The S&P 500 rose 1.1% and ended the week above its 200-day moving average. Fed Chair Powell spurred a strong rally in stocks on Wednesday, saying interest rates could rise less in December compared to their increase in November. Investors will have plenty to ponder this week. Economic data providing updates on inflation, the health of the services economy, and consumer sentiment are due.

U.S. stocks gained for the week after they surged on Wednesday in response to Federal Reserve Chair Powell’s speech at the Brookings Institution.

Powell said the central bank’s pace of interest-rate increases could slow as soon as its December 13-14 meeting. Traders raised the odds of a 0.50% increase in the federal fund’s interest rate after this meeting as the odds of a 0.75% increase fell.

The Labor Department showed payrolls rose by 263,000 in November, exceeding economists’ forecast of 200,000 in a Dow Jones survey. The unemployment rate was unchanged at 3.7%. Average hourly earnings rose 0.6%, exceeding economists’ 0.3% forecast.

Although stocks fell immediately after this stronger-than-expected jobs report hit the wires, they quickly resumed their uptrend. Interest rate fears were at bay in light of Powell’s outlook for interest rates.

Economic data suggested that the Fed’s policy of cutting inflation by raising interest rates is working. The Fed’s preferred inflation measure, the core personal consumption expenditures (PCE) price index, which excludes food and energy prices, rose 0.2%, less than economists’ 0.3% forecast. The core PCE was up 5% from a year ago, in line with economists’ forecasts.

According to the Institute of Supply Management, manufacturing activity in the United States fell in November for the first time in two and a half years as higher borrowing costs weighed on demand for goods.

Longer-dated Treasury bond yields fell. The 10-year note yielded 3.51% at the end of the week, 0.18% lower than a week ago. The rally in stocks lifted the S&P 500 above its 200-day moving average.

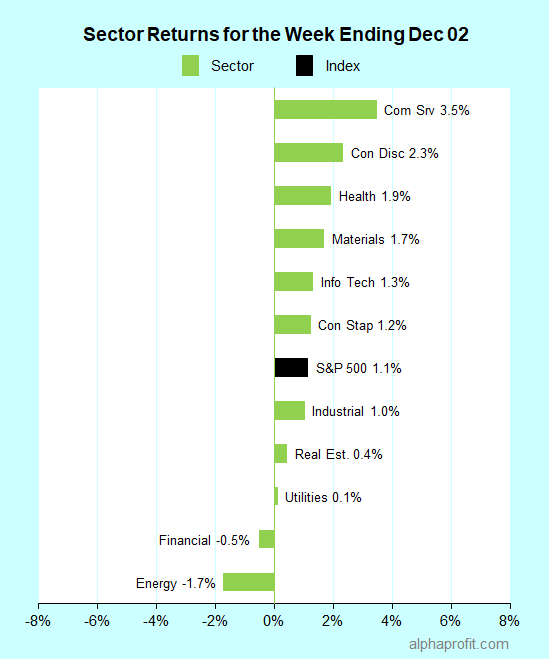

For the week ending December 02, the S&P 500 (SPY) rose 1.1%. Nine of the 11 sectors advanced.

Communication services (XLC) gained the most, while energy (XLE) lost the most.

The S&P 500’s top 10 winners included the following:

1. Health Care Sector

- Catalent, Inc (CTLT) +26% – The week’s top performer in the S&P 500.

2. Consumer Discretionary Sector

- Etsy, Inc. (ETSY) +17%

- PVH Corp. (PVH) +15%

- Wynn Resorts, Limited (WYNN) +14%

- Las Vegas Sands Corp. (LVS) +11%

- Bath & Body Works, Inc. (BBWI) +9%

3. Information Technology Sector

- Fidelity National Information Services, Inc. (FIS) +12%

4. Communication Services Sector

- Netflix, Inc. (NFLX) +12%

- Meta Platforms, Inc. (META) +11%

5. Financial Sector

- MarketAxess Holdings Inc. (MKTX) +9%

Top ETFs for the week

The following ETF themes worked well: China, cannabis, carbon credits, and silver. The top ETFs for the week include:

- KraneShares CSI China Internet ETF (KWEB) 24.4%

- iShares MSCI China ETF (MCHI) 12.2%

- AdvisorShares Pure US Cannabis ETF (MSOS) 9.1%

- KraneShares Global Carbon ETFF (KRBN) 8.5%

- iShares Silver Trust (SLV) 8.0%

Can Stocks Buck the Rising Odds of a Recession?

* Although stocks rose last week, the yield curve steepened further, implying an increase in the odds of a recession. The difference in yield between 10-year and 2-year Treasury notes widened to 0.77%. Meanwhile, analysts continued to lower their 2023 earnings growth estimates. Can stocks continue to buck the rising odds of a recession?

* The main economic data point for the week is the November producer price index (PPI) data. The Bureau of Labor Statistics releases the PPI on Friday. The PPI tracks inflation from a wholesale price perspective. Economists surveyed by Dow Jones expect the PPI to increase by 0.2% in November, matching the tally from October. They expect the annual increase in the PPI to moderate to 7.2% in November from 8.0% in October.

* The University of Michigan’s preliminary December reading of its Consumer Sentiment Index is due on Friday too. This report will include an update on consumers’ inflation expectations.

* Investors will also get insights into the state of the services economy when the Institute for Supply Management updates its services index for November. Economists expect the index to decline to 53.7 from 54.4 in October, suggesting slower expansion.

* A handful of S&P 500 member companies, including Autozone, Broadcom, Brown-Forman, Campbell Soup, and Costco, are due to report earnings this week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023