Stocks rallied sharply last week as bond yields fell. Data from the manufacturing and housing industries showed higher interest rates having the desired effect of slowing economic activity. The Fed meets to set interest rates. Market participants expect the Fed to raise interest rates by 0.75% and slow rate increases after December. The October jobs report comes out on Friday. The third quarter earnings reporting season continues.

Stocks rallied sharply for a second week in a row as the yield on the 10-year Treasury note fell 0.19% to end the week at 4.02%. Economic data suggested that higher interest rates implemented by the Federal Reserve are cooling economic growth as desired.

S&P Global’s flash reading of U.S. manufacturing showed business activity contracting in October. The Purchasing Managers’ Index fell to 49.9 in October, its first drop below 50 in 28 months.

Housing data showed the industry bearing the brunt of higher mortgage rates. The Commerce Department reported a 10.9% drop in new home sales in September from August. Home prices fell 1.63% in August, as measured by the S&P CoreLogic Case-Shiller 20-City Index.

Meanwhile, the core personal consumption expenditure (PCE) price index, the Federal Reserve’s preferred inflation measure, rose 0.5% in September, in line with consensus economists’ forecast. On a 12-month basis, the core PCE index rose 5.1%, a tad below economists’ 5.2% forecast.

Investors expected the Federal Reserve to raise interest rates by smaller increments after December on account of the above economic data.

In third-quarter earnings, mega-cap technology companies, except Apple, lagged analysts’ EPS forecasts. Energy and healthcare company profits exceeded analysts’ expectations.

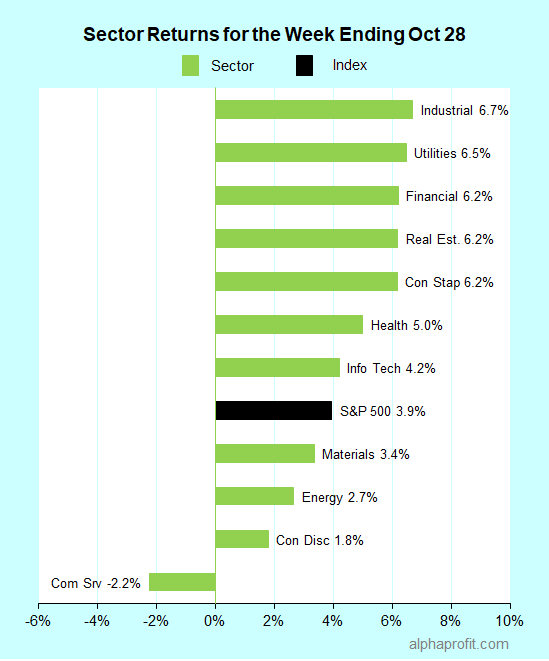

For the week ending October 28, the S&P 500 (SPY) rose 3.9%. Ten of the 11 sectors advanced.

Industrials (XLI) gained the most, while communication service (XLC) was the sole loser.

The S&P 500’s top 10 winners included the following:

1. Health Care Sector

- Universal Health Services (UHS) +30% – The week’s top performer in the S&P 500.

- DexCom (DXCM) +26%

- Moderna (MRNA) +18%

- Gilead Sciences (GILD) +17%

- IQVIA Holdings (IQV) +17%

2. Information Technology Sector

- Enphase Energy (ENPH) +21%

- ServiceNow (NOW) +17%

3. Financial Sector

- MSCI Inc. (MSCI) +18%

- Raymond James Financial (RJF) +18%

- Ameriprise Financial (AMP) +17%

Top ETFs for the week

The following ETF themes worked well: carbon credits, mortgage real estate, genomics & biotechnology, home construction, and smart grid infrastructure. The top ETFs for the week include:

- KraneShares Global Carbon ETF (KRBN) 13.5%

- iShares Mortgage Real Estate Capped ETF (REM) 11.2%

- ARK Genomic Revolution ETF (ARKG) 9.8%

- iShares U.S. Home Construction ETF (ITB) 8.9%

- First Trust NASDAQ Clean Edge Smart Grid Infrastructure (GRID) 7.9%

The Fed Holds the Keys to Stocks Now

* The interest-rate policy-setting Federal Open Market Committee (FOMC) meets on Tuesday and Wednesday this week. Market participants expect the FOMC to raise the benchmark federal funds rate by another 0.75% at this meeting, taking it to the 3.75-4.00% range. The tone of the comments setting market expectations for the interest rate decision at the December meeting and beyond is likely to be more of a market mover.

* Investors will also get a pulse on the labor market when the Labor Department releases the October jobs report. Economists surveyed by Dow Jones expect the U.S. economy to have added 220,000 jobs in October, lower than the 263,000 jobs created in September. They see the unemployment rate nudging up to 3.6% in October from 3.5% in September. Investors will also watch the number of job openings with interest when the Bureau of Labor Statistics updates the data. The number of job openings contracted sharply to 10.05 million in September from 11.18 million in August.

* Another busy week of third-quarter earnings reports lies ahead. Eli Lilly, Pfizer, ConocoPhillips, Qualcomm, PayPal, Advanced Micro Devices, and Starbucks are among the S&P 500 member companies reporting earnings this week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

The AlphaProfit ETF style rotation model portfolio will be reconstituted with new recommendations on Wednesday, November 19.

The AlphaProfit ETF style rotation model portfolio will be reconstituted with new recommendations on Wednesday, November 19.

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023