Stocks gained the most in a single month since November 2020 on better-than-expected second-quarter earnings reports and hopes that the Fed will temper interest rate increases. While the above positives cannot be ignored, inflation remains troublesome. Starting with the July jobs report this week, investors will get ample insight into the state of the economy to reassess if the current optimism is justified.

The S&P 500 index gained 9.2% in July, the most in a single month since November 2020.

Stocks rallied in July as investors’ worst fears about a disappointing second-quarter earnings reporting season and Federal Reserve Chair Powell’s aggressive stance on inflation did not materialize.

Upbeat earnings forecasts from mega-caps like Amazon, Apple, and Microsoft have quelled investors’ worries over the state of supply chains and consumer spending.

The Federal Reserve bank raised its benchmark short-term interest rate by 0.75% to curb high inflation. Opening the door for smaller interest rate increases in the future, Powell noted that it would be appropriate to slow the magnitude of interest rate hikes when the Fed assesses the impact of policy adjustments on the economy and inflation.

Here, we look at the ETFs, Select SPDRs, Fidelity funds, and S&P 500 stocks that returned the most in July 2022.

Best ETFs of July 2022

Natural gas exchange-traded products rose sharply as the demand for natural gas soared in the U.S. due to hot weather. The price of natural gas surged in Europe as Russia reduced supplies. Clean energy ETFs made sizeable gains after Sens. Manchin and Schumer struck a compromise, raising the odds of the U.S. passing the most ambitious climate bill.

- United States Natural Gas Fund LP, UNG +49.1%

- ProShares Bitcoin Strategy ETF, BITO +27.4%

- Sprott Uranium Miners ETF, URNM +20.8%

- ALPS Clean Energy ETF, ACES +19.2%

- Invesco WilderHill Clean Energy ETF, PBW +19.1%

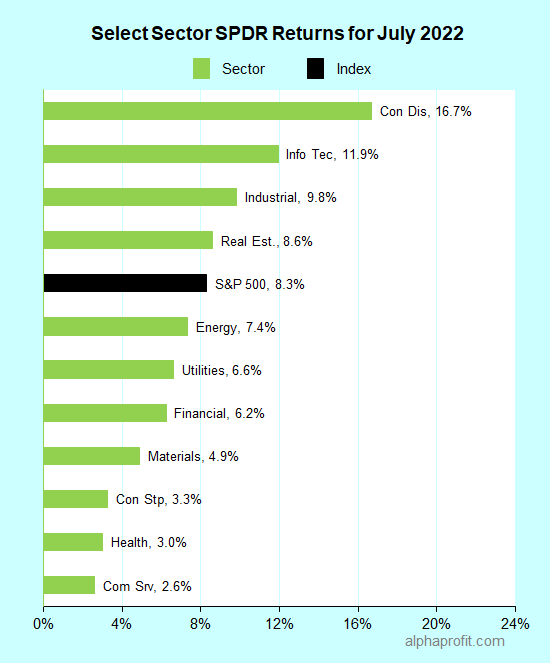

Best Select Sector SPDR ETFs of July 2022

The top-performing Consumer Discretionary Select Sector SPDR rode the rally in shares of Amazon and Tesla. Both companies reported better-than-expected earnings.

- Consumer Discretionary Select Sector SPDR Fund, XLY +16.7%

- Technology Select Sector SPDR Fund, XLK +11.9%

- Industrial Select Sector SPDR Fund, XLI +9.8%

Best Fidelity Funds of July 2022

Fidelity Select Semiconductors topped the performance table. Semiconductor stocks rallied after the House and Senate passed their versions of the Chips and Science Act. The legislation seeks to boost U.S. competitiveness with China by allocating billions of dollars toward domestic semiconductor manufacturing and scientific research. Consumer discretionary, retailing, and growth stocks fared well amidst falling interest rates, declining gasoline prices, and rising investor risk appetite.

- Fidelity Select Semiconductors Portfolio, FSELX +20.8%

- Fidelity Select Consumer Discretionary Portfolio, FSCPX +18.6%

- Fidelity Trend Fund, FTRNX +14.7%

- Fidelity Select Retailing Portfolio, FSRPX +14.3%

- Fidelity Disruptive Technology Fund, FTEKX +14.3%

See: Best Fidelity funds for 2022

Best S&P 500 Stocks of July 2022

Unexpected progress towards the climate bill and earnings reports largely accounted for the performance of the top gainers. Solar energy stocks Enphase Energy benefited from both drivers, while SolarEdge benefited from the climate bill. Beaten-down shares of peer-to-peer commerce site Etsy and equipment rental firm United Rentals rallied on higher earnings guidance, while Bath & Body Works managed to gain even after its earnings fell short.

- Enphase Energy, ENPH +54%

- Etsy, ETSY +39%

- SolarEdge Technologies, SEDG +37%

- Bath & Body Works, BBWI +35%

- United Rentals, URI +34%

See: Best Sectors and Stocks for Strongest Growth in 2022

Looking ahead to August 2022

* The July employment report is the main event of this week. Economists surveyed by Dow Jones expect the jobs report to show 250,000 job additions, down from 372,000 jobs added in June. The Institute of Supply Management’s manufacturing and services activity measures are also due this week. The employment measure in the services report will get investors’ attention since it fell to a two-year low last month.

* This week, nearly 150 S&P 500 members report their second-quarter earnings. The list of reporting companies includes several healthcare names, including Amgen, CVS Health, and Eli Lilly. Advanced Micro Devices & PayPal from the technology sector and Booking Holdings & Starbucks from the consumer discretionary sector also feature in this week’s reporting calendar.

* The S&P 500 is technically only a few points below the 4,180 level that halted the early June rally and provided support during the first quarter of 2022. It remains to be seen if the July momentum can push the benchmark above its early June high, paving the way for the index to move closer to its 200-day-moving-average of 4,346.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023