If you’re searching for the best growth stocks to buy now, this list of reliable veterans from top sectors deserves a look. First, each boasts robust near-term growth prospects. Second, some offer generous dividends on top of that.

The year 2024 has been highly favorable for U.S. stocks, despite the late-year headwinds. The S&P 500 (SPY) is up 28.1% as of December 24, after gaining in each of the quarters. The dynamics behind the rally evolved over the year.

Investors favored large-cap technology companies, known as the “Magnificent Seven,” in the first half of the year, as the Federal Reserve held interest rates high and steady.

The rally broadened in the third quarter as inflation declined, improving the prospects of the Fed lowering interest rates. High-dividend stocks, small-cap stocks, and value stocks rallied, contributing to a more inclusive market advance.

The Fed lowered interest rates in the third and fourth quarters. Stocks surged in November following decisive U.S. presidential elections. Investor optimism surrounding President-elect Trump’s market-friendly policies fueled strong gains.

However, the final month of the year has been less encouraging. Reacting to relatively robust growth and sticky inflation, the Fed signaled a more cautious approach to future interest rate cuts.

Although the “Magnificent Seven” supported the S&P 500 in December, the performance of the broad market weakened as investors reacted to the likelihood of fewer interest rate cuts in 2025.

High Growth Sectors for 2025

The U.S. economy is growing. The Federal Reserve’s latest economic outlook for 2025 paints a picture of resilience and measured optimism for the U.S. economy.

Fed officials now anticipate gross domestic product (GDP) to grow by 2.1% in 2025, a slight uptick from the 2.0% forecasted in September. Likewise, they expect the unemployment rate to edge lower to 4.3% from the previous estimate of 4.4%.

Inflation is an area of concern for policymakers. Fed officials expect their preferred inflation measure, the core personal consumption expenditures, to rise by 2.5% in 2025, 0.3% higher than the September projection of 2.2%.

With neither the growth nor the employment objectives of the Fed calling for lower interest rates, the central bank anticipates fewer interest rate cuts in 2025. The Fed has revised its September forecast of four interest rate cuts next year to just two.

Amid this backdrop, analysts are upbeat about the prospects for profit growth in 2025.

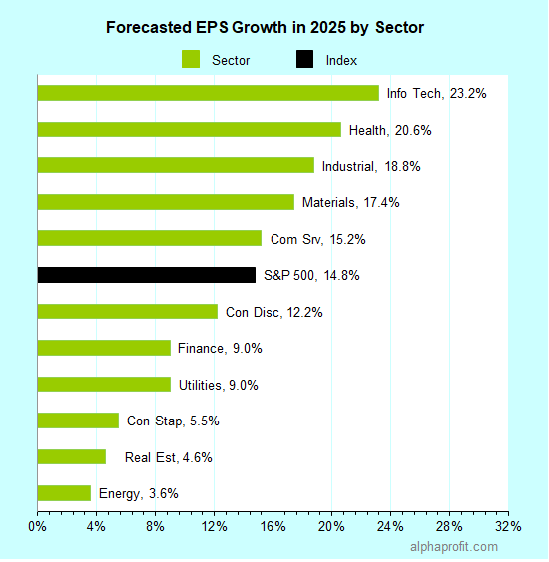

Here’s a snapshot of analysts’ earnings growth estimates for S&P 500 companies in 2025, based on FactSet data as of December 20:

Analysts forecast aggregate earnings for S&P 500 companies to grow by 14.8% in 2025.

As shown below, they expect earnings to grow in all eleven sectors.

Analysts expect aggregate earnings for the S&P 500 members to grow by 14.8% in 2025, with profits increasing in all 11 sectors. They predict earnings in information technology, health care, and industrials to grow the most. Analysts forecast earnings in energy, as well as defensive sectors like real estate and consumer staples, to grow the least.

Analysts expect companies in the information technology sector to deliver the highest earnings growth. They forecast aggregate earnings for the information technology sector to grow by 23.2%.

Other sectors expected to outpace the S&P 500’s 14.8% growth include health care and industrials.

Analysts expect earnings in the energy sector to expand the least in 2025.

So, what specific companies currently offer above-average earnings growth prospects?

Learn more: How does AlphaProfit make stock investing easy and help subscribers make a bundle?

Best Growth Stocks to Buy Now

Analysts forecast 14.8% earnings growth for S&P 500 companies in 2025.

Their earnings per share (EPS) forecasts reveal a select group of large U.S. companies poised to outpace the market average.

This list showcases the top three growth champions within sectors with multiple high-growth companies. All of them exceed the large-cap market capitalization threshold of $41 billion. The list excludes companies where analysts expect profits to decline in 2024. Note that asterisks (*) designate stocks offering dividend yields exceeding the S&P 500’s 1.25%.

1. Best Growth Stocks to Buy Now in Communication Services Sector

• Netflix (NFLX): 20%

2. Best Growth Stocks to Buy Now in Consumer Discretionary Sector

• Royal Caribbean Cruises (RCL): 24%

• Amazon.com (AMZN): 21%

• Chipotle Mexican Grill (CMG): 18%

3. Best Growth Stocks to Buy Now in Consumer Staples Sector

None

4. Best Growth Stocks to Buy Now in Energy Sector

None

5. Best Growth Stocks to Buy Now in Financials Sector

• Blackstone* (BX): 33%

• American International Group* (AIG): 33%

• KKR & Co (KKR): 28%

6. Best Growth Stocks to Buy Now in Health Care Sector

• Eli Lilly and Co. (LLY): 72%

• Merck* (MRK): 22%

7. Best Growth Stocks to Buy Now in Industrials Sector

• GE Vernova (GEV): 104%

• Uber Technologies (UBER): 28%

• GE Aerospace (GE): 27%

8. Best Growth Stocks to Buy Now in Information Technology Sector

• Advanced Micro Devices (AMD): 54%

• NVIDIA Corp (NVDA): 50%

• Micron Technology (MU): 44%

9. Best Growth Stocks to Buy Now in Materials Sector

• Newmont* (NEM): 26%

10. Best Growth Stocks to Buy Now in Real Estate Sector

• American Tower* (AMT): 34%

• Equinix* (EQIX): 17%

11. Best Growth Stocks to Buy Now in Utilities Sector

• Vistra Corp. (VST): 43%

• Dominion Energy* (D): 22%

AlphaProfit’s Recommendations of Best Growth Stocks to Buy Now

Although several sectors and stocks show promising growth potential, overall stock valuations remain elevated compared to historical averages.

The forward 12-month price-to-earnings (P/E) ratio for the S&P 500 now stands at 22.3, compared to its 5-year and 10-year averages of 19.7 and 18.1, respectively.

In this richly valued market, identifying impactful growth opportunities can be challenging.

That’s where AlphaProfit Premium Service comes in. It equips investors each month with attractively valued stocks poised for explosive growth.

AlphaProfit dives deep, unearthing hidden champions across diverse sectors with the potential to outperform and significantly boost your portfolio performance.

Here are some real-world examples of how AlphaProfit has propelled subscriber portfolios in the last 12 months:

• Alcoa (AA): 21.8% in 1 week

• Ameriprise Financial (AMP): 9.9% in 1 week

• Aptiv PLC (APTV): 18.1% in 1 month

In 2024, our 20 exiting stock recommendations netted subscribers a median gain of 17.7% with one loser, translating into a 95% win rate.

Unlock Explosive Growth Beyond 2024

Imagine consistently earning 12.8% from stocks at a 91% win rate.

That’s not just a dream. It is what countless thriving AlphaProfit subscribers have achieved since 2009.

To ensure sustainable growth, we employ a rigorous risk management strategy, including stop-loss targets to limit potential losses.

Our track record reflects our commitment to both profit and protection:

• 454 of our stock recommendations have exited since 2009 with a median gain of 12.8%.

• 415 of them delivered positive returns, translating into a 91% success rate.

See the detailed trade information yourself (registration is required).

Set Your Portfolio on the Fast Track!

Don’t miss out on the opportunity to join AlphaProfit and start earning exceptional returns.

Our Premium Service provides you with exclusive access to high-growth stock recommendations, expert analysis, and proven risk management strategies.

Now is the perfect time to subscribe and unlock your portfolio’s full potential.

Or register free to test drive the Premium Service.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023