The major U. S. stock market indices rose in March. Yet, they ended lower for the quarter, marking their first quarterly loss in two years. Investors worried about rising inflation, higher interest rates, and the war in Ukraine. Disruptions to exports of commodities from both Russia and Ukraine worsened inflation.

The S&P 500 fell 4.6% in the first quarter, while the Dow Jones Industrial Average declined 4.1%. The NASDAQ Composite was the worst performer, losing 8.9%.

Interest rates moved dramatically higher during the quarter. The benchmark 10-year Treasury yielded as high as 2.55% after starting the year at 1.51% and ended the quarter at 2.37%. The increase in the yield of the 2-year Treasury note was even starker. The 2-year Treasury ended the quarter yielding 2.45% after starting the year at a mere 0.73%.

Higher oil prices weighed on stocks. Many customers scrambled to make up for Russian oil after refusing to buy it due to sanctions imposed on Russia. West Texas Intermediate oil spiked as high as $130.50 a barrel on March 7, after starting the year at $75.21 a barrel. WTI oil ended the quarter at $100.28 a barrel.

The U. S. economy held up to these cross-currents quite well. The employment market stayed strong. Job creation averaged 562,000 per month in the first quarter, lowering the unemployment rate to 3.6%.

Here, we look at what ETFs, Select SPDRs, Fidelity funds, and S&P 500 stocks returned the most in 1Q 2022.

Best ETFs of 1Q 2022

Energy ETFs of various types featured at the top of the performance charts. Natural gas led the way. Other top performing energy ETFs include those investing in oil services stocks, natural gas producers, and oil producers.

- United States Natural Gas Fund, UNG +57.9%

- VanEck Oil Services ETF, OIH +52.9%

- First Trust Natural Gas ETF, FCG +42.6%

- Invesco S&P 500 Eq. Wt. Energy ETF, RYE +41.9%

- SPDR S&P Oil & Gas E & P ETF, XOP +40.9%

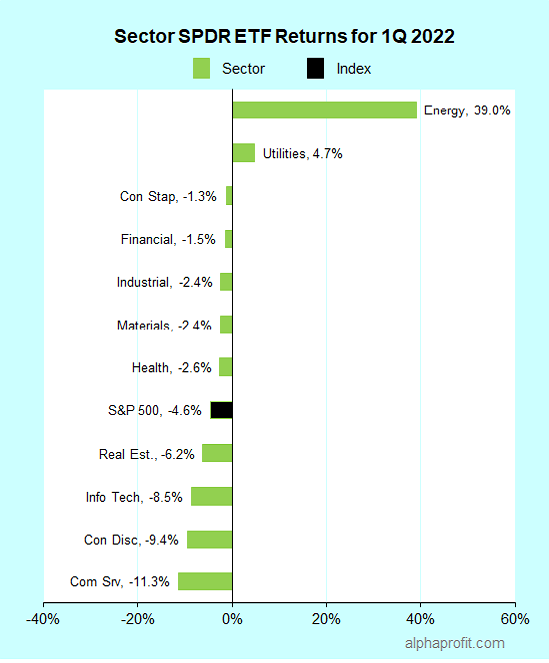

Best Select Sector SPDR ETFs of 1Q 2022

The Energy Select Sector SPDR took the top position. Select Sector SPDRs focusing on utilities and consumer staples followed. Invested gravitated towards defensive sectors in this uncertain investing backdrop.

- Energy Select Sector SPDR, XLE +39.0%

- Utilities Select Sector SPDR, XLU +4.7%

- Consumer Staples Select Sector SPDR, XLP -1.3%

Best Fidelity Funds of 1Q 2022

Commodity-oriented Fidelity funds clustered at the top of the performance table. The winners included Fidelity funds investing in energy, natural resources, and agriculture. With Russia cut off from the global economy, Latin American companies exposed to commodity markets boosted Fidelity Latin America.

- Fidelity Select Energy Portfolio, FSENX +40.2%

- Fidelity Natural Resources Fund, FNARX +32.3%

- Fidelity Glb Commodity Stock Fund, FFGCX +30.1%

- Fidelity Latin America Fund, FLATX +21.4%

- Fidelity Agricultural Productivity Fund, FARMX +19.4%

See: Best Fidelity funds for 2022

Best S&P 500 Stocks of 1Q 2022

Three of the top five winners for the quarter were oil & gas producers, Occidental Petroleum, APA Corp., and Marathon Oil. Fertilizer producer Mosaic and oil field service provider Halliburton rounded the list.

- Occidental Petroleum, OXY +96%

- The Mosaic Company, MOS +70%

- Halliburton, HAL +66%

- APA Corp., APA +54%

- Marathon Oil, MRO +53%

See: Best Sectors and Stocks for Strongest Growth in 2022

Looking ahead to 2Q 2022

Investors are looking to the Federal Reserve’s March meeting minutes for more information on the central bank’s plan to reduce its balance sheet. Investors’ fears of a recession grew last week after the yield curve. Investors will also keep an eye on oil prices and events surrounding the Ukraine war.

* The minutes of the Federal Reserve’s March interest rate policy meeting are a key event this week. The Fed releases these minutes on Wednesday. Investors expect to learn more about the Fed’s intentions to decrease its $9 trillion balance sheet in the minutes. The central bank intends to reduce its balance sheet as a further step toward tightening the interest rate policy. A few Fed officials, including Governor Brainard, are scheduled to speak this week.

* Interest rates and oil prices will remain on the top of investors’ minds. Last Friday, the 10-year Treasury note yielded 0.06% less than the 2-year note, inverting the yield curve. The inversion heightened recession worries since such a yield curve has often preceded recessions. Recession fears are likely to intensify if the yield curve stays inverted. Oil prices fell last week and closed below $100 a barrel last week after the U. S. announced plans to release barrels from the strategic petroleum reserve.

* The spotlight on corporate earnings switches to first-quarter results. Investors will be alert to corporate comments ahead of the first-quarter earnings reporting season starting the week of April 11. Among the S&P 500 companies reporting earnings this week are Conagra Brands, Constellation Brands, and Lamb Weston.

* The economic data calendar is light. The Institute of Supply Management reports its services activity index. Economists expect the index to rise to 58.5% in March from 56.5% in February.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023