Stocks gyrated wildly in the first week of the third-quarter earnings reporting season. The earnings reports failed to spur a sustained rally in stocks while inflation pressured them. The earnings reporting season picks up steam this week. The economic data calendar is light. Will earnings reports still be able to lift stocks, or will they steepen the slide?

Stocks swung between gains and losses as third-quarter earnings failed to lift stocks in the first week of the reporting season while inflation data pressured stocks.

Investors received updates on inflation in wholesale and consumer prices. The latter sparked an unexpectedly large rally in stocks.

The consumer price index, including food and energy costs, rose at an annual pace of 8.2% in September, compared to economists’ 8.1% forecast.

The core CPI, which excludes food and energy prices, rose 6.6% from a year ago. It topped economists’ 6.5% forecast by 0.1% too.

Stocks staged a remarkable turnaround after initially declining in response to the CPI data. On Thursday, the S&P 500 rose 194 points, or 5.6%, from its intraday low to its intraday high.

The surge, however, fizzled the following day after the University of Michigan’s consumer sentiment survey came out. The survey showed expectations for inflation over the next year rose to 5.1% from 4.7% in September due to higher gasoline prices.

Leading banks like JPMorgan Chase, Citigroup, and Wells Fargo joined Delta Air Lines, PepsiCo, and UnitedHealth to kick off the third-quarter earnings reporting season. The earnings reports failed to enthuse investors despite all six names topping analysts’ estimates.

FactSet data showed that 69% of the reporting S&P 500 members topped analysts’ third-quarter forecasts, trailing the 10-year average of 73%. The average earnings surprise was just 0.1%, compared to the 10-year average of 6.5%.

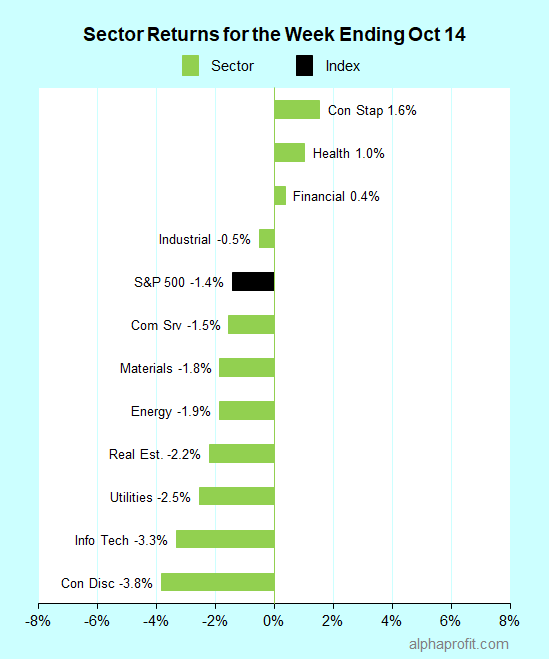

For the week ending October 14, the S&P 500 (SPY) fell 1.4%. Eight of the 11 sectors declined.

Consumer staples (XLP) gained the most, while consumer discretionary (XLY) lost the most.

The S&P 500’s top 10 winners included the following:

1. Health Care Sector

- Moderna (MRNA) +12% – The week’s top performer in the S&P 500.

- Amgen (AMGN) +10%

- Viatris (VTRS) +9%

- Walgreens Boots Alliance (WBA) +9%

2. Consumer Staples Sector

- Kraft Heinz (KHC) +8%

- Campbell Soup (CPB) +8%

3. Industrial Sector

- American Airlines (AAL) +8%

- Delta Air Lines (DAL) +6%

- 3M Company (MMM) +6%

4. Financial Sector

- U.S. Bancorp (USB) +6%

Top ETFs for the week

The following ETF themes worked well: low-volatility small caps, volatility, high yield stocks, food & beverage, airlines. The top ETFs for the week include:

- Invesco S&P SmallCap Low Volatility ETF (XSLV) 3.2%

- iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) 2.6%

- Invesco High Yield Equity Dividend Achievers ETF (PEY) 2.2%

- First Trust Nasdaq Food & Beverage ETF (FTXG) 2.1%

- U.S. Global Jets ETF (JETS) 2.0%

Will 3Q Earnings Steepen the Slide in Stocks?

* The third quarter earnings reporting season gains momentum this week. Several S&P 500 members from various industries are due to report. The reporting companies include Bank of America, International Business Machines, Johnson & Johnson, Procter & Gamble, Tesla, Union Pacific, and Verizon Communications.

* The latest updates on the state of the housing industry are due. The data include September housing starts, building permits, and existing home sales. Economists expect housing starts and existing home sales to decline in September from August; they expect building permits to stay flat.

* The Conference Board reports the Leading Economic Index for the U.S. Data on third-quarter gross domestic product growth in China and September inflation in the U.K. are due as well.

* Several Fed officials speak on Wednesday, Thursday, and Friday. Given the emphasis on inflation, investors will look for hints on the size of the future interest rate increases.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023