings this week. Updates on economic growth and inflation are also due this week.

Investors looked for signs of weakening demand and profit pressures as the pace of first-quarter earnings reports picked up last week.

According to FactSet, 76% of S&P 500 companies reported first-quarter EPS above analysts’ forecasts, after 18% of S&P 500 companies reported results. This tally compares with the 5-year average of 77% of companies outperforming.

Companies found it more challenging to top analysts’ revenue forecasts. Only 63% of companies reported revenue above analysts’ forecasts, lagging behind the 5-year average of 69% of companies posting positive revenue surprises.

Economic data pointed to a deteriorating economy. The March reading of the Conference Board’s U.S. Leading Economic Index was the lowest since November 2020. The number of people collecting unemployment benefits reached the highest level since November 2021, suggesting the labor market is cooling.

China’s GDP rose by 4.5% in the first quarter of 2023, compared to economists’ forecast of 4.0% growth in a Reuters poll. The Chinese economy grew at its fastest rate in 12 months last quarter.

The debt ceiling debate in Congress showed signs of being highly contentious. House Speaker McCarthy said a “no strings attached” debt ceiling increase will not pass the House. A proposal with spending cuts or “strings attached” is unlikely to pass the Senate.

Stocks failed to make headway as investors watched for signs of an economic slowdown and waited for mega-cap company earnings to follow.

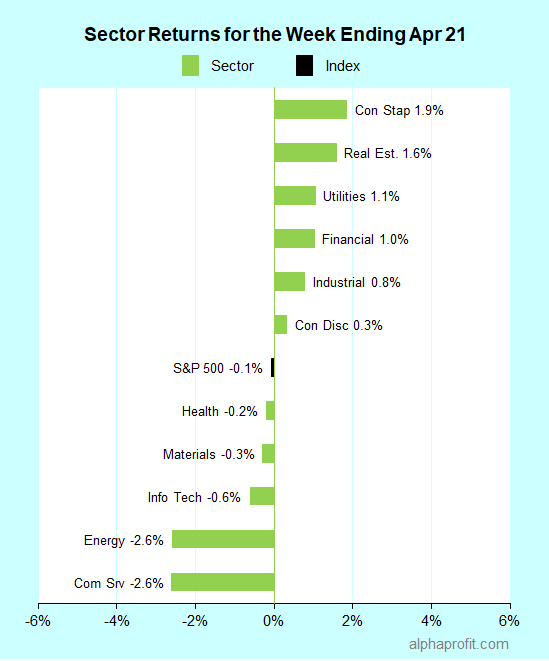

For the week ending April 21, the S&P 500 (SPY) fell 0.1%. Six of the 11 sectors advanced. Consumer Staples (XLP) gained the most, while communication services (XLC) lost the most.

The S&P 500’s top 10 winners included the following:

1. Health Care Sector

- Intuitive Surgical (ISRG) +12% – The week’s top performer in the S&P 500.

- Abbott Laboratories (ABT) +7%

- DexCom (DXCM) +7%

2. Industrial Sector

- Snap-on Inc. (SNA) +10%

- United Airlines (UAL) +7%

3. Financial Sector

- First Republic Bank (FRC) +9%

4. Consumer Discretionary Sector

- D.R. Horton (DHI) +8%

- Las Vegas Sands (LVS) +8%

5. Real Estate Sector

- Digital Realty Trust (DLR) +8%

6. Information Technology Sector

- Enphase Energy, Inc. (ENPH) +7%

Top ETFs for the week

The following ETF themes worked well: platinum, biotech, homebuilders, natural gas, and medical devices. The top ETFs for the week include:

- abrdn Physical Platinum Shares ETF (PPLT) +7.7%

- SPDR S&P Biotech ETF (XBI) +5.2%

- iShares U.S. Home Construction ETF (ITB) +5.0%

- United States Natural Gas Fund, LP (UNG) +4.6%

- iShares U.S. Medical Devices ETF (IHI) +3.0%

Investors’ Wait for Mega-Cap Earnings is Over

* Although 76% of S&P 500 members have topped analysts’ first-quarter EPS estimates, investors have not rewarded them for outperforming low-bar estimates. Investors have preferred to wait for mega-cap earnings due this week. Nearly sixty S&P 500 members, including three of the four trillion-dollar companies, are due to report earnings this week. They are Microsoft, Google parent Alphabet, and Amazon. Other notable names include Coca-Cola, Eli Lilly, Exxon Mobil, McDonald’s, Meta Platforms, and United Parcel Service.

* The Bureau of Economic Analysis will release its preliminary estimate for the first-quarter gross domestic product. Economists surveyed by Dow Jones expect the U.S. economy to grow at an annual rate of 1.8% in the first quarter of the year, down from 2.6% in the fourth quarter of 2022.

* The Bureau of Labor Statistics will update the Personal Consumption Expenditures (PCE) Price Index. Economists forecast the core PCE, which excludes food and energy components, to rise 0.3% in March, matching February’s tally. They expect the core PCE to rise 4.5% year-over-year in March, down from 4.6% a month ago.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023