Investors looking to invest in oil ETFs or energy ETFs often gravitate towards the Energy Select Sector SPDR (XLE). With over $8 billion in assets, the Energy Select Sector SPDR may appear as the best oil ETF.

Investing in energy companies included in the S&P 500 index, the Energy Select SPDR provides exposure to a broad range of oil companies at a modest 0.21% expense ratio.

This however does not mean that the Energy Select Sector SPDR is the best oil ETF.

In fact, nearly 15 oil ETFs performed better than the Energy Select SPDR in 2010.

The ETF marketplace has grown over time. Now, several oil ETFs are available to achieve a number of investment objectives.

Broadly speaking, oil ETFs can be classified into four types:

- Oil stock ETFs

- Oil commodity ETFs

- Leveraged oil ETFs

- Short oil ETFs

In this article, I shall focus on oil stock ETFs. I have discussed commodity ETFs elsewhere. See: Commodity Exchange Traded Funds: Best Commodity ETFs

Oil Stock ETFs

This class of oil ETFs can be divided into five types:

ETFs that owned oil exploration and production stocks were the best oil ETFs in 2010. Oil service ETFs and natural gas ETFs can be strong contenders for being the best oil ETFs in 2011.

Oil Exploration & Production ETFs

ETFs like iShares Dow Jones US Oil & Gas Exploration & Production ETF (IEO), PowerShares Dynamic Energy Exploration & Production (PXE), and SPDR S&P Oil & Gas Exploration & Production ETF (XOP) invest in stocks of companies like Apache (APA), EOG Resources (EOG), and Occidental Petroleum (OXY) that produce oil & gas.

Oil Services ETFs

ETFs like iShares Dow Jones US Oil Equipment ETF (IEZ), Oil Services HOLDRs (OIH), PowerShares Dynamic Oil & Gas Services (PXJ), and SPDR S&P Oil & Gas Equipment & Services (XES) invest in stocks of companies like Schlumberger (SLB), Halliburton (HAL), and National Oilwell Varco (NOV) that provide drilling equipment and services to oil companies.

Natural Gas ETFs

ETFs like First Trust ISE-Revere Natural Gas ETF (FCG) invest in stocks of companies like Chesapeake Energy (CHK), Devon Energy (DVN), and Southwestern Energy (SWN) that produce natural gas.

Diversified Oil ETFs

ETFs like Energy Select SPDR ETF, Vanguard Energy ETF (VDE), and iShares S&P Global Energy ETF (IXC) invest in a broad range of energy companies that includes integrated oil companies like Chevron (CVX), ConocoPhillips (COP), and ExxonMobil (XOM), as well as oil producers, refiners, and oil service companies. While the Energy Select SPDR ETF and the Vanguard Energy ETF invest in U. S.-based companies, iShares S&P Global Energy ETF invests in energy companies across the globe.

Oil Income ETFs

ETFs like JPMorgan Alerian MLP ETN (AMJ) and ALPS Alerian MLP ETF (AMLP) invest in energy companies structured as master limited partnerships. Enterprise Products Partners (EPD), Kinder Morgan Energy Partners (KMP), and Magellan Midstream Partners (MMP) are examples of such companies. Such companies pay a large portion of their profits as dividends, making these oil ETFs suitable for income investors.

Best Oil ETFs

Among oil stock ETFs, PowerShares Dynamic Energy Exploration & Production took top honors in 2010 gaining 40%. PowerShares Dynamic Energy (PXI) trailed the leader by less than a 1%. JPMorgan Alerian MLP gained a solid 33% to deliver income investors a sizzling return.

The above returns are quite impressive in light of the fact that Direxion Daily Energy Bull 3X Shares (ERX), using a leverage ratio of three, gained 49% in 2010.

Best Oil ETF for 2011

In the latter part of 2010, oil prices were favorably impacted by two factors: rising demand for oil and a falling dollar.

Demand for oil increased as emerging economies such as China and India grew rapidly and developed economies recovered from the Great Recession. Measures taken by the Federal Reserve and the Obama Administration to aid economic recovery pressured the U. S. dollar and provided a boost for dollar-denominated oil.

Things however did not work well for natural gas. Weak industrial demand coupled with relatively high production caused natural gas inventories to bulge. The price of natural gas declined in 2010.

A steady increase in the price of oil is encouraging oil companies to increase exploration & production spending. Energy services heavyweights Schlumberger and Halliburton are expected to increase EPS by over 36% in 2011.

If the price of oil continues to be favorably influenced by rising demand for oil and a falling dollar, oil services ETFs like iShares Dow Jones US Oil Equipment ETF, PowerShares Dynamic Oil & Gas Services, or SPDR S&P Oil & Gas Equipment & Services can be top contender for being the best oil ETF in 2011.

Likewise, natural gas ETFs should not be counted out, particularly if higher demand from increasing economic activity starts to work off excess inventories. Natural gas appeals as a contrarian investing idea and Natural Gas First Trust ISE-Revere Natural Gas ETF too has the potential to emerge as the best oil ETF in 2011.

AlphaProfit ETF Model Portfolios and ETF Investment Newsletter

AlphaProfit’s proven ETF selection process enables thousands of investors to thrive in turbulent markets.

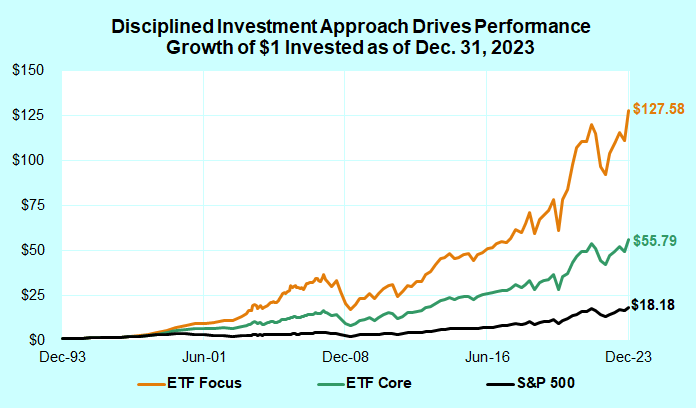

A dollar invested in the AlphaProfit’s Aggressive Growth (ETF-Focus) and Capital Appreciation (ETF-Core) model portfolios is worth $47.59 and $24.57, respectively. This implies annualized returns of 19.9% and 16.3%, respectively.

Performance of ETF model portfolios as of March 31, 2015.

Comparable investments in the Dow Jones Wilshire 5000 and S&P 500 benchmarks are worth $6.85 and $6.70, respectively implying annualized returns of 9.5% and 9.4%, respectively.

The ETF model portfolios use AlphaProfit’s proven ValuM investment process for selecting investments. This process has enabled AlphaProfit model portfolios to bag Hulbert Financial’s #1 rank numerous times.

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to