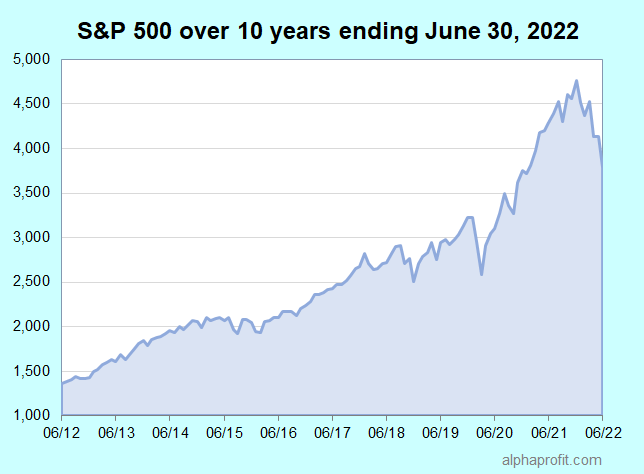

The last 10 years have been favorable for stocks. The S&P 500 has risen at a 13% annualized rate. The best-performing ETFs in specific categories have done much better. What are the best performing ETFs of the last 10 years? What are likely to be the best performing ETFs in the next 10 years?

Several events have caused investors anxiety during the last ten years. They include:

- Increasing possibility of recession or stagflation in 2022-2023.

- High inflation and rising interest rates in 2022.

- Russia’s invasion of Ukraine in 2022.

- The COVID pandemic in 2020.

- The trade war between the U. S. and China in 2018.

Global central banks responded to the COVID pandemic in 2020 with massive asset purchase programs (also known as quantitative easing) and near-zero interest rates.

After two years of unprecedented stimulus, inflation has now become the #1 issue for most economies. Disruptions to supply chains caused by COVID and the invasion of Ukraine have added fuel to inflation.

Central banks worldwide have tightened their interest rate policies in response to increasing inflation.

While low-interest rates favored stocks of growth companies for most of the past ten years, rising rates have recently brought value stocks into favor.

Excluding dividends, the S&P 500 has risen 2.8-fold implying a 10.8% compound annual return. The annualized rate of return increases to 13.0% with dividends.

While S&P 500 company earnings have grown 2.2-fold in the past 10 years, the S&P 500 index has risen more than 2.8-fold as stock valuation metrics have expanded. Register to learn more about the year-over-year performance of the AlphaProfit model portfolios since inception.

According to FactSet, S&P 500 company earnings have risen 2.2 fold from $101.73 a share to $218.82 a share during the ten years ending on June 30, 2022.

As interest rates fell through eight of the past 10 years, stock prices rose more than earnings from an increase in the price/earnings ratio.

According to Macrotrends, the yield on the 10-year Treasury bond fell from 1.67% in June 2012 to 0.52% in August 2020 during the depths of the pandemic. Following its gradual ascent in 2021, the yield has risen rapidly this year, reaching 2.98% in June.

In this milieu, the best performing ETFs in several categories have outpaced the S&P 500.

So, what are the best performing ETFs in the last 10 years?

Best Performing ETFs of Last 10 Years: Leveraged Equity

Leveraged equity ETFs made the most of rising stock prices over the past decade.

The Direxion Daily Semiconductor Bull 3X Shares ETF (SOXL), which seeks daily investment results that correspond to three times the daily performance of the ICE Semiconductor Index, is the best performing ETF of the last ten years with a 39.7% compound annual return.

Best Performing ETFs of Last 10 Years: Sector Equity

Among non-leveraged ETFs, several in the sector equity category have beaten the broad market. The ETFs that focus on specific industries in technology, and to a lesser extent, clean energy and health care, have fared well.

The iShares Semiconductor ETF (SOXX) claims top honors among non-leveraged ETFs with a compound annual return of 22.4%.

The First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) and the iShares U.S. Medical Devices ETF (IHI) have gained at annualized rates of 19.7% and 17.1%, respectively. They claim the top spot among clean energy and health care ETFs.

In comparison, ETFs tracking the S&P 500, such as the Vanguard S&P 500 ETF (VOO), the iShares Core S&P 500 ETF (IVV), and the SPDR S&P 500 ETF (SPY), have each gained 12.9% annualized.

Learn more: How to consistently choose the best sector ETF

Best Performing ETFs of Last 10 Years: U. S. Equity

Over the past ten years, the U. S. stock market has been most favorable for large-cap growth investments.

The large-cap growth-styled Invesco QQQ Trust ETF (QQQ), with an annualized return of 17.0%, is the best-performing ETF in the U. S. equity category. Selected broad market ETFs have fared quite well despite operating in out-of-favor investing styles.

The large-cap blend-styled Invesco S&P 500 GARP ETF (SPGP) and mid-cap growth-styled Invesco S&P MidCap Momentum ETF (XMMO) have gained at annualized rates of 15.6% and 13.6%, respectively, to trounce ETFs tracking the S&P 500.

Notably, the Schwab U.S. Dividend Equity ETF (SCHD) is the only value-styled ETF to beat ETFs tracking the S&P 500. It has gained 13.3% annualized.

Learn more: How you can increase returns from your investments in ETFs

Best Performing ETFs of Last 10 Years: International Equity

International stocks have lagged U. S. stocks during the past ten years.

The iShares MSCI EAFE ETF (EFA) that tracks the popular MSCI EAFE foreign stock benchmark has gained just 5.4% annualized during this period.

The rising U. S. dollar, for one, has been a headwind for international stocks.

According to Yahoo Finance, the U. S. dollar has gained 28% against major foreign currencies over the past 10 years. The U. S. Dollar Index (DXY), which measures the value of the dollar relative to a basket of major foreign currencies, has risen from 81.65 to 104.69.

Russia’s invasion of Ukraine has exacerbated the decline in the euro vis-à-vis the U. S. dollar. Energy and food commodity prices have skyrocketed in the European Union while economic growth has weakened.

Gaining 13.8% annualized, the iShares MSCI Denmark ETF (EDEN) is the best performing ETF in the international equity category.

Learn more: How to construct high-performing portfolios using ETFs

Best Performing ETFs for the Next 10 Years

What worked for the past ten years in financial markets seldom works in the next ten.

With that said, the QQQ Trust ETF (QQQ) and the iShares Semiconductor ETF (SOXX) have decent odds of topping the return charts in 10 years.

Although value stocks have fared better than growth stocks in 2022, they have lagged growth stocks by a wide margin over most of the past decade and have substantial room to catch up.

From a global perspective, the U. S. has been the dominant market for the past few years. Foreign stocks, particularly in Europe and Emerging Asia, have lagged and are valued attractively compared to their growth prospects.

As for trends shaping the world, the United Nations lists climate change, the aging population, and the emergence of digital technologies among the megatrends shaping the world.

These megatrends can provide enduring tailwinds for businesses involved in clean energy, health care, and information technology.

AlphaProfit believes the following ETFs have the potential to be among the top-performing ETFs over the next ten years.

Broad U.S. market: Invesco S&P 500 Pure Value ETF (RPV) and First Trust Capital Strength ETF (FTCS)

Foreign markets: WisdomTree Japan Hedged Equity Fund (DXJ) and iShares MSCI EAFE Value ETF (EFV)

Sectors and themes:

Financial sector: Financial Select Sector SPDR Fund (XLF)

Healthcare sector: iShares Biotechnology ETF (IBB)

Industrial sector: iShares U.S. Aerospace & Defense ETF (ITA)

One of the above ETFs may be the best performing ETF in 10 years.

[wbcr_html_snippet id=”16299″]

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023