Inflation continued to moderate. Falling consumer sentiment, rising unemployment claims, and continued uncertainties about the banking system and the debt ceiling raised recession worries. This week brings more insight into the consumer, including aggregate retail sales and retailer profit reports.

The preliminary reading on the University of Michigan’s consumer sentiment index fell to a six-month low of 57.7 in May from 63.5 in April. Economists polled by Dow Jones expected a 63.0 reading in May. More disturbingly, consumers’ inflation expectations over the next five years rose to 3.2%, the highest since 2011. The May reading reflected a 0.2% increase in inflation expectations from April.

Initial claims for unemployment benefits increased to 264,000, the highest since Oct. 30, 2021.

Shares of regional banks remained under pressure after PacWest said its deposits fell sharply last week. The April Senior Loan Officer Opinion Survey on Bank Lending Practices confirmed lending standards have tightened, and banks expect to tighten standards across all loan categories over the remainder of 2023.

Angst over the risk of the U.S. defaulting on payment obligations continued as negotiations between President Biden and congressional leaders on the debt ceiling and spending cuts failed to show signs of a deal.

The April reports on consumer and producer price indexes showed inflation moderating, with the latter more encouraging. The year-over-year increase in the core producer price index (excluding food and energy) moderated to a two-year low of 3.4% in April from 3.7% in March. Likewise, the year-over-year increase in the core consumer price index moderated to 5.5% from 5.6%.

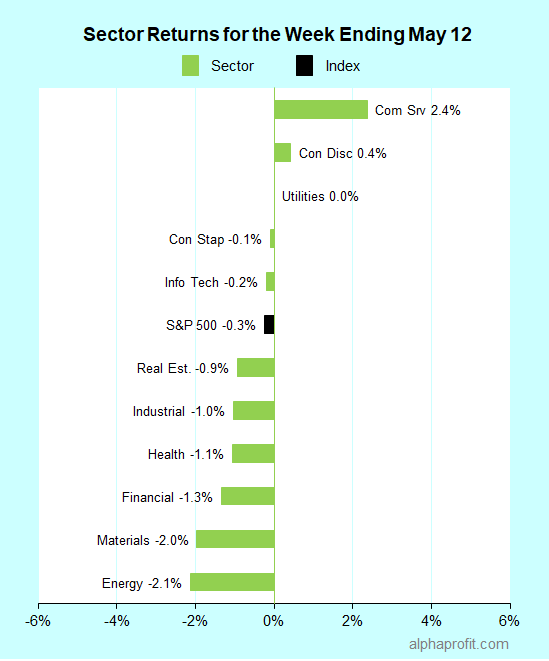

For the week ending May 12, the S&P 500 (SPY) fell 0.3%. Three of the 11 sectors advanced. Communication services (XLC) gained the most, while energy (XLE) lost the most.

The S&P 500’s top 10 winners included the following:

1. Information Technology Sector

- First Solar (FSLR) +30% – The week’s top performer in the S&P 500.

- Akamai Technologies (AKAM) +9%

- Advanced Micro Devices (AMD) +6%

2. Health Care Sector

- STERIS plc (STE) +11%

- McKesson Corp. (MCK) +7%

- DaVita (DVA) +6%

3. Communication Services Sector

- Alphabet (GOOGL) +11%

- News Corp. (NWS) +6%

4. Materials Sector

- Albemarle Corp. (ALB) +9%

Top ETFs for the week

The following ETF themes worked well: natural gas, Latin America, Chile, Brazil, strategic metals, and cloud computing. The top ETFs for the week include:

- United States Natural Gas Fund, LP (UNG) +7.6%

- iShares MSCI Chile ETF (ECH) +4.0%

- VanEck Rare Earth/Strategic Metals ETF (REMX) +3.9%

- iShares MSCI Brazil ETF (EWZ) +3.6%

- First Trust Cloud Computing ETF (SKYY) +3.4%

Retailing Holds the Key to Stocks This Week

* The decline in consumer sentiment increased fears of a recession and pressured stocks last week. More data on consumer financial well-being, including aggregate retail sales and earnings reports from major retailers, is due this week. The state of the retail landscape and consumer spending could determine how stocks do this week.

* The U.S. Census Bureau will report April retail sales. Economists surveyed by Dow Jones forecast a 0.4% increase in retail sales in April, reversing a 1.0% decline in March.

* Earnings season continues, with nearly a dozen S&P 500 members due to report. Earnings reports from major retailers like Walmart, Target, and Home Depot will bring consumer spending into the spotlight.

* Several Federal Reserve officials are scheduled to speak this week. Investors will look to the conversation between Fed Chairman Jerome Powell and former Chairman Ben Bernanke for clues on the next move in interest rates. Additionally, Fed Vice Chair for Supervision Michael Barr testifies before Congress.

* The Conference Board reports the April update of its U.S. leading economic index. Economists expect the U.S. LEI to fall 0.6% in April, extending its 1.2% decline in March.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023