Investors worried about a recession after the Fed signaled it would aggressively tighten monetary policy to tame inflation. The continued rise in interest rates and some high-profile earnings misses impacted investor sentiment.

April 2022 turned out to be a dismal month for stocks. The large-cap S&P 500 fell 8.7% in April, the benchmark’s worst April performance since 1970. The small-cap Russell 2000 index lost 9.9%. Defensive sectors fared better than economically sensitive ones as investors worried about a global economic slowdown.

Inflation remained well above the Federal Reserve’s long-term 2% target. The Fed’s preferred inflation gauge rose 5.2% increase during the past 12 months ending in March.

Federal Reserve officials portrayed an aggressive stance in fighting inflation. The yield on the 10-year Treasury Bond rose 0.56% in April to end at 2.89% after touching 2.95%.

Disruptions to the semiconductor and agriculture supply chains worsened from slowing economic growth in China and the war in Ukraine, respectively.

Although 80% of S&P 500 companies reporting earnings topped analysts’ estimates, disappointing forecasts from companies like Apple, Amazon, and JP Morgan weighed heavily on stocks.

Here, we look at what ETFs, Select SPDRs, Fidelity funds, and S&P 500 stocks returned the most in April 2022.

Best ETFs of April 2022

Led by natural gas and oil, commodity-related ETFs fared well in April. Saudi Arabian stocks also benefited from the rise in oil prices. The U. S. dollar surged, helped by the prospect of higher interest rates and global uncertainties.

- United States Natural Gas Fund, LP, UNG +26.8%

- Invesco DB Energy Fund, DBE +10.0%

- iShares MSCI Saudi Arabia ETF, KSA +6.8%

- Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF, PBDC +5.7%

- Invesco DB US Dollar Index Bullish Fund, UUP +4.8%

Best Select Sector SPDR ETFs of April 2022

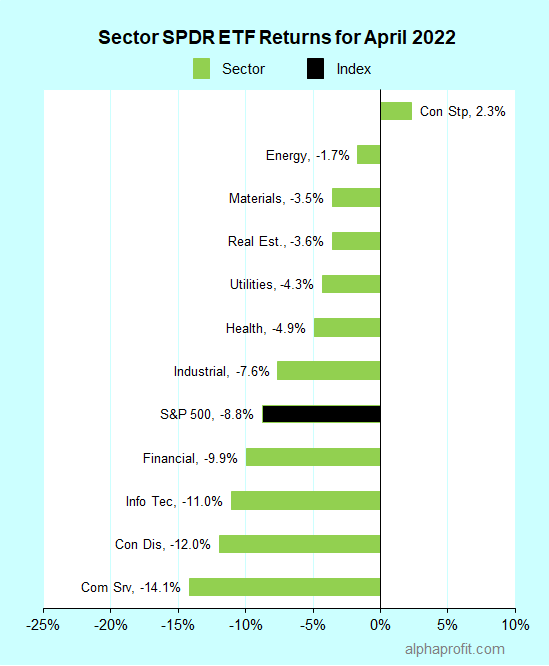

The Consumer Select Sector SPDR was the only SPDR ETF to finish above the flatline. Select Sector SPDRs focusing on energy and materials fared better than the S&P 500.

- Consumer Staples Select Sector SPDR Fund, XLP +2.3%

- Energy Select Sector SPDR Fund, XLE -1.7%

- Materials Select Sector SPDR Fund, XLB -3.5%

Best Fidelity Funds of April 2022

Few Fidelity funds managed to finish above the flatline. Among stocks funds, Fidelity Select Consumer Staples was an exception. Conservative income alternatives such as short-term bonds and tax-exempt money market funds took the other spots with fractional gains.

- Fidelity Select Consumer Staples Portfolio, FDFAX +3.09%

- Fidelity Conservative Income Bond Fund, FCONX +0.02%

- Fidelity California Municipal Money Market Fund, FCFXX +0.01%

- Fidelity Municipal Money Market Fund, FTEXX +0.01%

- Fidelity Tax-Exempt Money Market Fund, FMOXX +0.01%

See: Best Fidelity funds for 2022

Best S&P 500 Stocks of April 2022

Social media Twitter was the top performer in the S&P 500 after getting a buyout offer from Tesla CEO Musk. Flooring products maker Mohawk, discount retailer Ross Stores, household products maker Kimberly-Clark, and packaged foods maker Lamb Weston benefited after reporting earnings.

- Twitter, Inc., TWTR +27%

- Mohawk Industries, Inc., MHK +14%

- Kimberly-Clark Corporation, KMB +13%

- Lamb Weston Holdings, Inc., LW +10%

- Ross Stores, Inc., ROST +10%

See: Best Sectors and Stocks for Strongest Growth in 2022

Looking ahead to May 2022

The Federal Reserve’s May 2-3 interest rate policy meeting and the April jobs report are the main events as trading in May kicks off.

* The Federal Open Market Committee meets to discuss interest rate policy meeting this week. Some Fed officials have voiced their support for “front-loading” interest rate increases to break the inflation bogey. Economists expect the Fed to increase the federal funds benchmark interest rate by 0.5% at this meeting.

* Investors’ attention will shift from the FOMC meeting to the April unemployment report later this week. Economists surveyed by Dow Jones expect the Labor Department to report the addition of 400,000 non-farm jobs in April compared to 431,000 in March. They forecast the unemployment rate to dip to 3.5% in April from 3.6% in March.

* Several widely held S&P 500 companies such as Advanced Micro Devices, Booking Holdings, ConocoPhillips, Pfizer, and S&P Global report earnings.

* The economic data calendar includes the Institute of Supply Management readings on factory and service activity measures.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023