Quick Take

Navigate market cycles with precision. AlphaProfit’s ETF Style Rotation Investing Strategy rotates across domestic and foreign ETFs based on investment style, market capitalization, and multi-factor signals.

- 📅 Next Repositioning: November 19

- 🔄 Rebalancing: Mid-quarter repositioning (Feb, May, Aug, and Nov)

- 🌍 Coverage: U.S. and global ETFs across styles and market caps

- 📊 Signals: Multi-factor overlays including momentum, quality, and volatility

See Current ETF Style Rotation Model Portfolio Allocation

ETF Style Rotation Model Portfolio

The AlphaProfit ETF Style Rotation Model Portfolio is the actionable investment vehicle designed for investors seeking dynamic exposure across equity styles and geographies. Unlike AlphaProfit’s Core and Focus portfolios—which rotate among sectors, industries, and themes—this model targets multiple factors across domestic and foreign ETFs.

It incorporates market capitalization tiers and factor-based signals to optimize returns through disciplined mid-quarter rebalancing.

Why ETF Style Rotation Investing Strategy Matters in Today’s Market

In today’s volatile and macro-driven environment, static ETF allocations can leave investors exposed to underperforming styles. The ETF Style Rotation Investing Strategy offers a dynamic alternative by adapting to changing market leadership across growth, value, momentum, and quality factors.

As interest rates shift, inflation expectations evolve, and global markets diverge, style rotation becomes essential for capturing upside while managing downside risk. This strategy helps investors avoid style traps and stay aligned with prevailing market trends.

Whether it’s rotating into small-cap value during economic recoveries or shifting toward large-cap quality in risk-off regimes, the ETF Style Rotation Investing Strategy provides a disciplined framework for tactical portfolio management.

ETF Style Rotation Investing Strategy Overview

The ETF Style Rotation Investing Strategy is a dynamic, rules-based investment philosophy designed for tactical investors. It provides a systematic method for rotation based on style momentum, market capitalization, and quantitative factor overlays across both domestic and foreign ETFs.

This disciplined approach ensures the ETF Style Rotation Model Portfolio is positioned to capture prevailing market leadership and manage risk, irrespective of sector or theme. To understand how this strategy adapts to changing market conditions, let’s explore its methodology.

ETF Style Rotation Investing Strategy Methodology

The ETF Style Rotation Investing Strategy follows a disciplined, rules-based methodology built on multi-factor signals. Key components include:

Rotation Universe:

- Domestic ETFs: Large, mid, small cap across growth, blend, value

- Foreign ETFs: Developed, regional, emerging, country-specific

Factor Signals:

- Momentum

- Quality

- Yield

- Volatility

- Liquidity

Rebalancing Frequency:

- Mid-quarterly based on multiple factors with monthly updates (Repositioning occurs in February, May, August, and November)

Selection Process:

- 📈 Quantitative ranking of eligible ETFs

- 🧮 Style and factor overlays

- ⚖️ Risk-adjusted allocation

ETF Style Rotation Investing Strategy Performance

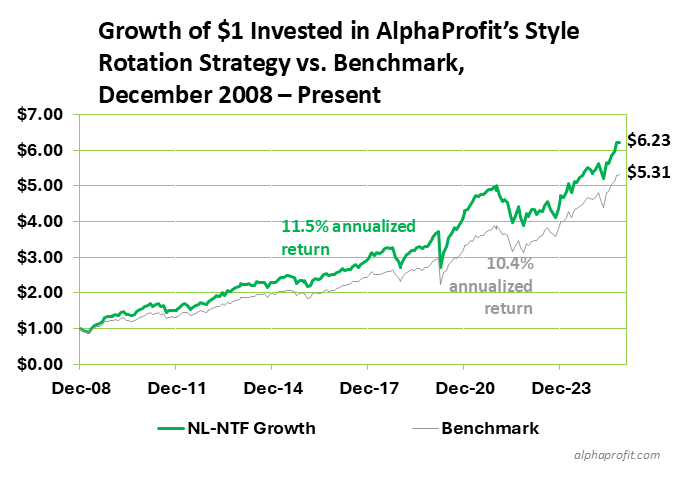

AlphaProfit’s disciplined style rotation methodology has delivered strong results since 2009. Since inception, the strategy has gained at an 11.5% annualized rate, compared to 10.4% for its benchmark.

In August 2023, AlphaProfit transitioned the strategy to an ETF-based implementation using the ETF Style Rotation Investing Strategy, maintaining the same rules-based, factor-driven approach across domestic and foreign ETFs.

Note: The implementation of the style rotation strategy transitioned from using no-load, no-transaction-fee (NL-NTF) mutual funds through the NL-NTF Growth Model Portfolio to using ETFs through the ETF Style Rotation Model Portfolio in August 2023.

Annualized Performance Summary (Since Dec 2008):

| Metric | AlphaProfit ETF Style Rotation Investing Strategy | Benchmark |

|---|---|---|

| Annualized Return | 11.5% | 10.4% |

The benchmark includes a blend of index ETFs representative of U.S. and international markets: Vanguard Total Stock Market Index ETF (VTI) and Vanguard Total International Stock Index ETF (VXUS).

See the Trades Behind the Performance

Want to review the historical holdings that generated this performance? Get instant, free access to the portfolio’s allocation history.

Get Your Free AlphaProfit Account Now

Accessing the AlphaProfit Premium Service

The AlphaProfit ETF Style Rotation Model Portfolio is a cornerstone of the AlphaProfit Premium Service. Subscribers receive actionable repositioning alerts on trade day, providing them with the model’s new target composition and sufficient lead time to trade their accounts concurrently with the models, plus instant access to a comprehensive suite of other market-beating tools, including:

🚨 Next Portfolio Repositioning: Wednesday, November 19.

Get instant access to this allocation and prepare your account.

- ETF Model Portfolios: Access all three key strategies—ETF Core, ETF Focus, and ETF Style Rotation—designed for various growth objectives.

- Fidelity Fund Model Portfolios: Specialized Fidelity Core and Fidelity Focus model portfolios built specifically for Fidelity investors.

- Stock and Income ETF Recommendations: Targeted stock picks and specialized Income ETF recommendations.

- Asset Allocation Guidance: Expert guidance to help you properly structure your entire portfolio.

The strategy’s standard primary rebalancing dates are mid-quarter: February, May, August, and November.

Unlock All Premium Portfolios & Guidance

ETF Style Rotation Investing Strategy FAQs

Q: What makes the ETF Style Rotation Strategy unique?

A: This strategy rotates across styles, market caps, and global ETFs using quantitative signals. It differs from sector-based models by focusing on style momentum and factor overlays.

Q: How is the ETF Style Rotation model Portfolio different from ETF Core and Focus?

A: Core and Focus portfolios rotate among sectors, industries, and themes. The ETF Style Rotation Model Portfolio focuses on investment styles, market caps, and global exposure.

Q: Can I combine the ETF Style Rotation model Portfolio with other AlphaProfit model portfolios such as ETF Core or ETF Focus?

A: Yes. Style Rotation complements sector-based models and adds diversification through factor and geographic rotation.

Q: Can I see the year-over-year returns of ETF Style Rotation Model Portfolio?

A: Yes. All you need is a free AlphaProfit account. To get one, register here.

Q: Can I see the historical holdings of the ETF Style Rotation Model Portfolio?

A: Yes. All you need is a free AlphaProfit account. To get one, register here.

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023