Concerns of Russia invading Ukraine intensified towards the latter part of last week after President Biden said the probability of an attack in coming days remains high. Earlier in the week, Russia announced it had pulled some of its military units back from its border with Ukraine. Speculation about the Federal Reserve’s next interest rate move also weighed on equities.

Stocks moved up and then down last week in response to the buildup of Russian troops along the Ukraine border and comments from Russia.

On Tuesday, Russia said it had withdrawn part of its troops near the Ukraine border. The saber-rattling, however, continued with U. S. President Biden warning that the threat of Russia invading Ukraine is “very high.” In return, Russia accused Biden of stoking tensions and ignoring its security demands.

The credibility of Russia withdrawing its troops took a hit after Russia prepared to carry out more drills near Ukraine’s border on Friday. After the stock market closed for the week, President Biden said he is “convinced” Russia has decided to attack Ukraine in the coming days.

The tension between the U. S. and Russia pushed oil prices higher due to the possibility of U. S. imposing retaliatory sanctions against Russian oil. Oil futures rose above $95 per barrel for the first time in seven years. Reports of a deal between the U. S. and Iran allowing the latter to sell its oil in the global market stemmed the rise. Oil retreated to close the week at about $91 per barrel.

St. Louis Fed President Bullard continued to press for a 0.5% hike in the benchmark interest rate in March. Interest rate futures, however, failed to follow suit. They reflected a lower probability of a 0.5% hike. The Fed’s January meeting minutes did not unveil additional support for a 0.5% step-up in interest rates.

The yield on the 10-year Treasury note declined by 0.03% for the week to end at 1.93% on a lower probability of a 0.5% interest rate increase in March and flight to quality from rising tension in Ukraine.

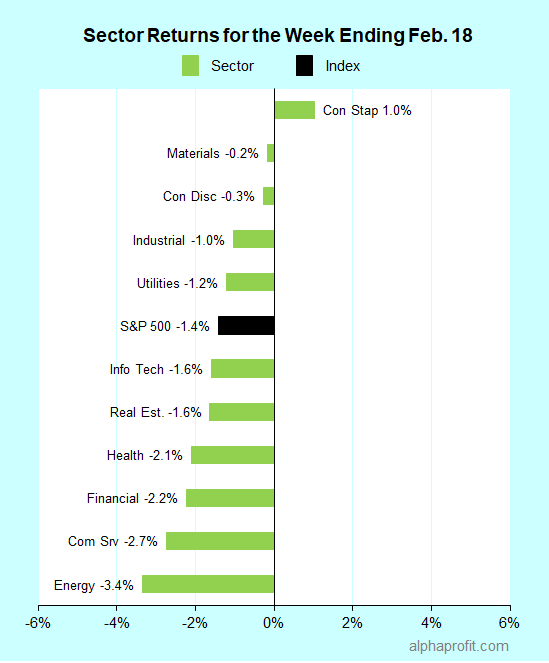

For the week ending February 18, the S&P 500 (SPY) fell 1.4%. Ten of the 11 sectors declined.

Market breadth was negative. The number of advancing stocks in the S&P 500 lagged the number of decliners by a 2-to-3 ratio.

Consumer staples (XLP) bucked the S&P 500, ending above the flatline. Materials (XLB) and consumer discretionary (XLY) held up better than the S&P 500.

Energy (XLF), communication services (XLC), and financials (XLF) lagged the S&P 500, losing 2.2% or more.

The S&P 500’s top 10 winners included the following:

1. Consumer Staples

Kraft Heinz (KHC) +11% – The consumer goods company earned $0.79 a share in the fourth quarter, beating analysts’ forecasts by 25%. Kraft Heinz shares were the week’s top performer in the S&P 500.

2. Industrials

Westinghouse Air Brake Technologies (WAB) +10% – The transportation equipment provider gave an upbeat assessment of its future from growth in orders for its battery-electric locomotives. Westinghouse Air Brake raised its quarterly dividend by 25%.

3. Health Care

Henry Schein (HSIC) +10% – The dental supplies company topped analysts’ fourth-quarter EPS forecasts by 18% and raised its 2022 EPS guidance to imply 5-9% growth.

4. Consumer Discretionary

Expedia (EXPE) +9% – The online travel agency continued to rise after its upside EPS surprise from the prior week. Several brokers, including Goldman Sachs & Bank of America, raised their price targets on Expedia amidst positive vibes about the recovery in travel volumes from Marriott and Airbnb this week.

5. Materials

Sealed Air (SEE) +9% – A $0.01 per share shortfall in Sealed Air’s fourth-quarter EPS versus analysts’ forecasts did not deter investors from driving the share price higher after the packaging materials provider forecasted sales and EPS to grow 6% and 14%, respectively, in 2022.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week also included:

- Backup power generation equipment maker Generac (GNRC) +7%

- Diversified consumer products company Newell Brands (NWL) +6%

- Gold producer Newmont Mining (NEM) +6%

- Networking & telecom equipment maker Cisco Systems (CSCO) +6%

- Office property owner Vornado Realty (VNO) +8%

Top ETFs for the week

The following ETFs themes worked well: gold miners, platinum, Shanghai & Shenzhen listed Chinese A-shares and silver miners. The top ETFs for the week include:

- VanEck Gold Miners ETF (GDX) +6.4%

- Aberdeen Standard Physical Platinum Shares ETF (PPLT) +3.6%

- VanEck Junior Gold Miners ETF (GDXJ) +3.2%

- KraneShares Bosera MSCI China A 50 Connect Index ETF (KBA) +2.9%

- Global X Silver Miners ETF (SIL) +2.5%

Top Fidelity Fund for the week

- Fidelity Select Gold (FSAGX) +5.0%

Are Bearish Charts Signaling More Losses in the Week Ahead

The Presidents’ Day holiday shortens the trading week. Investors are keenly watching technical levels & patterns on key stocks and indexes as tensions between Russia & Ukraine remain in focus. In economic data, an update on the Fed’s preferred inflation measure is the highlight of the week. The earnings calendar includes a few high-profile retailing names.

* Investors expect tension in Ukraine and inflation data to make the Presidents’ Day shortened four-day trading week a volatile one. Their attention is on the NASDAQ Composite & the S&P 500 stock indexes, and bellwether Apple. The NASDAQ Composite Index has formed a death cross with its 50-Day Moving Average (DMA) falling below the 200-DMA. The S&P 500 has fallen below its 200-DMA, and a test of the 4,223 January low could be in the offing. Apple, the largest constituent of the NASDAQ Composite and the S&P 500 benchmarks, holds above its 200-DMA currently. Sharper declines could be in store for stock indexes if Apple fails to hold above its 200-DMA.

* A meeting between the U. S. Secretary of State Blinken and Russian Foreign Minister Lavrov seeking a diplomatic solution over Ukraine is likely to materialize in the latter part of the week if Russia does not invade Ukraine.

* The week includes a few economic reports. The Commerce Department’s report on Personal Consumption Expenditures (PCE) is the one investors most eagerly await. Economists surveyed by the Wall Street Journal expect the core PCE (excludes food and energy expenditures) to rise 0.5% in January, matching the rise in December. They expect the Core PCE to rise 5.2% on a 12-month basis, up from 4.9% in December.

* The earnings reporting season is winding down. Home improvement retailers Home Depot and Lowe’s feature prominently among the S&P 500 companies reporting this week. Online travel agency Booking Holdings, health care companies, Medtronic & Moderna, oil producer EOG Resources, and storage REIT Public Storage are among the other names reporting.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023