The S&P 500 fell 5.1% last week after the consumer price index rose more than expected in May. Investors feared the Federal Reserve would raise interest rates more than anticipated to quell inflation. The Fed’s two-day meeting is the main event of this week. Investors will also get a pulse of state of the economy from different perspectives including inflation, consumer spending, housing, and manufacturing.

U. S. stocks fell across the board after the consumer price index (CPI) rose in May, well above the 0.7% monthly rise forecast by economists surveyed by The Wall Street Journal. The CPI rose 8.6% year-over-year, the highest annual rate since 1981. The year-over-year increase exceeded economists’ 8.3% forecast.

Consumer sentiment dropped sharply, impacted by inflation concerns. The University of Michigan’s gauge of consumer sentiment fell to a record low of 50.2, down from its May reading of 58.4.

With hopes of peaking inflation dashed, investors feared that the Federal Reserve would increase interest rates quickly this summer, potentially causing a recession.

Following the inflation report, investors raised their expectations for interest rate increases. Yields on the 2-year and 10-year Treasury bonds rose 0.41% and 0.23%, respectively, last week. At its Friday closing yield of 3.17%, the 10-year Treasury yielded just 0.1% more than its 2-year counterpart.

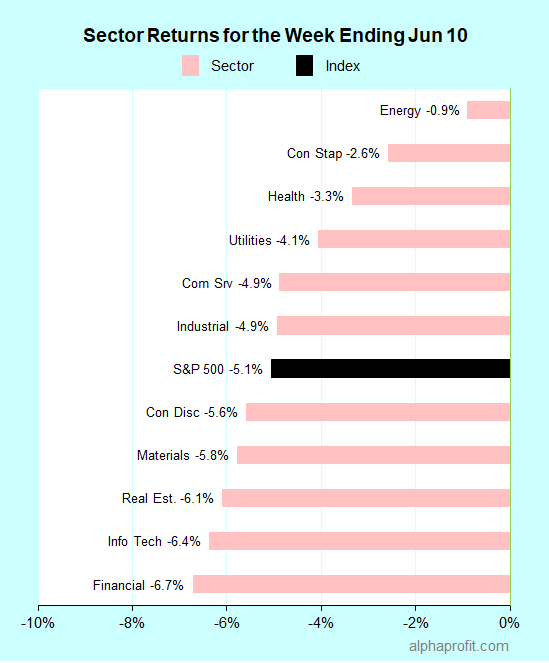

For the week ending June 10, the S&P 500 (SPY) fell 5.1%. All of the 11 sectors declined.

Market breadth was overwhelmingly negative. The number of advancing stocks in the S&P 500 lagged the number of decliners by a 1-to-17 ratio.

Energy (XLE), consumer staples (XLP), and health care (XLV) held up better than the S&P 500, losing 3.3% or less.

Financials (XLF), information technology (XLK), and real estate (XLRE) lagged the S&P 500.

The S&P 500’s top 10 winners included the following:

1. Consumer Staples Sector

- The J. M. Smucker Company (SJM) +5% – The week’s top performer in the S&P 500.

- Brown-Forman Corporation (BF-B) +3%

- The Kraft Heinz Company (KHC) +3%

- Dollar General Corporation (DG) +3%

- Kellogg Company (K) +3%

- Campbell Soup Company (CPB) +3%

- The Hershey Company (HSY) +2%

2. Energy Sector

- Valero Energy Corporation (VLO) +4%

- Marathon Petroleum Corporation (MPC) +3%

3. Consumer Discretionary Sector

- Domino’s Pizza, Inc. (DPZ) +3%

- Dollar General Corporation (DG) +3%

Top ETFs for the week

The following ETFs themes worked well: China, China tech, and gold. The top ETFs for the week include:

- KraneShares CSI China Internet ETF (KWEB) +7.8%

- The Emerging Markets Internet & Ecommerce ETF (EMQQ) +3.3%

- iShares China Large-Cap ETF (FXI) +2.7%

- GraniteShares Gold Trust (BAR) +1.2%

- SPDR Gold MiniShares (GLDM) +1.2%

Top Fidelity Fund for the week

- Fidelity Emerging Asia Fund (FSEAX) +2.1%

Fed in Focus After Red Hot CPI the Week of June 13

* The Federal Reserve’s June 14-15 interest rate policy meeting is the main event of this week. Most economists expect the Fed to raise its short-term benchmark interest rate by 0.5% on Wednesday. Some economists have raised their forecast to 0.75% in light of the CPI data released last Friday. Federal Reserve Chair Powell holds a press conference after the two-day meeting. Investors await Powell’s comments on the central bank’s plan for raising interest rates in July and September.

* Economic reports on the calendar this week include updates on inflation (producer price index), consumer spending (May retail sales), the housing market (May housing starts), and manufacturing activity (May industrial production).

* Just three members of the S&P 500 index report their quarterly earnings this week. They are software titans Adobe and Oracle, and supermarket chain Kroger.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023