Federal Reserve officials portrayed an aggressive stance in fighting inflation compared to previous communications. The bond and stock markets reacted to their comments. The 10-year bond yield rose to 2.7%, its highest since March 2019. Investors favored stocks with higher earnings stability over those with higher growth prospects.

The Federal Reserve changed its tone to communicate its urgency in its fight against inflation.

Federal Reserve Governor Brainard said, “Inflation is much too high and is subject to upside risks.” She added the central bank needs to shrink its balance sheet “rapidly” to drive down inflation.

Brainard expects the Fed to methodically increase interest rates and rapidly reduce its balance sheet to bring U. S. monetary policy to a “more neutral position” later this year.

Other Federal Reserve Presidents Harker and Bullard concurred with Brainard. The latter said the federal funds rate should reach 3.5% this year.

The Federal Reserve also released the minutes of its March interest rate policy meeting. The minutes revealed officials “generally agreed” on shrinking the central bank’s balance sheet by $95 billion per month or over $1 trillion per year. The minutes also revealed the inclination of bank officials to consider raising interest rates by 0.5% instead of the usual 0.25% in future meetings.

The yield on the 10-year Treasury note rose 0.34% last week to end above 2.7%, its highest since March 2019.

The war in Ukraine continued with civilians becoming targets. Russian Foreign Minister Lavrov said Ukraine had presented Moscow with a draft peace deal that contained “unacceptable” elements. Speaking to the United Nations Security Council, Ukraine’s President Zelenskyy called for a Nuremberg-like tribunal to hold Russia accountable for alleged war crimes.

Investors gravitated towards defensive sectors such as health care as they raised the odds of a U. S. recession resulting from the Fed’s fight against inflation. The continued rise in bond yields weighed on information technology companies.

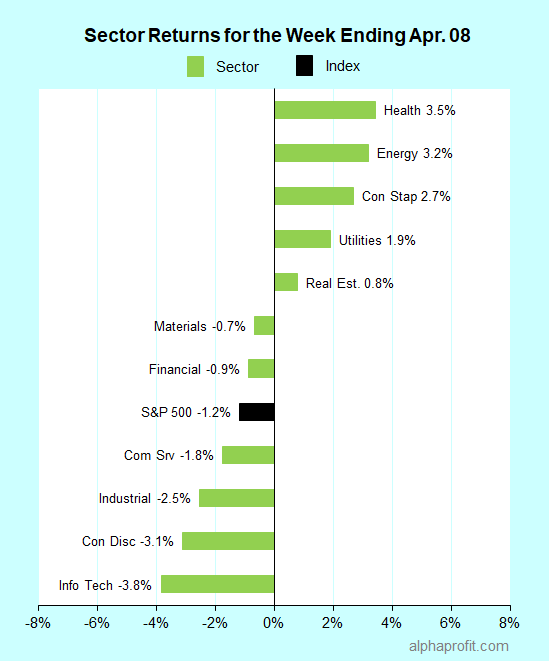

For the week ending April 8, the S&P 500 (SPY) fell 1.2%. Five of the 11 sectors advanced.

Market breadth was negative. The number of advancing stocks in the S&P 500 lagged the number of decliners by a 7-to-8 ratio.

Health care (XLV), energy (XLE), consumer staples (XLP) bucked the S&P 500 gaining 2.7% or more.

Information technology (XLK), consumer discretionary (XLY), and industrials (XLI) lagged the S&P 500.

The S&P 500’s top 10 winners included the following:

1. Communication Services Sector

- Twitter (TWTR) +18%

The social media company was the week’s top performer in the S&P 500 after Elon Musk took a 9.2% stake.

2. Materials Sector

- Mosaic (MOS) +16%

- CF Industries (CF) +15%

Fertilizer makers rode the rally in fertilizer prices as Belarus, China, Russia, and Ukraine curtail supplies.

3. Consumer Discretionary Sector

- AutoZone (AZO) +11%

- Target Corp. (TGT) +11%

- O’Reilly Automotive (ORLY) +10%

- Advance Auto Parts (AAP) +9%

- Dollar General (DG) +9%

As fears of a recession rose, investors favored auto parts retailers and discount retailers likely to fare well in a weak economy.

4. Utilities Sector

- Constellation Energy (CEG) +10%

5. Information Technology Sector

- HP Inc. (HPQ) +9%

Top ETFs for the week

The following ETFs themes worked well: uranium, health care, energy, health care providers, and consumer staples. The top ETFs for the week include:

- North Shore Global Uranium Mining ETF (URNM) +10.6%

- Health Care Select Sector SPDR Fund (XLV) +3.4%

- Energy Select Sector SPDR Fund (XLE) +3.2%

- iShares U.S. Healthcare Providers ETF (IHF) +2.8%

- Consumer Staples Select Sector SPDR Fund (XLP) +2.7%

Top Fidelity Fund for the week

- Fidelity Select Pharmaceuticals (FPHAX) +4.2%

1Q22 Bank Earnings and Inflation Data in Focus

Trading this week is a four-day affair due to the April 15 Good Friday holiday. Banks kick off the first-quarter earnings reporting season. The economic calendar includes two reports on inflation.

* The first-quarter earnings reporting season starts this week. According to FactSet, analysts expect S&P 500 companies to grow their earnings by 4.5% year-over-year in the first quarter. Top banks feature prominently in this week’s reporting calendar. JPMorgan reports on Wednesday, followed by Citigroup, Goldman Sachs, Morgan Stanley, and Wells Fargo on Thursday. Leading health insurer UnitedHealth reports in addition to the banks this week.

* The economic calendar is busy. On Tuesday, the Labor Department reports the March consumer price index reading. Economists expect the CPI to rise 7.9% year-over-year. Some economists forecast the year-over-year increase in CPI to peak in March. Data on the March producer price index and retail sales are due too.

* The 10-year bond yielded less than 2% last on March 9. The yield has risen over 0.7% in the past month and appears likely to climb over 3%. The Treasury auctions $110 billion in bonds this week. Will the 10-year bond yield over 3% next week? The answer to this question may well be determined by how bond yields respond to inflation data next week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023