AlphaProfit’s sector selection process enables subscribers to invest in winning sectors and lockup gains.

ValuM Investment Process

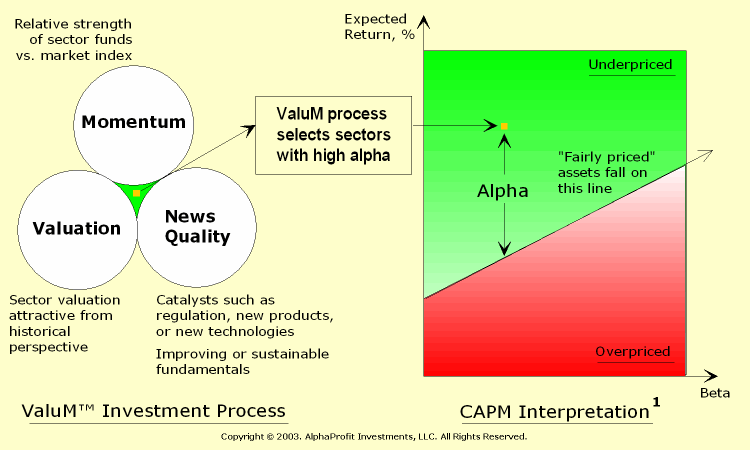

The AlphaProfit Sector Investors’ Newsletter uses AlphaProfit’s ValuM investment process for selecting sectors.

The ValuM process evaluates sectors based on their momentum, valuation, and news quality.

Specifically, we seek sectors demonstrating high relative strength while possessing attractive valuation. We also look for sectors with catalysts or favorable fundamentals.

1. The Capital Asset Pricing Model is a set of predictions concerning equilibrium expected returns on risky assets. Alpha is the difference between the expected return of the sector fund and the “fair return” for the fund based on its historical responsiveness to market movements. Beta is a measure of the sector funds’s responsiveness to market movements. For a complete description of the Capital Asset Pricing Model as well as terms, alpha and beta, refer ‘Investments’, Z. Bodie, A. Kane, A. J. Marcus, 2nd Edition, 1993.

We believe the ValuM Investment Process enables us to select investments for our model portfolios with high expected values of alpha from the perspective of the Capital Asset Pricing Model or CAPM. High expected alpha implies high expected sector-specific return.

Sector Selection Results

The ValuM investment process has a long and successful history of adding value by identifying leading sectors in both bull and bear markets and locking up gains before stay becomes unwelcome. Some examples are shown here:

ValuM Investment Process History

Sam Subramanian, founder of AlphaProfit Investments developed the ValuM Investment Process to evaluate sectors and industries in the 1990s. He applies this process to invest his personal assets in several Fidelity Select funds and sector ETFs since then.

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023