In 2022, high inflation and rising bond yields emerged as headwinds for stocks. The S&P 500 declined by over 18%, marking its worst yearly showing since 2008. After being late to recognize inflation, the Federal Reserve raised interest rates sharply. The disruptions from the war in Ukraine and trading restrictions on Russia helped energy and other commodity-related assets flourish. Top-performing ETFs and S&P 500 winners gained double digits. Here is a list of the best and what to expect in 2023.

U.S. stocks suffered their highest yearly loss since 2008 in 2022. The large-cap S&P 500 index fell 18.1%, while the small-cap Russell 2000 index declined 20.4%.

Stubborn inflation and rising bond yields weighed on stock prices. The Federal Reserve raised its federal funds benchmark interest rate by 4.0% through 2022 to the 4.25-4.50% range, the highest in 15 years.

Quick relief on inflation proved elusive. The year-over-year increase in core personal consumption expenditures, the Federal Reserve’s preferred inflation measure, averaged 5% in 2022 after peaking at 5.4% in March.

The 10-year Treasury bond ended the year with a yield of 3.9% after starting the year with a yield of 1.5%.

The stocks in the S&P 500 index collectively lost $8.2 trillion in market value. Stocks in the information technology, consumer discretionary, and communication services sectors suffered the most. Apple, Microsoft, Amazon, Alphabet, Meta, and Tesla alone accounted for over $5 trillion in lost market capitalization.

As 2022 ended, investors worried about the Fed’s focus on achieving its 2% long-term inflation goal in the context of a relatively robust job market. Investors feared that a healthy job market would give the Fed room to hike interest rates further and raise the chances of a recession.

Here, we look at which ETFs, Select SPDRs, Fidelity funds, and S&P 500 stocks returned the most in 2022.

Best ETFs of 2022

Energy-related ETFs topped the performance charts by a wide margin. They claimed the top five spots.

- VanEck Oil Services ETF, OIH +66.2%

- Energy Select Sector SPDR Fund, XLE +64.2%

- Fidelity MSCI Energy Index ETF, FENY +63.1%

- Vanguard Energy Index Fund ETF Shares, VDE +62.9%

- iShares U.S. Energy ETF, IYE +60.3%

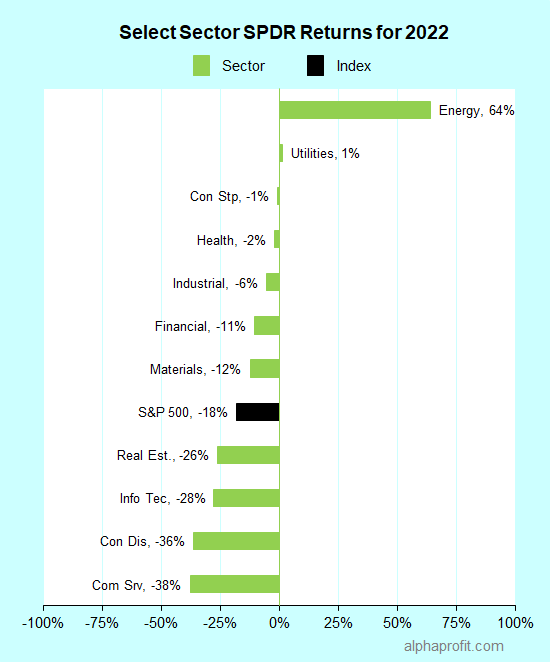

Best Select Sector SPDR ETFs of 2022

The Energy Select Sector SPDR took the top position. The only other sector to close above the flat line was utilities.

- Energy Select Sector SPDR, XLE +64.2%

- Utilities Select Sector SPDR, XLU +1.4%

- Consumer Staples Select Sector SPDR, XLP -0.8%

- Health Care Sector SPDR, XLV -2.1%

- Industrial Select Sector SPDR, XLI -5.6%

Best Fidelity Funds of 2022

Fidelity funds focusing on commodity stocks climbed to the top of the performance table. Fidelity Select Insurance was the sole non-commodity fund in the top five; it claimed the fifth spot as insurance stocks fared well in this rising interest rate environment.

- Fidelity Select Energy Portfolio, FSENX +63.0%

- Fidelity Natural Resources Fund, FNARX +41.0%

- Fidelity Global Commodity Stock Fund, FFGCX +20.7%

- Fidelity Agricultural Productivity Fund, FARMX +13.7%

- Fidelity Select Insurance Portfolio, FSPCX +7.8%

See: Best Fidelity funds for 2023

Best S&P 500 Stocks of 2022

Energy companies in the S&P 500 took the top five spots, gaining over 80% each. Oil & gas exploration and production companies Occidental Petroleum and Hess Corp. claimed the top two spots. Spots three and four were claimed by refiner Marathon Petroleum and integrated oil giant Exxon Mobil, respectively. Energy services provider Schlumberger was the fifth-best performer.

- Occidental Petroleum, OXY +119.1%

- Hess Corp., HES +93.6%

- Marathon Petroleum, MPC +85.8%

- Exxon Mobil, XOM +86.1%

- Schlumberger Ltd., SLB +80.7%

See: Best Sectors and Stocks for Strongest Growth in 2023

Looking ahead to 2023

Stocks have started 2023 on a positive note. The S&P 500 rose 1.5% in the first week of the new year, breaking a four-week losing streak. Stocks rallied sharply after the Labor Department showed wage gains slowed last December.

The Labor Department reported that the economy added 223,000 jobs. The unemployment rate fell to 3.5%. Average hourly earnings rose 0.3%, less than the 0.4% economists had forecast in a Dow Jones survey. Average hourly earnings were up 4.6% in December on a 12-month basis. The monthly and yearly changes in average hourly earnings declined from 0.6% and 5.1%, respectively, in November.

Investors saw the moderation in the rate of increase in average hourly earnings as a sign of easing inflation. Federal Reserve officials, however, downplayed the data in the jobs report, saying inflation remains far too high and the Fed has more work to do.

In other economic data, the Institute for Supply Management’s manufacturing and services sector indexes both fell below 50.0% for the first time in over 30 months, suggesting contraction.

U.S. Treasury yields declined across the board last week. The 10-year Treasury ended the week yielding 3.6%, 0.3% lower than its start this year.

Investors’ focus is now on the December consumer price index data due this Thursday. Economists surveyed by Dow Jones forecast the core CPI (which excludes food and energy prices) to increase by 5.7% on a year-over-year basis.

This week also marks the start of the fourth quarter earnings reporting season. Top banks, including Bank of America, JPMorgan Chase, and Wells Fargo, report earnings. Asset manager Blackrock, Taiwan Semiconductor, health insurer UnitedHealth Group, and Delta Airlines also report.

The CPI data and fourth-quarter earnings reports will impact stock prices this week.

The year 2023, in total, need not be a bad one for stocks after a dismal 2022. If inflation continues to trend lower, the Fed stops raising the federal funds rate around 5%, and the economy avoids a recession, stock prices can gain double digits in 2023.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023