Quick Take

- Top sectors for 2026: Information Technology, Materials, Industrials, Energy

- Best growth stocks to buy now: Concentrated in these outperforming sectors

- AlphaProfit’s strategy delivers lower risk, low expenses, and high returns

- New ETF recommendations coming September 30, 2025

- Explore Premium Service, Register Free, or Learn Our Selection Methodology

Best Growth Stocks to Buy Now for 2026: Top Sectors + AlphaProfit’s Proven Picks

Looking for the best growth stocks to buy now as we head into 2026? AlphaProfit’s proven strategy identifies the top sectors for 2026 and the stocks most likely to outperform—driven by rigorous analysis, disciplined execution, and a performance record that consistently beats the market.

In this guide, we reveal the best growth opportunities for 2026—including sector leaders and individual stock picks—designed to help you invest with confidence and outperform the S&P 500. Preview our Premium Service or explore our selection methodology to see how we do it.

2025 Market Recap: A Broadening Rally Amid Shifting Fed Policy

The year 2025 has been favorable for U.S. stocks, despite persistent concerns over tariffs, inflation, and slowing growth. The S&P 500 (SPY) dropped over 4% in Q1 but rebounded in Q2 and Q3, climbing to a 14.4% year-to-date gain as of September 19—setting a strong foundation for identifying the best growth stocks to buy now.

Market breadth remained narrow in early 2025, with investors favoring large-cap technology stocks while the Fed held rates steady. This concentration highlights the importance of sector selection—especially when identifying top sectors for 2026 with broadening participation.

By Q3, signs of labor market softness and political pressure raised expectations for rate cuts. As those prospects grew, the rally broadened—bringing small-cap stocks into play and reinforcing the case for growth stock rotation across sectors.

On September 17, the Fed cut rates by 0.25%, setting a new target range of 4.00% to 4.25%, and signaled two more cuts before year-end. This shift sets the stage for a more inclusive and sustained market advance—a key backdrop for identifying the best growth stocks to buy now.

Economic Outlook and Earnings Setup for 2026

The Fed’s latest projections show a modest pickup in growth heading into 2026. U.S. GDP is expected to rise 1.6% in 2025 and accelerate to 1.8% in 2026, with unemployment easing and inflation moderating. This macro setup supports earnings expansion in key sectors—a critical input in AlphaProfit’s growth stock selection.

While inflation remains above target, the Fed is prioritizing labor market stability and preemptively easing rates. Analysts view this non-recessionary easing cycle as a constructive backdrop for corporate earnings growth—especially in sectors with strong EPS momentum.

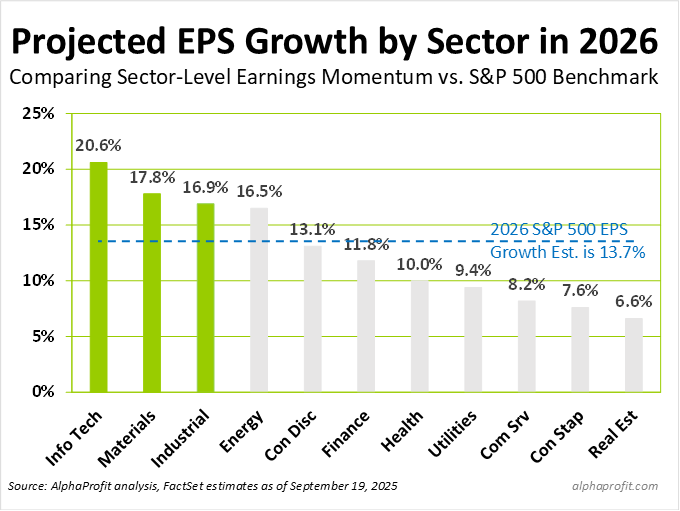

FactSet data as of September 19 shows analysts expect S&P 500 earnings to grow 13.7% in 2026, with gains projected across all eleven sectors. Several industries—led by Information Technology, Materials, Industrials, and Energy—are poised to deliver above-average EPS growth, making them top sectors for 2026 and fertile ground for identifying the best growth stocks to buy now.

Sector Commentary: 2026 EPS Growth Forecasts

- Information Technology: 20.6% EPS growth. Driven by AI infrastructure and semiconductors.

- Materials: 17.8% EPS growth. Supported by industrial metals and chemicals.

- Industrials: 16.9% EPS growth. Benefiting from electrification and defense spending.

- Energy: 16.5% EPS growth. Supported by stable oil prices and disciplined capital spending.

- Consumer Discretionary, Financials, Health Care: Near S&P 500 benchmark of 13.7%.

- Utilities, Communication Services, Consumer Staples, Real Estate: Lagging sectors with EPS growth between 6.6% and 9.4%.

AlphaProfit Stock Picks: Best Growth Stocks to Buy Now from Top Sectors

AlphaProfit’s recent stock recommendations reflect our disciplined approach to sector selection and earnings momentum. These picks—made over the past 12 months—span multiple outperforming sectors and showcase our ability to identify the best growth stocks to buy now with strong fundamentals and timely catalysts.

Information Technology

- Microsoft (MSFT) – Cloud leadership, AI integration across enterprise software, and consistent free cash flow generation

- Adobe (ADBE) – Creative and marketing software dominance, subscription growth, and expanding AI capabilities

Industrials

- Flex Ltd. (FLEX) – Diversified manufacturing exposure, margin expansion, and strong execution in supply chain solutions

- Sanmina (SANM) – High-reliability electronics manufacturing, improving operating leverage, and end-market diversification

Energy

- Coterra Energy (CTRA) – Low-cost natural gas and oil production, disciplined capital allocation, and shareholder returns

- Archrock (AROC) – Natural gas compression services with stable cash flows and infrastructure tailwinds

Consumer Discretionary

- PVH Corp. (PVH) – Brand strength in Calvin Klein and Tommy Hilfiger, margin recovery, and international growth

- General Motors (GM) – EV transition, cost discipline, and improving profitability in North America

Health Care

- AbbVie (ABBV) – Robust immunology and neuroscience pipeline, strong dividend profile, and post-Humira growth drivers

- ResMed (RMD) – Market leadership in sleep apnea devices, expanding digital health platform, and resilient margins

Communication Services

- Alphabet (GOOGL) – Resilient ad platform, cloud growth, and monetization of AI and YouTube assets

These selections reflect AlphaProfit’s ability to translate sector-level EPS forecasts into actionable stock ideas. Premium Service subscribers receive full analysis, entry points, and portfolio guidance for each recommendation.

Performance Snapshot: How AlphaProfit’s Picks Stack Up

ETF Focus Model Portfolio

Compounded at a 13.7% annualized rate since inception—beating the S&P 500 by 10.7%.

Recent Stock Recommendations

Delivered strong results over the past 12 months:

- ✅ 95% win rate — 19 of 20 existing stock picks generated profits

- ✅ +13.5% median return across 20 stock positions

Top Performers

Recent standouts include Coterra Energy (CTRA), Federated Hermes (FHI), HNI Corp. (HNI), Moelis & Co. (MC), and State Street (STT)—each gained 18–30%.

Each recommendation includes entry and exit points, strategic commentary, and portfolio guidance—giving Premium subscribers the clarity to stay ahead.

Why AlphaProfit: Lower Risk, Low Expenses, High Returns

AlphaProfit’s investment philosophy centers on minimizing risk, controlling costs, and maximizing returns. We focus on sectors with strong earnings momentum and stocks with favorable risk-reward profiles—delivering consistent outperformance for our subscribers.

Our Premium Service provides actionable recommendations, detailed analysis, and portfolio guidance tailored to your goals. Whether you’re seeking growth, income, or diversification, AlphaProfit helps you invest with confidence.

Ready to Act?

FAQs

- Q: Are AlphaProfit’s sector calls based solely on EPS forecasts?

- A: No. EPS consensus is just one input. Final sector selection is based on a multi-factor matrix that includes valuation, momentum, and news quality.

- Q: When will AlphaProfit release the new sector and thematic ETF recommendations?

- A: We’ll publish an updated slate of recommended sector and thematic ETFs—and Fidelity funds—on September 30, 2025.

- Q: When will AlphaProfit release the next stock recommendations?

- A: New stock picks are published on the 12th of each month. The next set will be released on October 12, 2025.

- Q: Can I see past performance of AlphaProfit’s model portfolios and stock recommendations?

- A: Absolutely. Detailed information on the performance of the model portfolios and stock recommendations is available. The performance page includes summary-level data with links to drill down into specifics. Registered users can also access year-over-year returns and a full compilation of stock recommendation performance in the login area.

AlphaProfit Investment Newsletter is independently published and subscriber-supported. Past performance is not indicative of future results. All investments involve risk.

How AlphaProfit's investment strategy minimizes your riskLearn more:

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

The AlphaProfit ETF style rotation model portfolio will be reconstituted with new recommendations on Wednesday, November 19.

The AlphaProfit ETF style rotation model portfolio will be reconstituted with new recommendations on Wednesday, November 19.

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023