If you are looking to earn great returns from the stock market sector mutual funds are right up your alley.

Sophisticated investors recognize the potential sector mutual funds offer and know how to make such funds work for them.

You can consistently beat the market by investing in the right sector mutual fund at the right time. In fact, you can make money even in bear markets.

The trick to benefiting from sector mutual funds is to capture the rewards they provide while mitigating the risks they carry.

And, that’s precisely what AlphaProfit helps you do … make money by smartly investing in the right sector mutual fund at the right time.

Select the Right Sector or Industry

AlphaProfit reliably selects winning sector mutual funds by combining fundamental and technical evaluation factors

Sign up for AlphaProfit’s FREE Mutual Fund Newsletter

Many investors make the mistake of choosing sectors or industries based on a single factor … trend. Such selection methods are prone to high failure rates.

To help you consistently invest in the right sectors and time entries & exits, AlphaProfit analyzes sectors on both fundamental and technical factors within the context of the business cycle.

AlphaProfit significantly enhances your sector selection success rate by holistically analyzing sectors using a wide range of criteria including valuation, momentum, and news quality.

Pick the Best Sector Mutual Fund in the Selected Sector or Industry

Sector mutual funds come in different colors and flavors. While many sector mutual funds are actively managed, sector index funds and leveraged sector funds are available too.

Some sector mutual funds invest primarily in the U. S. while others scout for opportunities around the globe. Sector mutual funds that limit their investments to specific industries or company sizes in a sector are available as well.

Selecting the right fund in the right sector can go a long way in enhancing returns.

AlphaProfit combines top-down and bottom-up analyses to ascertain the best sector mutual fund within the sector. Analysis of the overall market environment both in the U. S. and across the globe is complemented with analysis of the mutual fund’s top holdings, fund management style & consistency, fees & expenses, historical performance, and other factors.

Snapshot of Diversity in Sector Mutual Funds

| Sector Mutual Fund Name (Ticker) | Sector Mutual Fund Description |

|---|---|

| Vanguard REIT Index (VGSIX) | Sector index fund investing in real estate companies located in the U. S. |

| Fidelity Select Energy (FSENX) | Actively managed energy sector mutual fund investing in U. S. and foreign companies |

| Fidelity Select Chemicals (FSCHX) | Sector fund investing in the chemical industry within the materials sector |

| ING International Real Estate (IIRWX) | Actively managed real estate fund investing in companies outside the U. S. |

| FBR Small Cap Financials (FBRUX) | Actively managed financial sector mutual fund investing in smaller companies |

| Matthews Asia Sci and Tech (MATFX) | Actively managed technology sector mutual fund investing in companies in Asia |

| Oil & Gas UltraSector ProFund (ENPIX) | Leveraged sector fund investing in Dow Jones US oil & gas index companies |

| Alpine Emrg Mkts Real Estate (AEMEX) | Actively managed real estate fund investing in companies located in emerging markets |

Diversify across Top Sector mutual funds

Despite the rigor of the evaluation and selection process, there can be instances where investment in a sector mutual fund does not turn out to be exactly as expected. The performance of specific sector mutual funds can at times be affected by exogenous events like the earthquake in Japan or unanticipated industry changes like the ban on drilling in Gulf of Mexico.

To mitigate your risks, AlphaProfit brings together the sector mutual funds from top sectors to construct sector fund-based model portfolios for different investment objectives. AlphaProfit provides weightings for the individual sector funds with a view to minimize portfolio volatility.

Ensure Top Sector Mutual Funds Selections at all Times through Timely Sector Rotation

Mutual funds in different sectors tend to perform better in different stages of the business and interest rate cycles. Consumer discretionary sector funds like Fidelity Select Consumer Discretionary (FSCPX) tend to perform well as interest rates fall and the economy starts to recover from a recession while tech sector mutual funds like Allianz RCM Technology (DGTNX) tend to perform well during expansion phases.

AlphaProfit uses its time-tested sector rotation strategy to ensure sector mutual funds with outstanding return potential are included in the recommendations and model portfolios at all times. By the same token, the sector rotation strategy works to weed out sector mutual funds with inferior return potential in a timely manner.

Beat the Market with Sector Mutual Fund Recommendations and Model Portfolios

AlphaProfit’s proven sector mutual fund selection process enables thousands of investors to thrive in turbulent markets.

AlphaProfit provides two market-beating sector fund-based model portfolios you can use in your regular and retirement accounts. Starting out with just a few thousand dollars, you can use the model portfolios to grow your investments to secure your retirement.

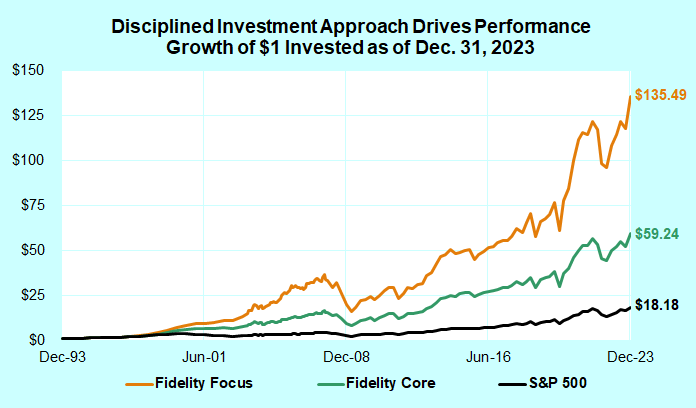

The AlphaProfit Focus model portfolio pursues aggressive growth while the AlphaProfit Core model portfolio is tailored for investors seeking long-term capital appreciation.

A dollar invested in the Aggressive Growth (Focus) and Capital Appreciation (Core) model portfolios is worth $135.49 and $59.24, respectively. This implies annualized returns of 17.8% and 14.6%, respectively.

A comparable investment in the S&P 500 benchmark is worth $18.18, implying an annualized return of 10.1%.

Performance of Fidelity Focus and Fidelity Core mutual fund model portfolios as of December 31, 2023. Sign up for Fidelity Newsletter.

Dow Jones & Company’s Hulbert Financial unit has ranked the AlphaProfit Focus and Core model portfolios #1 rank numerous times.

Here are just a few examples of actual returns earned by AlphaProfit readers from individual sector mutual fund recommendations:

- 94.4% gain from Consumer Services ProFund, CYPIX

- 98.3% gain from Fidelity Select Wireless, FWRLX

- 77.1% gain from Rydex Retailing, RYRIX

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023