The S&P 500 lost 4.8% as investors confronted inflation concerns, ominous economic signs, and looming interest rate increases. The August CPI data topped economists’ consensus forecast. FedEx startled investors. The transportation titan removed its annual outlook, citing worsening macroeconomic trends worldwide. Investors are bracing for the Federal Reserve to increase benchmark interest rates by 0.75-1.00% this week. The Fed’s comments on future interest rate increases will determine how stocks perform this week.

The Labor Department’s report on consumer prices showed inflation is running hot. The core consumer price index (core CPI), which excludes food and energy prices, rose 0.6% from July to August, exceeding economists’ forecast of 0.3%. Higher rents, new vehicle prices, and medical costs drove the core CPI up. The core CPI rose 6.3% in the 12 months ending in August, up from 5.9% in July.

The CPI, which includes food and energy prices, rose 0.1% month over month in August, compared to economists’ expectations for a 0.1% decline. Food prices rose, more than offsetting the decline in gasoline prices.

The producer price index (PPI) data suggested inflation in wholesale price increases is moderating. Investors, however, ignored this data point.

Investors feared that the higher-than-expected CPI reading could lead the Fed to rapidly hike interest rates, increasing the odds of a recession.

Global logistics and transportation titan FedEx added to investors’ recession worries. FedEx withdrew its fiscal 2023 outlook after its preliminary first-quarter results fell short of analysts’ estimate. FedEx attributed the shortfall to a decline in global volumes. The company said macroeconomic trends worsened during the quarter in Asia, Europe, and the U.S. FedEx shares dropped 21% last Friday, their worst one-day decline.

The World Bank and the International Monetary Fund also warned of a global economic slowdown last week. Steelmakers Nucor and U.S. Steel lowered their guidance for quarterly results, noting an increase in “market headwinds” during the third quarter.

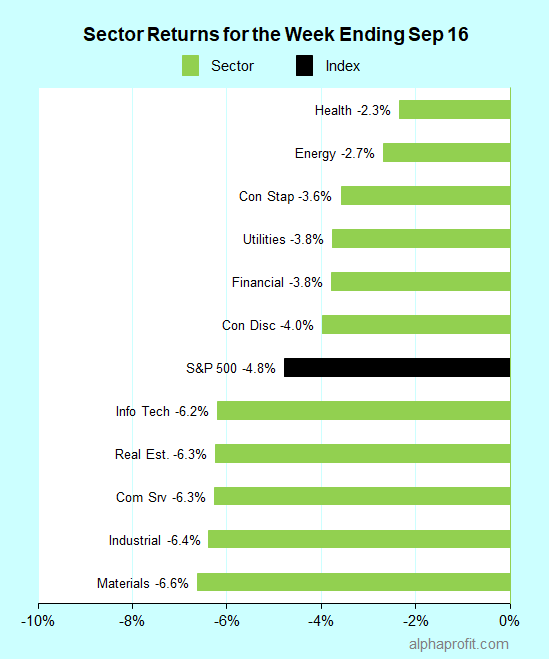

For the week ending September 16, the S&P 500 (SPY) fell 4.8%. All of the 11 sectors declined.

Healthcare (XLV) fell the least, while materials (XLB) fell the most.

The S&P 500’s top 10 winners included the following:

1. Consumer Discretionary Sector

- Royal Caribbean Cruises (RCL) +7% – The week’s top performer in the S&P 500.

- Norwegian Cruise Line (NCLH) +5%

- Wynn Resorts (WYNN) +4%

- Carnival Corp. (CCL) +3%

- Starbucks (SBUX) +3%

2. Energy Sector

- APA Corp. (APA) +6%

3. Healthcare Sector

- Humana (HUM) +4%

4. Information Technology Sector

- Enphase Energy (ENPH) +4%

5. Communication Services Sector

- Netflix (NFLX) +3%

6. Financial Sector

- Allstate Corp. (ALL) +2%

Top ETFs for the week

The following ETF themes worked well: carbon credits, silver, platinum, U.S. dollar, foreign bonds. The top ETFs for the week include:

- KraneShares Global Carbon ETF (KRBN) 6.4%

- iShares Silver Trust (SLV) 3.9%

- abrdn Physical Platinum Shares ETF (PPLT) 3.2%

- Invesco DB US Dollar Index Bullish Fund (UUP) 0.7%

- Vanguard Total International Bond Index Fund ETF Shares (BNDX) 0.2%

Does the Fed Want Stocks to Fall More?

* Investors’ attention this week is on interest rate policies in the U.S., the U.K., and Japan. The U.S. Federal Reserve, Bank of England, and Bank of Japan hold discussions to decide interest rates. In the U.S., the Federal Open Market Committee meets on September 20 and 21. The CME Group FedWatch tool shows an 82% chance of the FOMC raising the federal funds rate by 0.75% and an 18% chance of upping it by 1.00%. Economists expect the Bank of England to raise interest rates and the Bank of Japan to leave them unchanged or lower them.

* The uncertainty on interest rates after the September meeting is high. Worries about a recession are rising rapidly. The Fed can worsen such concerns by continuing its hawkish stance. The Fed can also ease recession worries by acknowledging that its steps to fight inflation are working. What the Fed says in this regard will determine how stocks fare next week.

* August data from the housing industry come out. Rising raw material costs and declining affordability are weighing on housing demand. For the first time since 2008, the average rate on a 30-year fixed-rate mortgage is now above 6%. Industry forecasters expect existing home sales, housing starts, and building permits to decline.

* Several S&P 500 index constituents from various industries report earnings. The reporting companies include Accenture, AutoZone, Costco, Darden Restaurants, FactSet Research Systems, FedEx, General Mills, and Lennar Group.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023