Stocks closed the week at record highs after a surge in COVID cases from the delta variant threatened to extend the prior week’s decline. Stocks rallied for four straight days as investors bought on the dip. Analysts boosted second-quarter EPS forecasts for companies reporting later in the season, boosting investors’ appetite for stocks.

Stocks staged a turnaround after a renewed surge in COVID cases from the delta variant escalated worries of lockdowns returning to impact the economy. The Dow Jones Industrial Average slumped over 725 points on Monday, its highest one-day decline since October.

Upbeat earnings reports helped stocks to rebound. Investors bought on the dip as 88% of S&P 500 companies reporting earnings topped analysts’ second-quarter EPS forecasts.

The reports showed companies sustaining profit margins in the face of rising inflation. The profit margin for the reporting companies is averaging 12.8%, above the historic range, according to S&P Global.

The early trend in second-quarter earnings reports prompted analysts to raise EPS forecasts for companies to follow. According to FactSet, analysts now expect S&P 500 company earnings to grow 74% year-over-year in the second quarter, up from 63% they forecasted on June 30.

Stocks rose four straight days on the back of robust earnings reports to close the week at record highs. The DJIA scaled above 35,000 for the first time. Investors favored growth stocks over value stocks amidst the backdrop of rising COVID cases and falling bond yields.

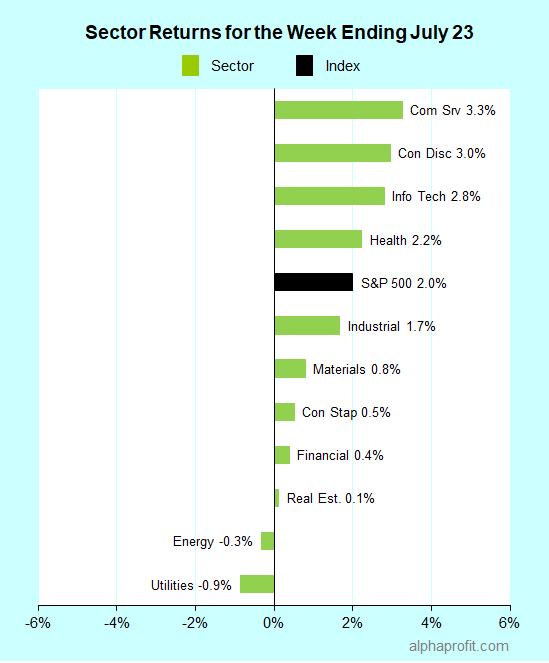

For the week ending July 23, the S&P 500 (SPY) rose 2.0%. Nine of the 11 sectors gained.

Communication services (XLC), consumer discretionary (XLY), and information technology (XLK) led the S&P 500, gaining 2.8% or more.

Utilities (XLU), energy (XLE), and real estate (XLRE) lagged the benchmark.

Market breadth was positive. The number of advancing stocks in the S&P 500 led the number of decliners by a 5-to-2 ratio.

Information technology and consumer discretionary companies accounted for seven of the S&P 500’s top 10 winners. Health care and communication services companies rounded out the top 10.

1. Health Care

Moderna (MRNA) +22% – Shares of the new entrant to the S&P 500 surged 22% to claim honors as the week’s top performer in the benchmark. Investors saw Moderna having more opportunities to increase COVID vaccine sales from rising concerns of the coronavirus delta variant. Moderna also announced new deals to supply its COVID vaccine to Japan and Taiwan.

HCA Healthcare (HCA) +13% – The hospital operator beat analysts’ second-quarter sales and EPS forecasts and raised full-year sales and EPS guidance.

2. Consumer Discretionary

Chipotle Mexican Grill (CMG) +17% – The burrito specialist’s results confirmed the changes it made in response to the pandemic work in a post-pandemic world. Chipotle’s second-quarter same-store sales surged 31% and 18% from the second quarter in 2020 and 2019, respectively. Chipotle expects this momentum to continue in the third quarter, with same-store sales growing 19-25% from the 2019 level.

Online marketplace Etsy Inc. (ETSY) and restaurant chain Domino’s Pizza (DPZ) were among the week’s top 10 winners, gaining 13% and 9%, respectively.

3. Communication Services

The Interpublic Group of Companies (IPG) +12% – The global advertising and marketing services company posted a 23% increase in sales in the second quarter that helped EPS top analysts forecasts by 63%. IPG also raised its full-year guidance for organic revenue growth to a range of 9-10%.

4. Information Technology

KLA Corp. (KLAC) and Lam Research (LRCX) +9% – Shares of semiconductor equipment companies rose as they benefit from semiconductor contract manufacturers, increasing production in response to semiconductor chip shortage.

Enphase Energy (ENPH) +9% – Shares of the solar energy storage system and technology company rose after JPMorgan increased its price target by $28 to $238 a share. Enphase reports second-quarter earnings on July 27.

Software company PTC Inc. (PTC) rose 9%, becoming the fourth information technology in the week’s top 10 winners.

Top ETFs for the week

The following ETFs themes worked well: rare earth, social media, cloud computing, home builders, health care. The top ETFs for the week include:

- VanEck Vectors Rare Earth/Strategic Metals ETF (REMX) +7.2%

- WisdomTree Cloud Computing Fund (WCLD) +6.8%

- First Trust U. S. Equity Opportunities ETF (FPX) +6.6%

- iShares U. S. Home Construction ETF (ITB) +5.9%

- Invesco DWA Healthcare Momentum ETF (PTH) +5.9%

Top Fidelity Fund for the week

- Fidelity Select Semiconductors (FSELX) +5.1%

Looking ahead to the week of July 26

The week includes several events with market-moving potential. First, the second-quarter earnings season is in its busiest week. Second, the FOMC meets to discuss monetary policy. Last, investors get a read on second-quarter GDP growth and June inflation.

* The Federal Open Market Committee meets on Tuesday and Wednesday to discuss interest rate policy. Economists expect the FOMC to leave interest rates unchanged. Investors are focusing on what Chairman Powell says about the coronavirus’ delta variant impact and risks. Investors will also be looking for clues on when the central bank may begin tapering its bond purchases.

* Nearly 170 S&P 500 members report second-quarter earnings this week, the busiest one of the reporting season. Index heavyweights Apple, Microsoft, Amazon, Alphabet, and Facebook report. The earnings calendar also includes reports from sector heavyweights Visa, Procter & Gamble, ExxonMobil, Pfizer, and United Parcel Service.

* The Commerce Department reports its GDP growth estimate for the second quarter. According to Briefing.com, economists expect the GDP to grow at an 8.5% annualized rate in the second quarter, marking the peak for growth. Wall Street also gets to look at inflation from the June reading for personal consumption expenditures, the Fed’s preferred measure. Investors will also be watching developments on the U. S. federal debt ceiling since the 2019 agreement to suspend the debt limit expires on August 1.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023