The Communication Services Select Sector SPDR ETF with ticker symbol XLC is in the works. State Street Global Advisors plans to launch this 11th Select Sector SPDR ETF when a new Communication Services sector is created in September. Read this article for insights into the nuts & bolts of the Communication Services Select Sector SPDR ETF and what this change means for other Select Sector SPDR ETFs.

In September, the licensor of the S&P 500 Index intends to reclassify several companies included in this popular U. S. stock market benchmark.

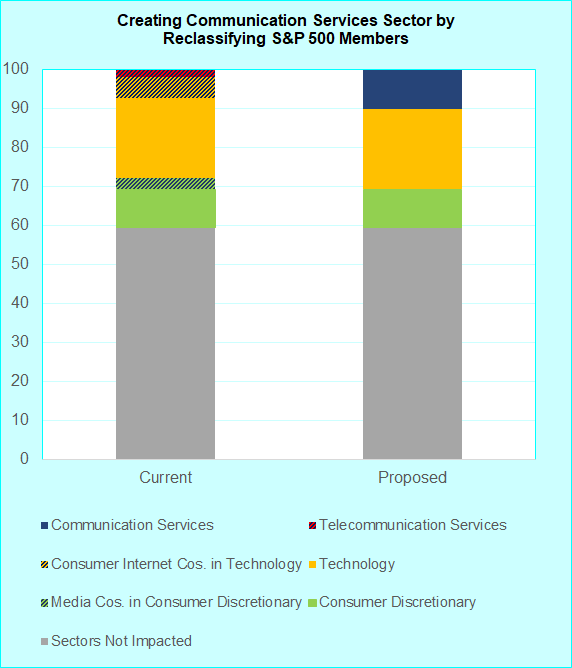

The current Telecommunication Services sector will broaden to include companies from the Consumer Discretionary and Technology sectors and rename itself as Communication Services.

The new Communication Services sector intends to capture modern methods of communication. To accomplish this objective, media, entertainment, and consumer Internet stocks from the current Consumer Discretionary and Technology sectors will be brought into Communication Services. The current constituents of the Telecommunication Services sector will also be a part of the new Communication Services sector.

The new Communication Services sector will be formed by including all companies currently in the Telecommunication Services sector, all media companies currently in the Consumer Discretionary sector, and selected consumer Internet companies currently in the Technology sector.

The new Communication Services sector will be formed by including all companies currently in the Telecommunication Services sector, all media companies currently in the Consumer Discretionary sector, and selected consumer Internet companies currently in the Technology sector.

The new Communication Services sector will account for 10% of the S&P 500 Index’s market capitalization compared to the 2% weight of the current Telecommunication Services sector.

Communication Services Select Sector SPDR ETF in the Works

State Street Global Advisors currently provides 10 ETFs under the Select Sector ETF brand. These ETFs mimic the performance of the underlying sector indexes.

For example, the Consumer Discretionary Select Sector SPDR ETF (XLY) seeks to mimic the performance of Consumer Discretionary sector index. This ETF holds all Consumer Discretionary companies in the S&P 500 benchmark that form the Consumer Discretionary sector index.

Under the proposed reclassification, the Consumer Discretionary Select Sector SPDR ETF and Technology Select Sector SPDR ETF (XLK) will eliminate holdings that move to the new Communication Services sector and reinvest the proceeds in new and continuing holdings.

State Street Global Advisors has filed for an ETF targeting the new Communication Services sector. When approved, this new ETF will become the 11th member of the SPDR Select Sector ETF suite. Named Communication Services Select Sector SPDR ETF, this entity will trade under ticker symbol XLC.

Although the gross expense ratio for the Communication Services Select Sector SPDR ETF has not been announced, it is likely to be the same as the other Select Sector SPDR ETFs at 0.13%.

Communication Services Select Sector SPDR ETF Holdings

The proposed Communications Services sector will be broader and economically more sensitive than the current Telecommunication Services sector.

Facebook (FB), Alphabet (GOOG, GOOGL), and Activision Blizzard (ATVI) are slated to leave the Technology sector and enter the Communication Services sector. Media titans Comcast (CMCSK), Disney (DIS), Netflix (NFLX), and Time Warner (TWX) are expected to move out of Consumer Discretionary and make the Communication Services sector their new home.

Current Telecommunication Services heavyweights AT&T (T) and Verizon (VZ) are expected to round out the top 10 companies in the Communication Services sector.

Here is a snapshot of the top 10 holdings of the Communication Services Select Sector SPDR ETF and their weightings based on market capitalizations as of May 11:

- Facebook: 19%

- Alphabet Class C: 14%

- Alphabet Class A: 14%

- AT&T: 8%

- Verizon: 8%

- Disney: 7%

- Comcast: 6%

- Netflix: 6%

- Time Warner: 3%

- Activision Blizzard: 2%

Total weight of top 10 holding rounds to 89%.

Communication Services Select Sector SPDR ETF Characteristics

The current Telecommunication Services sector is commonly seen as a domestically-oriented value play or bond-proxy. Only 3% of this sector’s sales originate outside the U. S. The sales and profits of Telecommunication Services companies have usually grown at rates below those of the S&P 500 index. All these companies fit the value investing style box. Several Telecommunication Services stocks pay relatively high dividends making their performance interest rate-sensitive.

The inclusion of companies from the current Consumer Discretionary and Technology sectors changes the characteristics of the new Communication Services sector quite markedly to a global growth play. Nearly 32% of Communication Services’ sales will originate overseas. With historical and forecasted revenue & profit growth exceeding those of the S&P 500 index, nearly 57% of the companies in Communication Services fit the growth investing style box.

Several companies in the Communication Services sector prefer to retain capital to fund their growth and do not pay much by way of dividends. As such, the dividend yield of the Communication Services sector is likely to be only one-third the dividend yield of the Telecommunication Services sector.

Impact of Communication Services Select Sector SPDR ETF on other Select Sector SPDR ETF

After high-growth names Facebook and Alphabet depart, the Technology sector and the Technology Select Sector SPDR ETF will be spearheaded by Apple (AAPL), Microsoft (MSFT), and Intel (INTC). At current market capitalizations, these three companies account for 41% of the proposed Technology sector.

In general, Apple, Microsoft, and Intel have lower forecasted earnings growth, lower forward P/E ratios, and higher dividend yield compared to Facebook and Google leaving the Technology sector. The Technology Select Sector SPDR ETF’s allocation to growth stocks will decline from about 60% to 50% after the formation of the Communication Services sector.

Following the departure of media companies, retailers led by Amazon (AMZN) would become the primary constituent of the Consumer Discretionary sector and the Consumer Discretionary Select SPDR ETF. At its current market capitalization, Amazon accounts for 28% of the proposed Consumer Discretionary sector. The Consumer Discretionary Select SPDR ETF’s allocation to growth stocks will rise from about 50% to 60% after the S&P 500 members are reclassified.

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023