Should I invest in international stocks in 2022? This is a common question in investors’ minds since international stocks are holding up better than U. S. stocks in 2022. In this post, I compare the valuation & growth prospects for U. S. stocks and international stocks. I also analyze the potential for changes in currency exchange rates impacting international stock returns and answer the question: Should you invest in international stocks in 2022?

U. S. stocks outperformed stocks in both developed international markets and emerging international markets for the fourth straight year in 2021.

The MSCI USA index designed to measure the performance of large-cap and mid-cap segments of the U. S. market rose 26.5%.

The MSCI EAFE index of developed market stocks gained 11.3% in U. S. dollar terms last year, while the MSCI Emerging Markets index of the namesake stocks lost 2.5%.

The tables have, however, flipped in 2022. International stocks are holding up better than U. S. stocks.

The MSCI USA index is down 8.5% year-to-date as of February 25, while the MSCI EAFE and MSCI Emerging Markets indexes have declined 6.8% and 4.9%, respectively.

Should I Invest in International Stocks in 2022: Valuation Perspective

Developed and emerging market stocks have lagged U. S. stocks over the past 5- and 10-year timespans ending in 2021.

The MSCI USA index is up a cumulative 130% from 2017 through 2021, compared to 58% and 60% for the MSCI EAFE Developed Market index and the MSCI Emerging Markets index, respectively.

Likewise, the MSCI USA index has risen 340% from 2012 through 2021. Comparatively, the MSCI EAFE index and the MSCI Emerging Markets index are up 117% and 71%, respectively.

The extended underperformance of international stocks vis-a-vis U. S. stocks has enhanced their appeal from a valuation perspective.

According to MSCI, stocks in the MSCI EAFE and MSCI Emerging Markets indexes trade at forward price-to-earnings ratios of 14.5 and 12.0, respectively.

In comparison, stocks in the MSCI USA index trade at a forward P/E ratio of 20.8.

Should I Invest in International Stocks in 2022: Growth Perspective

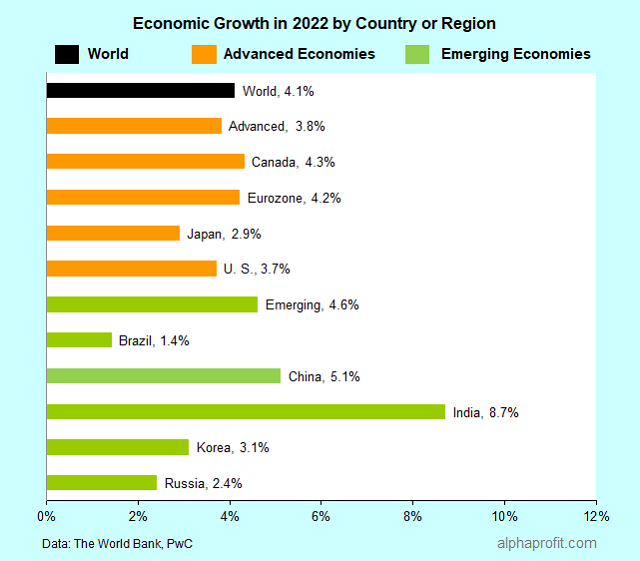

The World Bank expects continued COVID flare-ups, diminished fiscal support, and lingering supply bottlenecks to limit global economic growth to 4.1% in 2022 after expanding 5.5% in 2021.

The bank forecasts growth in advanced and emerging economies to slow to 3.8% and 4.6%, respectively, this year.

The World Bank expects the world economy to grow 4.1% in 2022 compared to 5.5% in 2021. The bank forecasts slower growth in both advanced and emerging economies.

The resurgence of the pandemic from the omicron variant, widespread supply constraints, and rising inflation dampened the pace of recovery in advanced economies towards the end of 2021.

The World Bank expects growth to moderate further from the withdrawal of policy support and the depletion of pent-up demand.

The economic growth rate in the U. S. and the euro area are forecasted to decline to 3.7% and 4.2%, respectively, this year. Japan is a bright spot in contrast. The economic growth rate in Japan is forecasted to increase to 2.9%.

In emerging economies, the World Bank expects China’s growth rate to moderate to 5.1% in 2022 due to the lingering effects of the pandemic and tighter regulations on specific sectors of the economy.

Against the above backdrop, analysts expect corporate earnings growth in developed and emerging international markets and the U. S. to converge to a relatively narrow range.

According to Refinitiv, analysts expect corporate earnings in developed and emerging markets to grow 6.6% and 8.0%, respectively, compared to 7.9% in the U. S.

However, from a trend perspective, analysts have been raising their earnings growth estimates for developed and emerging markets companies while lowering their earnings growth estimates for U. S. companies.

Should I Invest in International Funds in 2022: Currency Conversion Perspective

Helped by strong economic growth in 2021 and prospects of higher interest rates in 2022, the U. S. dollar enjoyed a banner year versus developed market currencies last year.

According to data on TradingEconomics.com, the trade-weighted dollar index (DXY) gained 6.7% versus developed country currencies in 2021. The dollar gained 12.6% versus the Japanese yen and 7.4% versus the euro.

The dollar moved in a narrower range versus emerging market currencies. The Chinese yuan managed to rise 2.7% versus the dollar. The Indian rupee and the Mexican peso fell 2.0% and 3.1%, respectively, versus the dollar.

The Federal Reserve’s tough talk on inflation and rising geopolitical worries from Russia’s invasion of Ukraine has supported the dollar in 2022 despite its apparent over-valuation.

The CME Group currency futures show traders expect the dollar to decline fractionally versus developed market currencies in 2022. The quotes show the dollar falling 1.3% vis-a-vis the euro and 1.1% vis-à-vis the yen.

Traders, however, expect the dollar to gain versus emerging market currencies. The quotes show the dollar rising between 1% and 6% vis-à-vis the Chinese yuan, Indian rupee, and the Mexican peso.

Should I Invest in International Funds in 2022: Technical Perspective

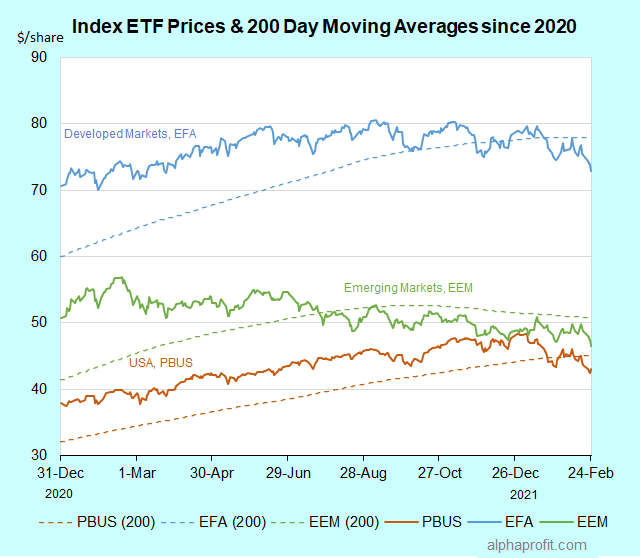

The ETFs tracking the MSCI USA, MSCI EAFE, and MSCI Emerging Markets indexes are trending lower. All of them have fallen below the 200-Day Moving Averages (DMA).

Invesco MSCI USA (PBUS), iShares MSCI EAFE (EFA), and iShares MSCI Emerging Markets (EEM) are all in downtrends, having fallen below their corresponding 200-Day Moving Averages.

The iShares MSCI Emerging Markets ETF (EEM) was the first to lose its hold on its 200-DMA in 2021, falling below the trendline in the summer. The iShares MSCI EAFE ETF (EFA) followed suit in the fourth quarter.

While the Invesco PureBeta MSCI USA ETF (PBUS) held above its 200-DMA through 2021, its fall in 2022 has been swift. The Invesco PureBeta MSCI USA ETF has fallen more rapidly in 2022 than the iShares MSCI EAFE and iShares MSCI Emerging Markets ETFs.

Should I Invest in International Stocks in 2022: Bottom Line

Attractive valuation is one argument that supports the case for owning international stocks. Corporate earnings growth prospects also appear to be improving overseas. Currency translation effects can provide a tailwind for international stocks if the U. S. dollar loses some of its shine. There is not much to choose between the U. S. and international stocks from a technical perspective.

So, what will it take for international stocks to outperform U. S. stocks in 2022?

International stocks tend to be more sensitive to global growth than U. S. stocks. The likelihood of international stocks outperforming U. S. stocks should improve if forecasts for euro area economies growing faster than the U. S. in 2022 turn true.

So, should you invest in international stocks in 2022?

The answer is Yes.

Now is not the time to give up on international investing. If anything, it is time to increase allocation to international stocks and international funds.

International stocks are due to provide superior returns compared to U. S. stocks. Whether 2022 turns out to be such a year depends on whether global growth accelerates this year.

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023