The Federal Reserve raised its benchmark interest rate by 0.25% to a target range of 4.75%–5.00%. Fed Chairman Powell noted that financial conditions have tightened due to the banking crisis. Investors sought safety in U.S. mega-caps amid rising bank liquidity concerns in Europe. Fed Governor Barr’s Congressional testimony on bank oversight and the inflation report on the Fed’s preferred measure are the key events this week.

Last Wednesday, the Federal Reserve raised its benchmark interest rate by 0.25% to a target range of 4.75%–5.00%. This 0.25% uptick in the federal funds rate marked the Fed’s ninth interest rate increase since 2022 and its first since the banking sector crisis.

The Fed’s summary of economic predictions indicated officials expect to end this interest rate hiking cycle after one more 0.25% increase.

Commenting on the banking crisis, Fed Chairman Jerome Powell noted that bank deposit flows have stabilized over the last week. Acknowledging that financial conditions have tightened due to the banking crisis, Powell said the Fed would closely monitor the situation and assess its implications for monetary policy.

Last week, Treasury Secretary Janet Yellen told the U.S. House of Representatives that the administration is ready to take additional actions to stabilize the U.S. banking system if needed. Yellen, however, stopped short of providing “blanket insurance” for bank deposits through the Federal Deposit Insurance Corporation.

Concerns with bank liquidity persisted in Europe even after the Swiss National Bank arranged the purchase of Credit Suisse by the UBS Group. European stocks closed the week on a weak note after Deutsche Bank’s cost of default insurance jumped to a four-year high.

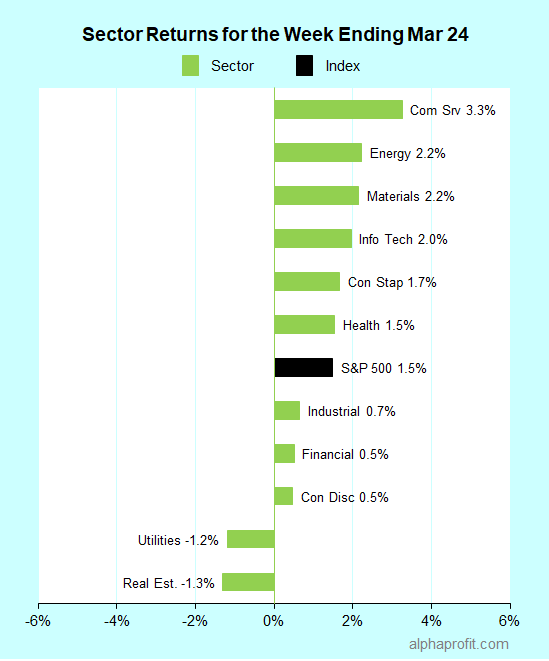

For the week ending March 24, the S&P 500 (SPY) rose 1.5%. Nine of the 11 sectors advanced. Communication Services (XLC) gained the most, while real estate (XLRE) lost the most.

The S&P 500’s top 10 winners included the following:

1. Health Care Sector

- Regeneron Pharma (REGN) +10% – The week’s top performer in the S&P 500.

- Intuitive Surgical (ISRG) +8%

2. Communication Services Sector

- Match Group (MTCH) +9%

- Netflix (NFLX) +8%

3. Information Technology Sector

- Accenture (ACN) +9%

- Micron Technology (MU) +8%

4. Energy Sector

- APA Corporation (APA) +9%

5. Consumer Discretionary Sector

- Carnival Corp. (CCL) +8%

6. Financial Sector

- Truist Financial (TFC) +8%

- Assurant (AIZ) +7%

Top ETFs for the week

The following ETF themes worked well: solar energy, foreign markets, Saudi Arabia, Asia, China, and Mexico. The top ETFs for the week include:

- Invesco Solar ETF (TAN) +5.1%

- iShares MSCI Saudi Arabia ETF (KSA) +5.1%

- iShares Asia 50 ETF (AIA) +5.0%

- KraneShares CSI China Internet ETF (KWEB) +4.8%

- iShares MSCI Mexico ETF (EWW) +4.5%

U.S. Mega-caps versus European Financials

* Investors look for ‘safety’ in U.S. mega-cap firms while the financial sector struggles due to years of abnormally low short-term interest rates. Years of negative interest rates have exacerbated the problems facing European banks. The S&P 500 is up slightly in March as U.S. mega-caps have rebounded in the face of banking sector problems. Dropping bond yields have increased the appeal of U.S. mega-caps. The battle between the allure of U.S. mega-caps and concerns over the soundness of European financials will determine how equities end March.

* Federal Reserve Governor Michael Barr testifies before Congress on bank oversight this Tuesday and Wednesday. Additionally, several Fed officials have speaking engagements this week. The speakers include Fed Governors Cook, Jefferson, and Waller and the Presidents of the Boston and New York Federal Reserve banks.

* The Bureau of Economic Analysis (BEA) will release the February Personal Consumption Expenditures (PCE) Price Index on Friday. Economists surveyed by Dow Jones expect inflation to continue trending lower. They expect the core PCE price index, which excludes food and energy costs, to rise 4.7% year-over-year in February, matching the increase in January.

* Updates on the Conference Board’s consumer confidence index, the University of Michigan’s consumer sentiment index, and the S&P Case-Shiller home price index are also due.

* Six companies in the S&P 500 index are due to report earnings this week. They are Carnival, Cintas, McCormick, Micron Technologies, Paychex, and Walgreens Boots Alliance.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023