The S&P 500 fell 5.7% last week. The Federal Reserve raised benchmark interest rates by 0.75%, intensifying worries of a recession. The Fed will be in the spotlight during this trading week, shortened by the Juneteenth holiday. Fed Chair Powell testifies before Congress on Wednesday and Thursday. The University of Michigan’s June consumer sentiment reading and earnings reports from the consumer discretionary sector and FedEx Corp. will likely influence stocks this week.

The Federal Reserve raised its target interest rate by 0.75% to fight inflation. This increase marked the steepest interest rate hike since 1994.

Fed officials cut their outlook for 2022 gross domestic product growth to 1.7%, down from 2.8% in March.

At the press conference, Fed Chair Powell said the central bank would likely raise interest rates by either 0.5% or 0.75% when the Federal Open Market Committee meets in July.

Worries of a recession rose after the central banks of England and Switzerland joined the Federal Reserve in raising their benchmark interest rates.

Separately, data suggests the U. S. economy is rapidly cooling while inflation remains high. The producer price index showed wholesale prices rose 10.8%, close to a record, during the 12 months ending in May.

Housing starts swooned 14% in May, well above economists’ forecast for a 2.6% decline. Retail sales surprisingly fell 0.3% in May from April. Economists expected retail sales to grow by 0.2%.

Investors worried the Federal Reserve’s aggressive approach to curbing inflation would push the economy into a recession and crimp corporate profits. The Dow Jones Industrial Average fell below 30,000 for the first time since January 2021.

The yield on the 10-year Treasury note rose 0.07% for the week to close at 3.24%. Oil prices fell more than 8%.

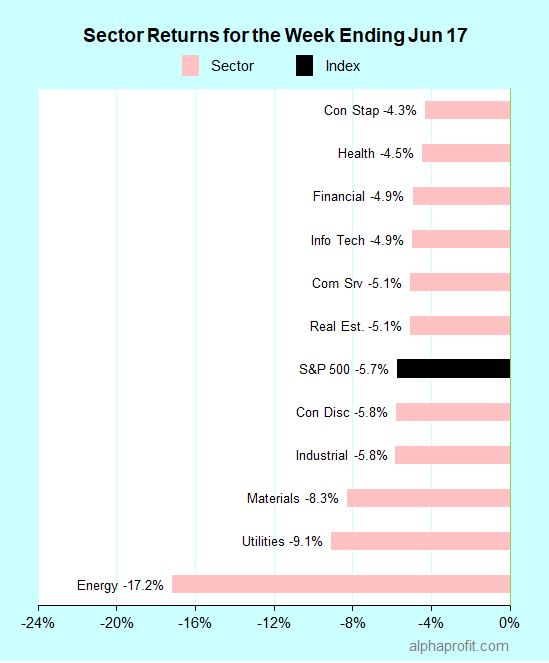

For the week ending June 17, the S&P 500 (SPY) fell 5.7%. All of the 11 sectors declined.

Market breadth was overwhelmingly negative. Only 14 of the S&P 500 index’s constituents ended the week in the black.

Consumer staples (XLP), health care (XLV), and financials (XLF) held up better than the S&P 500, losing 4.9% or less.

Energy (XLE), utilities (XLU), and materials (XLB) lost more than the S&P 500.

The S&P 500’s top 10 winners included the following:

1. Industrials Sector

- FedEx Corporation (FDX) +11% – The week’s top performer in the S&P 500.

- The Boeing Company (BA) +8%

2. Real Estate Sector

- Duke Realty (DRE) +3%

3. Health Care Sector

- Vertex Pharmaceuticals (VRTX) +3%

- Biogen Inc. (BIIB) +2%

- Regeneron Pharmaceuticals (REGN) +2%

- Incyte Corporation (INCY) +1%

4. Consumer Staples Sector

- Monster Beverage (MNST) +1%

5. Information Technology Sector

- Oracle Corporation (ORCL) +1%

6. Financial Sector

- Truist Financial (TFC) +1%

Top ETFs for the week

The following ETF themes worked well: China, biotech, and income. In the income theme interest rate volatility, floating rate bonds, and T-bills performed well. The top ETFs for the week include:

- KraneShares Bosera MSCI China A 50 Connect Index ETF (KBA) 3.4%

- SPDR S&P Biotech ETF (XBI) 0.9%

- Quadratic Interest Rate Volatility and Inflation Hedge ETF New (IVOL) 0.8%

- iShares Treasury Floating Rate Bond ETF (TFLO) 0.1%

- SPDR Bloomberg 1-3 Month T-Bill ETF (BIL) 0.0%

Top Fidelity Fund for the week

- Fidelity Select Biotechnology Portfolio (FBIOX) +1.3%

Fed Chair Powell Heads to Capitol Hill the Week of June 20

* The Federal Reserve and Chair Powell will again be in the news this week. Powell testifies to the Senate Banking Committee on Wednesday and the House Committee on Financial Services on Thursday. He is likely to hold on to his plan for taming inflation.

* The University of Michigan updates the consumer sentiment reading for June. The significance of this economic data point has increased since Powell cited the weakness in this reading among the reasons for raising interest rates last week. Investors will see a green light for the Fed to raise rates if the survey’s update matches or turns worse than the preliminary reading.

* Investors will get insights into the U. S. consumer spending when homebuilder Lennar, used car retailer CarMax, and restaurant chain Darden report earnings this week. Likewise, earning reports from freight titan FedEx and IT services firm Accenture should provide investors with insights into the state of the global economy.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023