If you’re searching for the best growth stocks to buy now, this list of reliable veterans from top sectors deserves a look. First, each boasts robust near-term growth prospects. Second, some offer generous dividends on top of that.

In some ways, the performance of U.S. stocks is an extension of how they fared in 2023.

Helped by large-cap technology companies known as the “Magnificent Seven,” the S&P 500 (SPY) has extended its rally from 2023 to 2024. The benchmark is up 15% in 2024 and stands just shy of its record high.

Leading the charge among the “Magnificent Seven” is semiconductor giant NVIDIA (NVDA), which has gained more than 165% in value this year.

Meta Platforms (META) has rallied over 40%, while Amazon.com (AMZN) and Alphabet (GOOG, GOOGL) have advanced over 20%. Microsoft (MSFT) and Apple (AAPL) have climbed 18% and 10%, respectively.

Telsa (TSLA), with a 28% decline, is the sole loser in the “Magnificent Seven” in 2024.

With Tesla’s negative impact included, the “Magnificent Seven” have contributed a staggering $3.7 trillion, or a sizeable 63%, to the S&P 500’s $5.8 trillion market capitalization gain in 2024.

Just over 100 members of the S&P 500 benchmark are up more than the index in 2024. The median stock in the index has gained just 3%, and more than 40% of the benchmark members are down for the year.

With many members of the S&P 500 failing to join the rally, the lack of broad participation or poor market breadth is a point of concern for some investors.

High Growth Sectors for 2024

At the start of 2024, investors expected the Federal Reserve to reduce the benchmark federal funds rate six times this year, with the central bank implementing the first interest rate cut in March.

However, inflation has stayed above the Fed’s 2.0% long-term goal through 2024.

Investors have pushed expectations of the first reduction in the federal funds rate to the fourth quarter. They expect just one or two 0.25% cuts in the benchmark interest rate this year.

The yield on the 10-year Treasury bond has risen by 0.3% this year to 4.2%.

Economic data have not portrayed a consistent trend, adding to investor uncertainty. Fears of inflation, recession, and stagflation have ebbed and flowed in response to economic data.

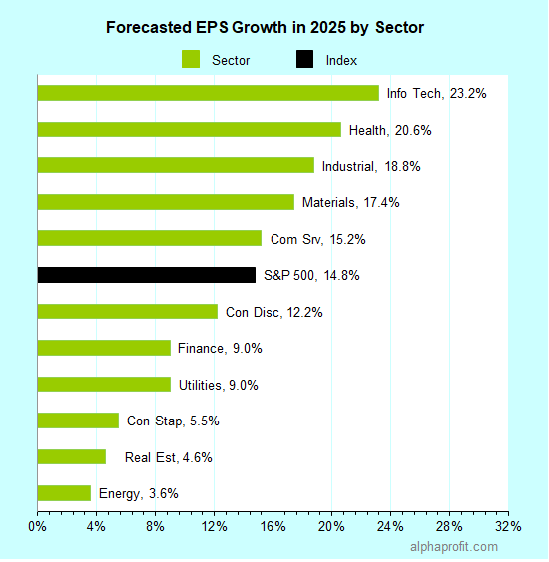

Here’s a snapshot of analysts’ earnings growth estimates for S&P 500 companies in 2024, based on FactSet data as of June 14:

Analysts forecast aggregate earnings for S&P 500 companies to grow by 11.3% in 2024.

As shown below, they expect only nine of the eleven sectors to show growth in earnings.

Analysts expect aggregate earnings for the S&P 500 members to grow 11.3% in 2024, with profits increasing in nine of the 11 sectors. They forecast earnings in commodity-oriented sectors like energy and materials to decline. Analysts predict earnings in communication services, information technology, and finance to grow the most.

Analysts expect companies in the communication services sector to deliver the highest earnings growth. They forecast aggregate earnings for the communication services sector to grow by 21.0%.

Other sectors expected to outpace the S&P 500’s 11.3% growth include information technology, finance, and consumer discretionary.

Analysts expect earnings in the energy sector to contract the most in 2024.

So, what specific companies currently offer above-average earnings growth prospects?

Learn more: How does AlphaProfit make stock investing easy and help subscribers make a bundle?

Best Growth Stocks to Buy Now

Analysts forecast 11.3% earnings growth for S&P 500 companies in 2024.

Their earnings per share (EPS) forecasts reveal a select group of large U.S. companies poised to outpace the market average.

This list showcases the top three growth champions within sectors with multiple high-growth companies. All of them exceed the large-cap market capitalization threshold of $41 billion. Note that asterisks (*) designate stocks offering dividend yields exceeding the S&P 500’s 1.35%.

1. Best Growth Stocks to Buy Now in Communication Services Sector

• Netflix (NFLX): 53%

• Meta Platforms (META): 36%

• T-Mobile US* (TMUS): 30%

2. Best Growth Stocks to Buy Now in Consumer Discretionary Sector

• Amazon.com (AMZN): 56%

• Chipotle Mexican Grill (CMG): 24%

• Booking Holdings (BKNG): 16%

3. Best Growth Stocks to Buy Now in Consumer Staples Sector

None

4. Best Growth Stocks to Buy Now in Energy Sector

• Hess Corp.* (HES): 94%

• Schlumberger* (SLB): 18%

5. Best Growth Stocks to Buy Now in Financials Sector

• Travelers* (TRV): 38%

• Blackstone* (BX): 21%

• Mastercard (MA): 17%

6. Best Growth Stocks to Buy Now in Health Care Sector

• Merck* (MRK): 473%

• Eli Lilly and Co. (LLY): 118%

• Moderna (MRNA): 42%

7. Best Growth Stocks to Buy Now in Industrials Sector

• Boeing (BA): 76%

• GE Aerospace (GE): 45%

• TransDigm Group* (TDG): 28%

8. Best Growth Stocks to Buy Now in Information Technology Sector

• Micron Technology (MU): 122%

• NVIDIA Corp. (NVDA): 109%

• Super Micro Computer (SMCI): 102%

9. Best Growth Stocks to Buy Now in Materials Sector

• Newmont* (NEM): 59%

10. Best Growth Stocks to Buy Now in Real Estate Sector

• Welltower* (WELL): 100%

11. Best Growth Stocks to Buy Now in Utilities Sector

• Dominion Energy* (D): 42%

AlphaProfit’s Recommendations of Best Growth Stocks to Buy Now

Although several sectors show promising growth potential, overall stock valuations remain elevated compared to historical averages.

The forward 12-month price-to-earnings (P/E) ratio for the S&P 500 now stands at 21.0, compared to its 5-year and 10-year averages of 19.2 and 17.8, respectively.

In this richly valued market, identifying impactful growth opportunities can be challenging.

That’s where AlphaProfit Premium Service comes in. It equips investors each month with attractively valued stocks poised for explosive growth.

AlphaProfit dives deep, unearthing hidden champions across diverse sectors with the potential to outperform and significantly boost your portfolio performance.

Here are some real-world examples of how AlphaProfit has propelled subscriber portfolios in the last 12 months:

• Autoliv (ALV): 12.9% in 2 weeks

• Expedia (EXPE): 17.3% in 1 month

• FedEx (FDX): 11.1% in 3 weeks

In 2023, our 23 exiting stock recommendations netted subscribers a median gain of 13.4% with one loser, translating into a 96% win rate.

Unlock Explosive Growth in 2024

Imagine consistently earning 12.8% from stocks at a 91% win rate.

That’s not just a dream. It is what countless successful AlphaProfit subscribers have achieved.

Here is our track record:

• 446 of our stock recommendations have exited since 2009 with a median gain of 12.9%.

• 407 delivered positive returns, translating into a 91% success rate.

See the detailed trade information yourself (registration is required).

Don’t miss out on the next wave of winners in 2024.

Or register free to test drive the Premium Service.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023