Stocks endured a tough first half, pressured first by fears of inflation and later by worries of a recession. The jobs report and minutes from the Federal Reserve’s last interest rate meeting will likely move stock prices during this trading week shortened by the July 4 holiday.

The S&P 500 ended the first half of the year 20.0% below where it started in 2022. The benchmark declined in both the first and second quarters.

Inflation continued to accelerate from where it ended in 2021, worsened by spiraling food and energy commodity prices.

Having been slow to react to the surge in inflation, the Federal Reserve raised interest rates sharply, attempting to catch up.

The Fed raised interest rates three times in 2022, with each step being higher than the previous one.

The yield on the benchmark 10-year Treasury note more than doubled to 3.5% by mid-June after starting the year at 1.5%.

Rising bond yields forced investors to reprice stocks, with ‘growth stocks’ bearing the brunt of the decline.

The NASDAQ Composite index, heavily weighted towards large-cap growth companies, fell nearly 29% in the first half.

Recession concerns escalated by the end of the second quarter. Investors worried that the Fed’s attempt to subdue inflation by raising interest rates would lead to a recession.

The 10-year Treasury yield fell in the closing weeks of June as recession fears rose. The 10-year Treasury yielded a tad below 3.0% on June 30.

Below, we look at the ETFs, Select SPDRs, Fidelity funds, and S&P 500 stocks that returned the most in 1H2022.

Best ETFs of 1H2022

Exchange-traded products investing in energy commodities such as oil and natural gas rose to the top of the performance charts.

- Invesco DB Energy, DBE +53.2%

- United States Natural Gas, UNG +52.2%

- United States Oil, USO +47.8%

- iShares S&P GSCI Commodity-Indexed Trust, GSG +35.0%

- Invesco DB Oil, DBO +34.6%

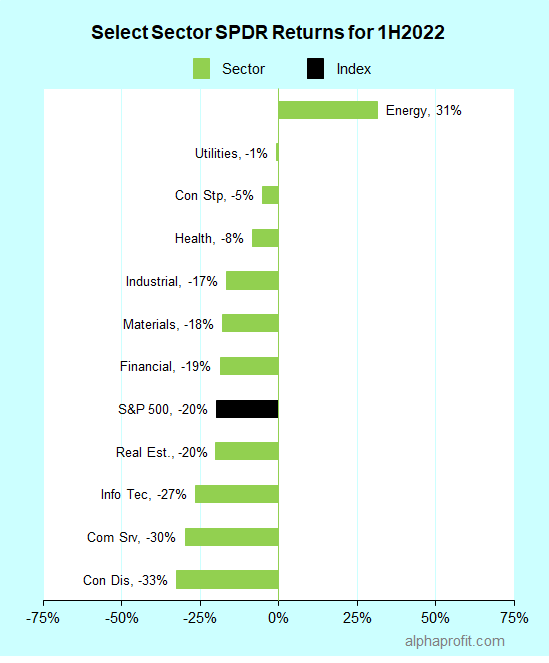

Best Select Sector SPDR ETFs of 1H2022

The Energy Select Sector SPDR took the top position. Select Sector SPDRs focusing on utilities and consumer staples followed energy with single-digit losses as investors gravitated towards defensive sectors in this uncertain investing backdrop.

- Energy Select Sector SPDR, XLE 31%

- Utilities Select Sector SPDR, XLU -1%

- Consumer Staples Select Sector SPDR, XLP -5%

Best Fidelity Funds of 1H2022

Commodity-oriented Fidelity funds rose to the top of the performance table. Gains in shares of telecom services provider AT&T lifted the defensive Fidelity Telecom and Utilities Fund into the fourth spot. Highlighting the challenging environment for most risk assets, the Fidelity Money Market Fund claimed the fifth spot by preserving capital.

- Fidelity Select Energy Portfolio, FSENX +33.7%

- Fidelity Natural Resources Fund, FNARX +17.3%

- Fidelity Glb Commodity Stock Fund, FFGCX +7.1%

- Fidelity Telecom and Utilities Fund, FIUIX +0.8%

- Fidelity Money Market Fund, SPRXX +0.1%

See: Best Fidelity funds for 2022

Best S&P 500 Stocks of 1H2022

All of the top five winners for the first half were energy stocks. Occidental Petroleum returned more than double the next best performer, riding the Warren Buffett effect. Oil refiners Hess and Valero, natural gas producer Coterra, and international major Exxon Mobil accounted for the other four.

- Occidental Petroleum, OXY +103%

- Hess, HES +43%

- Valero Energy, VLO +42%

- Coterra Energy, CTRA +40%

- Exxon Mobil, XOM +40%

See: Best Sectors and Stocks for Strongest Growth in 2022

Looking ahead to 2H2022

* The June jobs report, due on Friday, is the main event of this four-day trading week. Economists expect the job report to reflect the impact of higher interest rates. A survey conducted by Dow Jones shows economists expect the economy to have added 250,000 jobs to payrolls in June, fewer than the 390,000 added in May. Investors will likely perceive some decline in job creation as a positive. Stocks could react negatively if the job creation number exceeds expectations since the Fed would be in a position to raise interest rates without worrying about the economy.

* Minutes of the Federal Open Market Committee’s June 14-15 interest rate policy meeting are due on Wednesday. With the FOMC widely expected to raise interest rates by 0.75% at its July meeting, market participants will examine the minutes for clues on interest rate policy beyond the FOMC’s July meeting. In particular, they will try to assess the impact of a slowing economy on the size and frequency of future interest rate increases.

* Fears of a recession have risen in recent weeks. Last week, the Commerce Department reported that the U.S. economy contracted by 1.6% in real terms in the first quarter. The Atlanta Fed’s GDP Now tracker forecasts the economy to contract by 2.1% in the second quarter. If this forecast proves correct, the economy would have contracted for two straight quarters, meeting the definition of a recession. Investors will watch for the GDP Now tracker’s Thursday update to gauge if the economy could already be in a recession.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023