Investors worried about the banking industry last week as attempts by the government and private sector to stabilize struggling institutions failed. Mega-cap technology stocks attracted buyers in a troubled market due to their perception as safe havens. Interest rate policy takes center stage this week, with market participants split on the Fed’s decision between leaving the fed funds rate unchanged or raising it by 0.25%.

Investors fretted about the banking industry last week as attempts by the government and the private sector to stabilize struggling institutions failed.

The efforts included assurances from the government that all depositors at the troubled Silicon Valley Bank and Signature Bank of New York would be fully protected.

Eleven large banks, including JPMorgan Chase, pledged $30 billion of uninsured deposits in troubled San Francisco bank First Republic to boost confidence.

The Federal Reserve also introduced a Bank Term Funding Program (BTFP) to help banks avoid selling Treasury securities at a loss.

News that banks increased their borrowing from the Federal Reserve from just $4.4 billion to a record $165 billion in one week undid the stabilization efforts. Investors saw this rise in borrowing as a warning that things may be worse than what the government was admitting.

Meanwhile, liquidity concerns at Credit Suisse added to banking sector worries. Credit Suisse received a lifeline from the Swiss National Bank, which lent nearly $54 billion.

By the end of the week, SVB Financial Group, the parent company of Silicon Valley Bank, filed for bankruptcy. Regional bank shares fell 14% after declining 16% the week before, extending their decline in March to 29%.

In measures of inflation, the core consumer price index rose 0.5% in February, marking a 5.5% year-over-year increase. Economists surveyed by Dow Jones expected a 5.5% year-over-year increase, down from 5.6% in January. The core producer price index rose 0.2% in February, lagging economists’ forecast of 0.4%.

U.S. Treasury security yields fell as investors sought safety. The 2- and 10-year note yields fell by 0.79% and 0.31%, respectively, to 3.81% and 3.39%.

Mega-cap technology stocks attracted buyers in a troubled market due to their perception as safe havens. The rally in mega-cap tech stocks lifted the S&P 500.

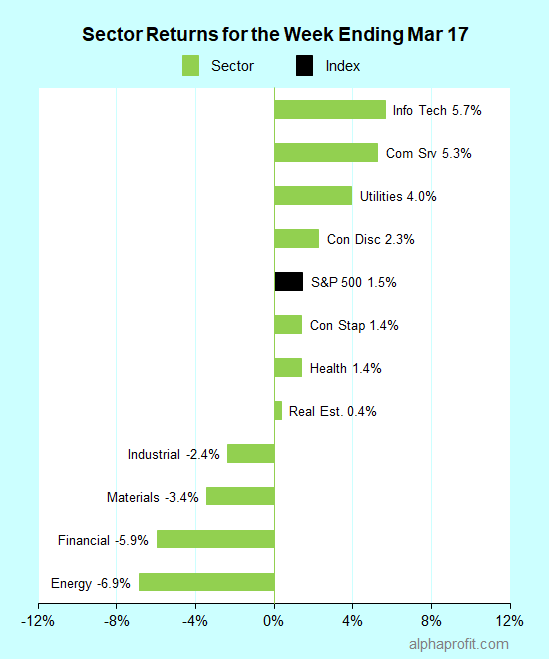

For the week ending March 17, the S&P 500 (SPY) rose 1.5%. Seven of the 11 sectors advanced. Information technology (XLK) gained the most, while energy (XLE) lost the most.

The S&P 500’s top 10 winners included the following:

1. Information Technology Sector

- Advanced Micro Devices (AMD) +18% – The week’s top performer in the S&P 500.

- Microsoft (MSFT) +12%

- NVIDIA (NVDA) +12%

- Arista Networks (ANET) +11%

- Intel (INTC) +10%

2. Health Care Sector

- Illumina (ILMN) +16%

3. Materials Sector

- Newmont (NEM) +14%

4. Communication Services Sector

- Alphabet (GOOG) +10%

5. Financial Sector

- MarketAxess Holdings (MKTX) +12%

6. Industrial Sector

- FedEx (FDX) +10%

Top ETFs for the week

The following ETF themes worked well: cryptocurrency, bitcoin, precious metals, gold, silver, mega-cap technology, and high-growth story stocks. The top ETFs for the week include:

- ProShares Bitcoin Strategy ETF (BITO) +35.9%

- VanEck Gold Miners ETF (GDX) +12.4%

- ARK Next Generation Internet ETF (ARKW) +9.7%

- iShares Silver Trust (SLV) +9.4%

- iShares U.S. Technology ETF (IYW) +6.9%

Is the Fed in a No-Win Situation?

* The stress in the banking industry is at the forefront of investors’ minds as trading begins this week. Investors will monitor news indicating the pervasiveness of troubled banks.

* Federal Reserve policymakers meet on Tuesday and Wednesday to set the federal funds rate. Market participants have lowered their interest rate expectations after troubles in the banking industry surfaced. The likelihood of a 0.5% increase has fallen after 70% of market participants expected this outcome as recently as March 8. According to the CME FedWatch tool, the tossup is between leaving the fed funds rate unchanged (38% odds) and raising the fed funds rate by 0.25% (62% odds). The Fed may be in a no-win situation if market participants see unchanged interest rates as an admission of widespread banking troubles and a 0.25% increase as adding stress to a fragile economy.

* The economic calendar is light. Data on home sales, unemployment claims, and flash U.S. manufacturing and service activity measures are due.

* Five companies in the S&P 500 are due to report earnings this week. They are Accenture, Darden Restaurants, FactSet Research Systems, General Mills, and Nike.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023