The S&P 500 ended last week higher by 0.9%. Robust earnings reports from Microsoft and Meta Platforms offset concerns about the health of the U.S. banking system. The first-quarter earnings reporting season is near its midway point. Earnings reports from over a third of S&P 500 members are due this week. Yet these earnings reports could take a back seat to macro issues as investors focus on the Fed’s interest rate decision and the April jobs report.

U.S. stocks overcame a midweek sell-off last week. Worries about the state of the banking industry returned after First Republic Bank reported a 40% drop in deposits during the first quarter. Weak earnings reports from transportation titan UPS added to the downward pressure.

Robust earnings reports from Microsoft and Facebook’s parent, Meta Platforms, lifted stock prices later in the week.

FactSet reported that S&P 500 companies are recording their best performance relative to analysts’ expectations since the fourth quarter of 2021. Approximately 79% of S&P 500 members have beaten analysts’ EPS estimates midway through the first quarter reporting season. Nearly 74% of them have topped analysts’ revenue forecasts.

On Friday, the Bureau of Economic Analysis reported the U.S. gross domestic product expanded at a 1.1% annual rate in the first quarter, less than the 2.0% economists forecast in a Dow Jones survey.

The Federal Reserve’s preferred inflation metric, core personal consumption expenditures (PCE), rose 0.3% in March, in line with consensus economists’ forecast. The core PCE rose 4.6% year-over-year in March, compared to economists’ forecast for a 4.5% increase and 4.7% in February.

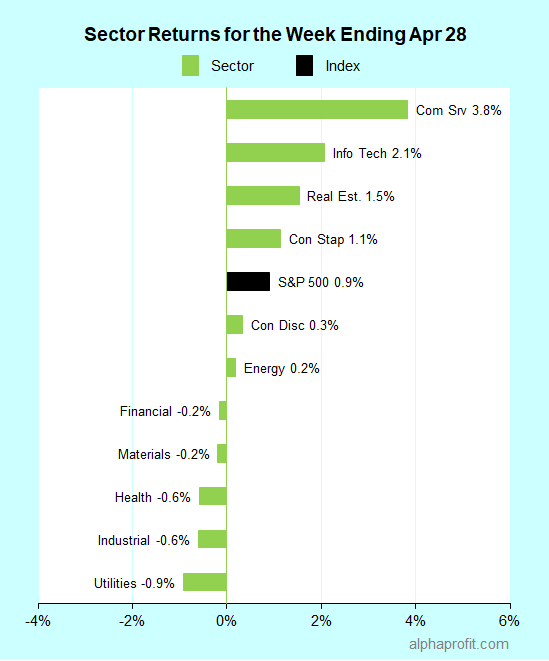

For the week ending April 28, the S&P 500 (SPY) rose 0.9%. Six of the 11 sectors advanced. Communication services (XLC) gained the most, while utilities (XLU) lost the most.

The S&P 500’s top 10 winners included the following:

1. Consumer Discretionary Sector

- Chipotle Mexican Grill (CMG) +15% – The week’s top performer in the S&P 500.

- Hasbro (HAS) +15%

- Mohawk Industries (MHK) +9%

2. Communication Services Sector

- Meta Platforms (META) +13%

- Charter Communications (CHTR) +11%

- Comcast Corporation (CMCSA) +10%

3. Health Care Sector

- Catalent (CTLT) +11%

- Molina Healthcare (MOH) +8%

4. Real Estate Sector

- CoStar Group (CSGP) +10%

5. Industrial Sector

- Pentair plc (PNR) +9%

Top ETFs for the week

The following ETF themes worked well: cryptocurrency, bitcoin, uranium, communication services, India, and Chile. The top ETFs for the week include:

- ProShares Bitcoin Strategy ETF (BITO) +7.3%

- Sprott Uranium Miners ETF (URNM) +5.7%

- Communication Services Select Sector SPDR Fund (XLC) +3.8%

- iShares MSCI India ETF (INDA) +3.1%

- iShares MSCI Chile ETF (ECH) +3.1%

Will the May 3 Rate Hike Be Time to Buy or Sell?

* May has started a six-month weak period in stock prices frequently enough for the saying “Sell in May and go away” to be popular. The Federal Open Market Committee (FOMC), the central bank’s rate-setting committee, meets May 2 and 3. Market participants expect the FOMC to raise the benchmark federal funds rate by 0.25% to the 5.00–5.25% range in what could be the final rate hike of the Fed’s tightening cycle to fight inflation. Fed Chair Jerome Powell’s interest rate outlook will set the tone for trading after the FOMC meeting.

* The Labor Department’s April jobs report is due on Friday. Economists surveyed by Dow Jones expect 180,000 job additions in April, the smallest monthly gain since December 2020. They also forecast job openings to fall to a two-year low of 9.6 million in March from 9.9 million in February.

* Earnings season rolls on this week with reports from Advanced Micro Devices, Apple, Booking Holdings, ConocoPhillips, Pfizer, Qualcomm, and Starbucks due.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023