Certain industries or groups, at times, get hit hard providing venturesome contrarian investors opportunities to earn outsized profits. Contrary investors with the courage and conviction to get into automotive and retailing shares at the depth of the Great Recession have made it out like a bandit.

Fidelity Select Automotive Fund (FSAVX) and SPDR S&P Retail ETF (XRT) are up 305% and 189%, respectively from their 2009 lows, while selected stocks in these groups like Ford (F) and Saks (SKS) are up 699% and 449%, respectively.

In this two-part article, I present three contrarian investment ideas in the current market.

Contrarian Investing Pick #3: Medical Device Stocks

Top Medical Device Stock for Contrarian Investors: Medtronic (MDT)

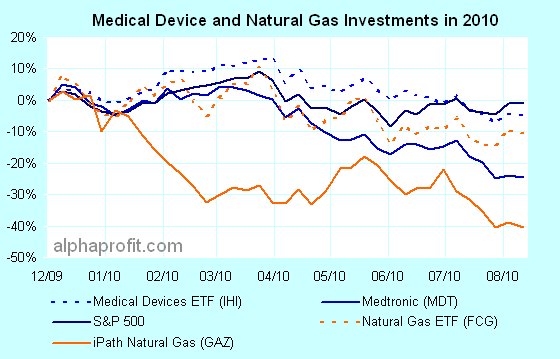

Medical device stocks are among the weaker performers this year. iShares Dow Jones US Medical Devices ETF (IHI) and Fidelity Select Medical Equip & Systems Fund (FSMEX) are both down 3% and 5%, respectively.

Contrarian Investing: With strong recovery potential, medical devices and natural gas represent two groups where contrarian investors can find plenty of stocks getting primed for profits. Medtronic (MDT) and iPath DJ-UBS Natural Gas ETN (GAZ) are my favorites.

Business conditions for medical device makers have not been robust. High unemployment and rising insurance costs have caused patients to cut down on doctor’s visits. Leading medical device companies Medtronic (MDT) and Stryker (SYK) are reporting a slowdown in sales. Product safety-related recalls have weighed on shares of Boston Scientific (BSX). Price competition in the medical device business has heightened at a time when hospitals are implementing cost-reduction strategies.

If you believe patients cannot postpone the usage of medical devices forever and will return to the doctor, you can find plenty of opportunities in this space. Among the opportunities, industry heavyweight Medtronic trading at nearly 9-times next year’s earnings and yielding just under 3% stands out in my view.

Historically, Medtronic has been adept at coming up with market-dominating products that have enabled the company to maintain profit margins in excess of 20%. With $16 billion in annual revenue and $2.6 billion in free cash flow, Medtronic has the means to execute its strategy and grow its businesses by investing in research, developing new products, and making targeted acquisitions.

Contrarian Investing Pick #2: Natural Gas Stocks

Top Natural Gas Stock for Contrarian Investors: iPath DJ-UBS Natural Gas ETN (GAZ)

Combination of slack industrial demand and rising production from shale formations has caused a glut in domestic natural gas supplies. The U. S. Energy Information Administration recently reported total natural gas storage of 3.1 trillion cubic feet (Tcf), nearly 6% above the 5-year average. The administration forecasts U. S. natural gas inventories to climb to over 3.7 Tcf approaching November 2009’s record of 3.84 Tcf.

The price of natural gas is down about 35% this year. Shares of natural gas producers have declined to a lesser degree. Anadarko Petroleum (APC), Chesapeake Energy (CHK), Devon Energy (DVN), and EnCana (ECA) are down between 11% and 17% each. Natural gas ETFs and mutual funds like First Trust ISE-Revere Natural Gas (FCG) and Fidelity Select Natural Gas (FSNGX) are both down about 10%.

At current prices, natural gas is undervalued vis-à-vis coal. Given natural gas’s advantage of being a cleaner fuel than coal, electric utilities should feel compelled at some point to switch from coal- to natural gas-fired power plants.

If you believe the natural gas glut will prove temporary and that natural gas cannot remain this low forever, you are in good company. The oil titan Exxon Mobil (XOM) has made a massive wager on natural gas by buying XTO Energy for $41 billion. And, if natural gas does become the fuel of the future … as Exxon thinks it will … the price of natural gas may well exceed its 2005 record high earning you a 300% return.

With natural gas stocks not down nearly as much as natural gas, I believe the best natural gas play is the commodity itself. Easy ways to play the commodity is through ETNs like iPath DJ-UBS Natural Gas ETN (GAZ) or United States Natural Gas Fund (UNG).

Before You join Contrarian Investors …

As attractive as medical device and natural gas investments are, they can go down further in the near-term. For one, some investors holding these shares through the decline may choose to recognize losses before year-end to minimize their capital gains taxes.

To maximize your return, you need to make sure that these groups have indeed bottomed and then get in on the action in a timely manner. If you do not want to do the watching yourself, subscribe to AlphaProfit’s Premium Investment Newsletter and we do it for you!

In a subsequent article, I will look at what I believe is the single best contrarian investing idea in the current market that is worthwhile for contrarian investors to consider.

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023