Investors worry that the Federal Reserve will aggressively increase interest rates to tame decades-high inflation, tipping the U. S. economy into recession. Although stocks rallied to end May above the flatline, last Friday’s May jobs report has reinforced these fears. The consumer price index may boost stocks if it suggests inflation has peaked. Meanwhile, the S&P 500 threatens to break the 4,000 to 4,100 support range from a technical perspective.

The S&P 500 index rose 0.2% in May. The result, however, masked the volatility in stocks. At its lowest point in the month, the S&P 500 was down 13.7% in May.

The rate of inflation remained too high for investors’ comfort. The Federal Reserve raised its target interest rate by 0.5% in early May. Signaling additional increases at future interest rate policy meetings, Chairman Powell said the central bank would continue to raise interest rates to temper the surge in inflation.

Investors feared rapid interest rate increases would tip the economy into a recession. Subpar quarterly profits and profit forecasts from retailers Walmart and Target raised concerns about U. S. corporate profit margins and profit growth.

The relentless selling pressure on stocks eased after the S&P 500 recorded its seventh straight weekly decline.

The minutes from the Federal Reserve’s May 3-4 interest rate policy meeting helped stocks turn around. The minutes reaffirmed the central bank’s commitment to lower inflation while remaining responsive to economic data. Growth in consumer spending also topped economists’ forecasts, boosting investors’ confidence in the economy’s ability to avoid a recession.

Here, we look at what ETFs, Select SPDRs, Fidelity funds, and S&P 500 stocks returned the most in May 2022.

Best ETFs of May 2022

The iShares Chile ETF claimed the top spot, helped by gains in mining company SQM and Chilean banks. SQM rallied as prices of products such as lithium and fertilizers surged. Chilean banks rallied as the nation’s central bank raised interest rates. ETFs invested in oil & gas producers featured prominently among the top performers as oil surged 10% to close May at $115 per barrel.

- iShares MSCI Chile ETF, ECH +19.7%

- First Trust Natural Gas ETF, FCG +18.0%

- iShares U.S. Oil & Gas Exploration & Production ETF, IEO +17.8%

- SPDR S&P Oil & Gas Exploration & Production ETF, XOP +17.3%

- Invesco S&P 500 Equal Weight Energy ETF, RYE +16.5%

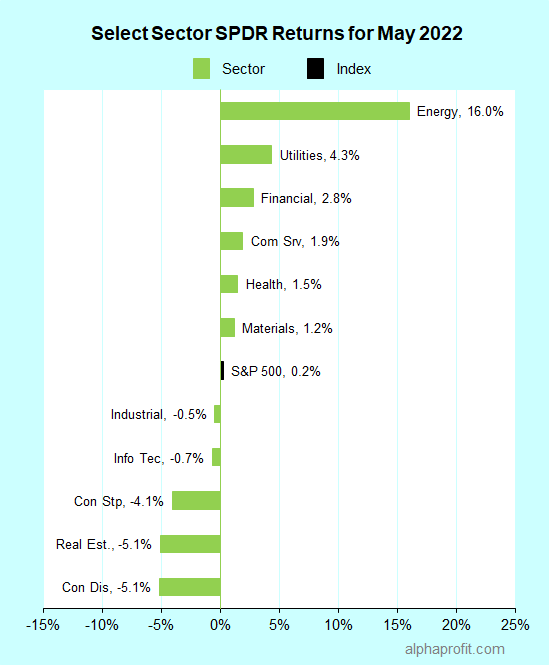

Best Select Sector SPDR ETFs of May 2022

The Energy Select Sector SPDR outperformed the S&P 500 by a sizeable margin. Investors gravitated towards energy stocks as oil supplies remained tight. Select Sector SPDRs focused on utilities and financials outperformed the S&P 500.

- Energy Select Sector SPDR Fund, XLE +16.0%

- Utilities Select Sector SPDR Fund, XLU +4.3%

- Financial Select Sector SPDR Fund, XLF +2.8%

Best Fidelity Funds of May 2022

Commodity-oriented Fidelity funds such as Energy, Natural Resources, and Global Commodity Stock accounted for three of the top five funds. Shares of telecom giants AT&T and Verizon rose as investors preferred high-yielding stocks in this milieu of rising interest rates. Although semiconductor titans NVIDIA and Broadcom did not fare well, robust gains in shares of Microchip Technology, NXP Semiconductors, and ON Semiconductor boosted Fidelity Select Semiconductors.

- Fidelity Select Energy Portfolio, FSENX +15.4%

- Fidelity Natural Resources Fund, FNARX +10.5%

- Fidelity Select Telecommunications Portfolio, FSTCX +7.9%

- Fidelity Select Semiconductors Portfolio, FSELX +6.2%

- Fidelity Global Commodity Stock Fund, FFGCX +5.8%

See: Best Fidelity funds for 2022

Best S&P 500 Stocks of May 2022

Lithium producer Albemarle was the top performer in the S&P 500 as the commodity’s price continued to stay firm after rallying sharply earlier this year. Oil & gas producers Devon Energy and Marathon Oil, electricity generator NRG Energy, and IT services provider EPAM Systems also featured among the top five winners.

- Albemarle, ALB +35%

- Devon Energy, DVN +29%

- NRG Energy, NRG +28%

- EPAM Systems, EPAM +28%

- Marathon Oil, MRO +26%

See: Best Sectors and Stocks for Strongest Growth in 2022

Looking ahead to June 2022

* Stocks started June on a downbeat note after the May jobs report surprised to the upside, reinforcing expectations for interest rates to increase substantially in the coming months. The Labor Department said nonfarm payrolls rose by 390,000 in May, compared to the economists’ consensus forecast of 328,000. Average hourly earnings rose 0.3% in May, slightly less than the consensus estimate of 0.4%. The unemployment rate was unchanged in May at 3.6%.

* Comments from chief executives unnerved investors last week. JPMorgan Chase CEO Dimon warned of an ‘economic hurricane’ from inflation, the war in Ukraine, and tighter monetary policy. In an email to Tesla executives, CEO Musk said he has a ‘super bad feeling’ about the economy and needs to cut about 10% of jobs at the electric car maker.

* Among economic data this week, investors will focus most on the consumer price index (CPI). Economists expect the CPI to rise 8.2% year-over-year in May, a tad below the 8.3% increase recorded in April. Stocks could react favorably if the CPI meets the consensus economist’s forecast, suggesting inflation has peaked.

* Traders are watching to see if the S&P 500 can hold above the 4,000-4,100 range after closing at 4,108.54 on June 3. A retest of the May 20 low of 3,810 could be in the offing if the benchmark fails to hold above 4,000.

* Three S&P 500 consumer staples companies report earnings this week. They are Brown-Forman, Campbell Soup, and J. M. Smucker.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023