Atlanta Fed President Bostic’s comment favoring interest rate increases in 0.25% increments boosted market sentiment last week. Stocks rallied as the yield on the 10-year Treasury note dipped below the psychologically important 4.0% mark. This week, investors will focus on the jobs data and Fed Chair Powell’s Congressional testimony.

Investors digested comments from several Fed officials last week. Comments from Atlanta Federal Reserve President Raphael Bostic boosted market sentiment.

Bostic said the central bank should limit its interest rate hikes to 0.25% rather than pursue the 0.50% increase favored by other Fed officials.

With the effects of higher interest rates unlikely to be felt until spring, Bostic said a “slow and steady” course of action is appropriate since it would minimize the risk of starting a recession.

In economic data, the Institute for Supply Management (ISM) said its service activity index held steady at 55.1% in February, suggesting expansion. Economists polled by Dow Jones expected the index to fall to 54.3% from 55.2% in January. Encouragingly, the inflation measure in the service activity index fell by 2.2%.

Earlier, the ISM’s factory index remained below 50.0% at 47.7%, as predicted by economists. The inflation measure in the factory index spooked investors, rising by 6.8%.

China’s National Bureau of Statistics said its official manufacturing Purchasing Manager’s Index (PMI) increased to 52.6 in February, suggesting the re-opening of China’s economy from COVID restrictions is proceeding without setbacks. The February PMI reading marked the highest since April 2012.

The yield on the benchmark 10-year Treasury note dipped below the 4.0% threshold after Bostic’s comment to close the week at 3.97%.

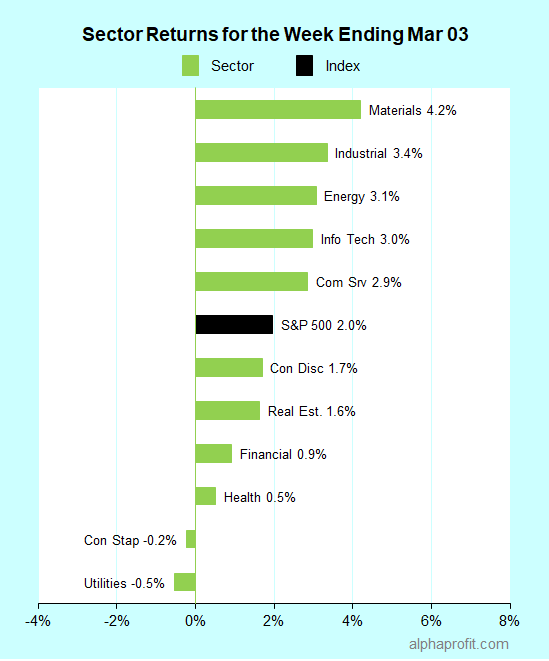

For the week ending March 03, the S&P 500 (SPY) rose 2.0%. Nine of the 11 sectors advanced. Materials (XLB) gained the most, while utilities (XLU) lost the most.

The S&P 500’s top 10 winners included the following:

1. Information Technology Sector

- First Solar (FSLR) +30% – The week’s top performer in the S&P 500.

- Salesforce (CRM) +15%

- SolarEdge Technologies (SEDG) +10%

2. Materials Sector

- Steel Dynamics (STLD) +15%

- Mosaic (MOS) +11%

3. Health Care Sector

- Dentsply Sirona (XRAY) +13%

- Illumina (ILMN) +13%

- DexCom (DXCM) +12%

4. Consumer Discretionary Sector

- Ford Motor (F) +10%

- Wynn Resorts (WYNN) +10%

Top ETFs for the week

The following ETF themes worked well: energy, natural gas, solar, metals, mining, copper, and China Internet. The top ETFs for the week include:

- United States Natural Gas Fund, LP (UNG) +16.4%

- Global X Copper Miners ETF (COPX) +9.9%

- SPDR S&P Metals and Mining ETF (XME) +9.8%

- KraneShares CSI China Internet ETF (KWEB) +9.5%

- Invesco Solar ETF (TAN) +7.7%

Can the S&P 500 push toward 4,200?

* Last week’s late rally pushed the S&P 500 above its 50- and 200-day moving averages. The S&P 500 has ranged between 3,800 and 4,200 in 2023. Can the jobs data and Powell’s testimony this week keep the rally going for the S&P 500 to push toward the top of this trading range?

* The labor market will be in the spotlight next week with the job openings survey on Wednesday and the February employment report on Friday. TradingEconomics.com forecasts job vacancies in the job openings survey to fall to 10.6 million in January from 11.0 million in December. Economists surveyed by Dow Jones predicted the U.S. economy added 225,000 jobs in February. In comparison, the economy added 517,000 jobs in January.

* The Federal Reserve Chairman, Jerome Powell, will testify before Congress on monetary policy on Tuesday and Wednesday. Market participants now expect the Fed to implement four more 0.25% increases in the federal funds rate this year, resulting in a terminal interest rate of 5.50–5.75% in September. Market participants will look to Powell’s testimony to validate the above expectations.

* Three consumer companies in the S&P 500 will report earnings this week. They are Brown-Forman, Campbell Soup, and Ulta Beauty.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023