Stocks fell for a third straight week after Fed Chair Powell said the central bank would consider increasing the fed funds rate by 0.5% when it meets in May. Netflix shares fell 37% after reporting first-quarter earnings. Investors weighed the risks of a recession from interest rate hikes.

The Dow Jones Industrial Average dropped about 1,000 points on Friday, marking its worst one-day decline since 2020.

Stocks fell sharply after Fed Chair Powell spoke at an International Monetary Fund panel. Powell said it is ‘absolutely essential’ to tame inflation. He backed moving more quickly to combat inflation and said a 50-basis-point increase would be ‘on the table’ when the Fed meets in May.

In earnings news, Netflix dented market sentiment after it reported a decline in subscriber count. Netflix shares were down 37% for the week. Disappointing earnings from hospital operator HCA Healthcare and robotic surgery equipment maker Intuitive Surgical weighed heavily on health care stocks.

The yield on the 10-year Treasury Bond rose 0.08% to end the week at 2.91%.

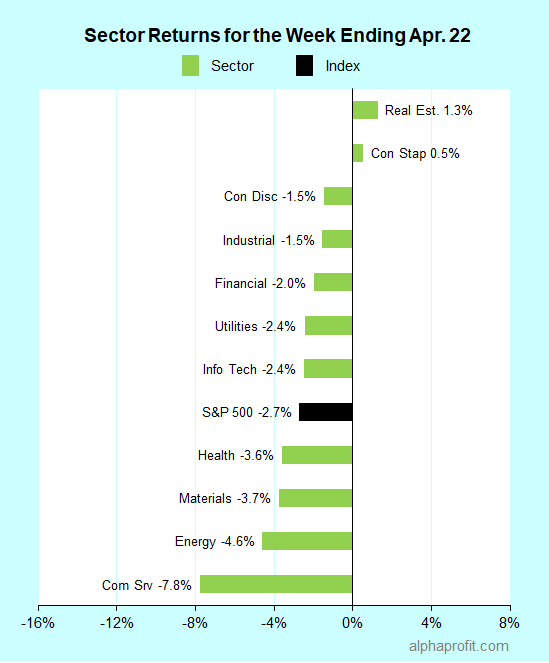

As investors worried about how higher interest rates could impact the economy, defensive sectors fared better than economically sensitive ones.

For the week ending April 22, the S&P 500 (SPY) fell 2.7%. Only two of the 11 sectors advanced.

Leading and lagging sectors for the week ending April 22, 2022, before Mega-caps report 1Q22 earnings.

Market breadth was negative. The number of advancing stocks in the S&P 500 lagged the number of decliners by a 3-to-7 ratio.

Real estate (XLRE) and consumer staples (XLP) bucked the S&P 500, ending above the flat line.

Communication services (XLC), energy (XLE), and materials (XLB) lagged the S&P 500.

The S&P 500’s top 10 winners included the following:

1. Industrials Sector

- United Airlines Holdings (UAL) +14%

- Allegion plc (ALLE) +7%

- American Airlines Group (AAL) +6%

- Snap-on Inc. (SNA) +5%

Airlines shares rallied after the Transportation Security Administration removed the mask mandate for air travel. Reporting first-quarter earnings, United and American noted robust increases in flight bookings and willingness of passengers to pay more to travel. Both airlines predicted profits in the second quarter. United shares rose 14% to be the week’s top performer in the S&P 500.

2. Consumer Staples Sector

- Kimberly-Clark (KMB) +10%

The consumer products company topped analysts’ quarterly EPS estimates and raised its full-year sales forecast.

3. Information Technology Sector

- International Business Machines (IBM) +9%

- Western Digital Corp. (WDC) +7%

IBM shares rose after reporting sales and EPS above analysts’ estimates.

4. Communication Services Sector

- Twitter, Inc. (TWTR) +9%

The social media company moved up after Tesla CEO Elon Musk said he has $46.5 billion in funding available to take over Twitter and may explore a tender offer to acquire shares directly from shareholders. Musk is Twitter’s largest shareholder.

5. Financials Sector

- M&T Bank Corp. (MTB) +8%

- SVB Financial Group (SIVB) +7%

Regional bank shares moved up after reporting better-than-expected first-quarter results.

Top ETFs for the week

The following ETFs themes worked well: carbon credits, airlines, real estate, transportation, and Indonesia. The top ETFs for the week include:

- KraneShares Global Carbon ETF (KRBN) +6.1%

- U.S. Global Jets ETF (JETS) +2.7%

- The Real Estate Select Sector SPDR Fund (XLRE) +1.3%

- SPDR S&P Transportation ETF (XTN) +1.1%

- iShares MSCI Indonesia ETF (EIDO) +1.0%

Top Fidelity Fund for the week

- Fidelity Real Estate Index Fund (FSRNX) +1.0%

1Q22 Mega-cap Earnings and Economic Data Ahead of FOMC

A heavy dose of earnings reports is in store this week. Almost 150 members of the S&P 500 index report earnings. Data on inflation and GDP growth are also due ahead of the Fed’s May 3-4 interest rate policy meeting. The earnings reports and economic data points should collectively answer questions vexing investors.

* Concerns of pandemic beneficiaries falling short of analysts’ earnings expectations are up after Netflix disappointed last week. This week’s earnings reports from some of the largest companies will shed light on two key issues. First, is Netflix’s subscriber shortfall limited to streaming video companies, or is it a part of the broader trend impacting many subscription businesses, including software and cybersecurity? Second, are companies successful in maintaining profit margins in this high inflation environment?

* Nearly 150 S&P 500 members report earnings this week. However, the focus is on mega-cap stocks. The reporting calendar includes the top four S&P 500 members, Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), and Microsoft (MSFT), with Alphabet and Microsoft leading the way on Tuesday.

* Index heavyweights from other sectors reporting this week include Visa (V), ExxonMobil (XOM), Coca-Cola (KO), AbbVie (ABBV), and United Parcel Services (UPS).

* Key economic data are due before the Federal Open Market Committee’s May 3-4 interest rate policy meeting. The Bureau of Economic Analysis reports the March reading of the personal consumption expenditures (PCE) index, the Fed’s preferred inflation measure. Economists surveyed by Dow Jones expect the core PCE, excluding food and energy expenditures, to show month-over-month and year-over-year increases of 0.4% and 5.4%, matching the corresponding tallies in February. The Commerce Department reports its preliminary estimate of first-quarter gross domestic product growth. This report should provide insights into how the economy is faring in this milieu of high inflation, rising bond yields, and the war in Ukraine.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023