The S&P 500 gained for a second straight week after leading banks reported fourth-quarter earnings in line with investors’ expectations. Inflation continued to moderate, raising hopes that the Fed would increase interest rates gradually. The markets are open for trading four days this week, shortened by Martin Luther King Jr. Day on Monday. Congress needs to address the U.S. debt ceiling to avoid a default. The fourth-quarter earnings reporting season continues this week. Investors will also get an update on wholesale price inflation.

The S&P 500 posted its second consecutive week of gains, recording its best weekly performance since November.

Leading banks kicked off the fourth quarter earnings reporting season. The CEOs of JPMorgan Chase, Bank of America, and Citigroup said they anticipate a “mild recession.”

Investors were unfazed, taking this assessment as expected.

Inflation data raised hopes of the Federal Reserve less aggressively increasing interest rates.

Helped by a sharp decline in gasoline prices in December, U.S. consumer prices fell for the first time in more than 2-1/2 years. The consumer price index dropped 0.1% to show a 12-month increase of 6.5%.

The core CPI, which excludes food and energy prices, rose 0.3% last month, in line with economists’ expectations. The 5.7% increase in the core CPI on a 12-month basis also matched economists’ forecasts.

St. Louis Federal Reserve Bank President James Bullard said the probability of an economic soft landing has increased due to “encouraging” inflation data.

In other data, the University of Michigan consumer sentiment survey showed the one-year inflation outlook slowed to 4%, the lowest level since April 2021.

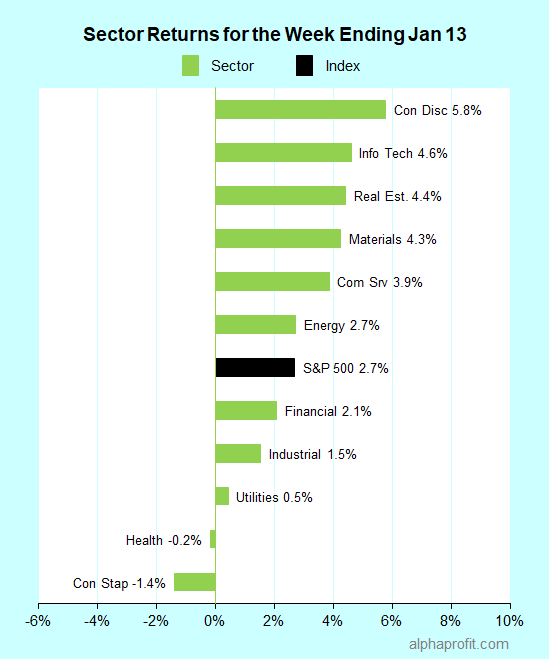

For the week ending January 13, the S&P 500 (SPY) rose 2.7%. Nine of the 11 sectors advanced. Consumer discretionary (XLY) gained the most, while consumer staples (XLP) lost the most.

The S&P 500’s top 10 winners included the following:

1. Industrial Sector

- United Airlines, (UAL) +22% – The week’s top performer in the S&P 500.

- American Airlines (AAL) +20%

2. Consumer Discretionary Sector

- Norwegian Cruise Line Holdings (NCLH) +20%

- Royal Caribbean Cruises (RCL) +15%

- Carnival Corporation (CCL) +14%

- Amazon.com (AMZN) +14%

3. Communication Services Sector

- Warner Bros. Discovery (WBD) +16%

4. Information Technology Sector

- First Solar (FSLR) +15%

- NVIDIA Corp. (NVDA) +14%

- ServiceNow (NOW) +13%

Top ETFs for the week

The following ETF themes worked well: airlines, bitcoin, and high-growth groups such as innovation, clean energy, and cloud computing. The top ETFs for the week include:

- ProShares Bitcoin Strategy ETF (BITO) 16.0%

- Invesco WilderHill Clean Energy ETF (PBW) 14.8%

- ARK Innovation ETF (ARKK) 14.7%

- U.S. Global Jets ETF (JETS) 9.4%

- WisdomTree Cloud Computing Fund (WCLD) 8.3%

Will 4Q2022 Earnings Offset the Debt Ceiling Worry?

* The debt ceiling is back in the spotlight. Treasury Secretary Janet Yellen has said the U.S. would hit the statutory debt limit this week. Congress needs to either raise or suspend the debt ceiling. A quick resolution to the debt ceiling issue is hardly a foregone conclusion. Recently, the House of Representatives voted 15 times before confirming Kevin McCarthy as Speaker. Yellen has said the Treasury Department will “begin taking extraordinary measures to prevent the U.S. from defaulting on its debt obligations.”

* Fourth-quarter earnings reports continue this week. Leading companies from other industries will report earnings alongside financial firms Morgan Stanley, Goldman Sachs, and PNC Bank. They include Netflix, Procter & Gamble, PPG Industries, and Schlumberger.

* Updates on two widely followed economic measures are due this week. First, the U.S. Census Bureau’s December retail sales report should provide insights into consumer spending during the 2022 holiday season. Second, investors will look for signs of continued slowing in wholesale price inflation when the Bureau of Labor Statistics releases the December Producer Price Index.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023