The S&P 500 lost 2.3% for the week, despite rising 2.4% on Friday. The benchmark’s sixth straight weekly loss was its longest losing streak in nearly a decade. Fears of the Federal Reserve’s tighter interest rate policy tilting the economy into recession offset relief provided by signs of peaking inflation.

The Labor Department’s reports on the consumer price index (CPI), the producer price index (PPI), and the price index for imports collectively suggested that inflation may have peaked in March. Here are the year-over-year changes in the three metrics:

* Total CPI: up 8.3% in April, down from 8.5% in March.

* PPI for final demand: up 11.0% in April, down from 11.5% in March.

* Price index for imports: up 12.0% in April, down from 13.0% in March.

Inflation expectations in the bond market came down, slowing the relentless rise in bond yields. The 10-year yield ended the week at 2.93%, after peaking at 3.2% earlier in the week.

Stocks appeared to bounce off “washout lows” on Thursday, as they cut their losses for the week. The S&P 500 rebounded to end the week above 4,000 after falling as low as 3,859 on Thursday. Buyers on Friday hunted for bargains among the hard-hit growth stocks.

The U. S. Senate confirmed Federal Chairman Powell for a second term. Powell repeated the central bank’s determination to battle inflation while expressing belief that the economy can avoid a serious downturn.

Although inflation measures showed signs of peaking in March, investors worried that inflation was still too high. They feared that the Fed would aggressively tighten interest rates to contain inflation.

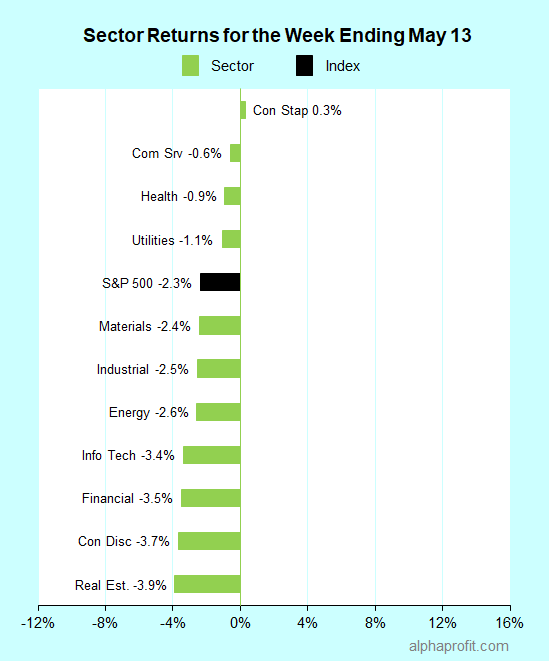

For the week ending May 13, the S&P 500 (SPY) fell 2.3%. Only one of the 11 sectors advanced.

Leading and lagging sectors for the week ending May 13, 2022, as growth fears trounce peaking inflation.

Market breadth was negative. The number of advancing stocks in the S&P 500 lagged the number of decliners by a 1-to-3 ratio.

Consumer staples (XLP) bucked the S&P 500, gaining 0.3%. Communication services (XLC) and health care (XLV) lost less than the S&P 500.

Real estate (XLRE), consumer discretionary (XLY), and financials (XLF) lagged the S&P 500.

The S&P 500’s top 10 winners included the following:

1. Health Care Sector

- Viatris Inc. (VTRS) +11%

The drugmaker beat analysts’ first-quarter EPS and raised its dividend by 9%. Viatris also provided 2022 revenue and cash flow projections above analysts’ estimates. Up 11% for the week, Viatris shares were the week’s top performer in the S&P 500.

2. Communication Services Sector

- Electronic Arts Inc. (EA) +8%

- Lumen Technologies, Inc. (LUMN) +6%

- News Corp. (NWS) +6%

The video game publisher reported fiscal fourth-quarter EPS above analysts’ forecasts. Electronic Arts reported an 18% increase in net bookings from the launch of popular content in Apex Legends, EA Sports, and The Sims franchises.

3. Materials Sector

- International Flavors & Fragrances (IFF) +8%

Synergies from DuPont’s Nutrition & Biosciences business purchase helped specialty chemicals maker International Flavors & Fragrances top analysts’ first-quarter sales and EPS estimates.

4. Real Estate Sector

- Duke Realty Corporation (DRE) +8%

Industrial REIT Duke Realty rallied after competitor Prologis offered $24 billion to buy the former. Duke Realty rejected the hostile offer, calling it “insufficient.”

Other Top 10 Winners

The S&P 500’s top 10 winners for the week also included:

- Online marketplace Etsy, Inc. (ETSY) +7%

- Air conditioning equipment maker Carrier Global Corp. (CARR) +6%

- Oil services provider Baker Hughes (BKR) +6%

- Cybersecurity solutions provider Fortinet, Inc. (FTNT) +6%

Top ETFs for the week

The following ETFs themes worked well: China Internet, Europe, Sweden, long-term bonds, and China large-cap. The top ETFs for the week include:

- Invesco China Technology ETF (CQQQ) +4.8%

- WisdomTree Europe Hedged Equity Fund (HEDJ) +2.7%

- iShares 20+ Year Treasury Bond ETF (TLT) +2.0%

- iShares MSCI Sweden ETF (EWD) +2.0%

- iShares China Large-Cap ETF (FXI) +1.9%

Top Fidelity Fund for the week

- Fidelity Long-Term Treasury Bond Index Fund (FNBGX) +1.9%

Can Stocks Rebound After 6-Weeks of Losses?

Following a sharp plunge and rebound in stock prices last week, investors will watch for signs that the S&P 500 can hold its low of 3,859 set last Thursday. Investors will get an update on consumer financial well-being from retailer earnings reports and retail sales data.

* Investors will assess if the bounce from Thursday’s bottom has the makings of an endurable one and if the rally has further legs. The rally in stocks could extend if bond yields stay range-bound.

* Fed Chairman Jerome Powell speaks at a Wall Street Journal conference on Tuesday afternoon. Investors will continue to look for clues on the central bank’s interest rate hiking path.

* Investors will get insights into the impact of inflation on consumer spending and attitudes from retailer earnings and retail sales data. Walmart, Home Depot, and Target report their first-quarter earnings this week. Economists surveyed by Briefing.com expect retail sales to increase 1.1% in April, up from 0.5% in March.

* Earnings from a few technology companies are also in store. They include Analog Devices, Applied Materials, Cisco Systems, and Palo Alto Networks.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023