Stocks swooned last Friday after Fed Chairman Powell dispelled expectations of a less aggressive monetary policy stance than some investors had anticipated. The S&P 500 ended the week lower by 4.0%. Economic data is in focus this week. The August jobs data is due this Friday. Investors will also seek confirmation on moderating inflation from home price data. The earnings report should provide investors with insights on the financial wellbeing of the consumer.

The Federal Reserve’s Jackson Hole Economic Symposium was the main event of the week of August 22.

Federal Reserve Chairman Powell iterated a tough stance on inflation at this event. He downplayed hopes for a less-aggressive monetary policy stance that some investors expected.

Powell said, “Restoring price stability will likely require maintaining a restrictive policy stance for some time. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses.”

Economic data showed a moderation in inflation. The personal consumption expenditures index (PCE) fell 0.1% in July. The Core PCE, which excludes food and energy prices and watched by Fed policy makers, rose 0.1% in July. On an annual basis, the core PCE declined by 4.6% versus economists’ forecast for 4.8%.

Falling gasoline prices helped to lift consumer sentiment. The University of Michigan’s consumer sentiment index rose to 58.2 in August from 51.5 in July. Consumers’ year-ahead inflation expectations declined to 4.8%, the lowest reading in eight months.

The Bureau of Economic Analysis (BEA) revised its estimate for second-quarter gross domestic product (GDP) growth upward. The BEA said GDP contracted at a 0.6% annual rate. The BEA had preliminarily estimated GDP to shrink by 0.9% in the second quarter.

Investors weighed the implications of interest rates staying high for a longer time. The yield on the 10-year Treasury bond nudged higher by 0.05% for the week to 3.04%.

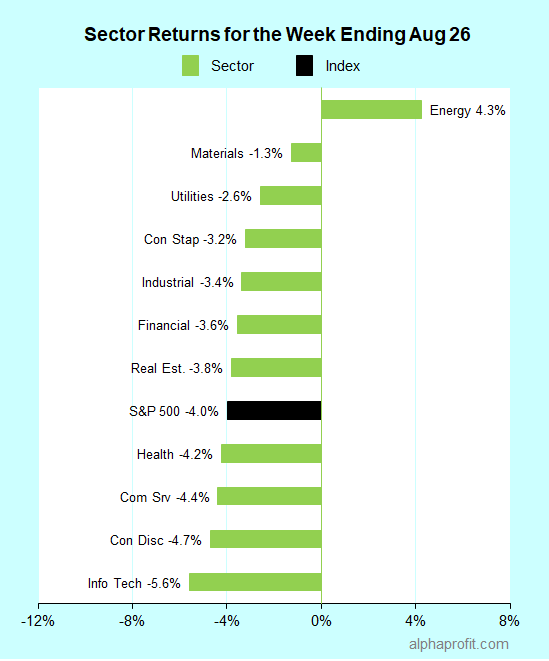

For the week ending August 26, the S&P 500 (SPY) fell 4.0%. Ten of the 11 sectors declined.

Among the S&P 500 sectors, energy (XLE) was the sole winner while information technology (XLK) lost the most.

The S&P 500’s top 10 winners included the following:

1. Materials Sector

- The Mosaic Company (MOS) +15% – The week’s top performer in the S&P 500.

- CF Industries Holdings, Inc. (CF) +14%

- Albemarle Corporation (ALB) +7%

2. Energy Sector

- APA Corporation (APA) +11%

- Marathon Oil Corporation (MRO) +7%

- Hess Corporation (HES) +7%

- ConocoPhillips (COP) +7%

- Pioneer Natural Resources Company (PXD) +6%

- Devon Energy Corporation (DVN) +6%

3. Consumer Discretionary Sector

- Royal Caribbean Cruises Ltd. (RCL) +7%

Top ETFs for the week

The following ETF themes worked well: uranium, China Internet and large-caps, cannabis, and oil services. The top ETFs for the week include:

- Sprott Uranium Miners ETF (URNM) 13.3%

- KraneShares CSI China Internet ETF (KWEB) 10.7%

- AdvisorShares Pure US Cannabis ETF (MSOS) 9.4%

- iShares China Large-Cap ETF (FXI) 5.2%

- VanEck Oil Services ETF (OIH) 5.1%

Looking Ahead to the Week of August 29

* The closing week of August is heavy on economic data. The Labor Department’s August employment report, due on Friday, is the week’s key event. A survey conducted by Dow Jones shows economists expect job creation in August to total 325,000, lower than July’s 528,000. They expect the unemployment rate to remain unchanged from July at 3.5%.

* Investors will also receive updates on the state of manufacturing and housing. They will look for signs of cooling home prices when Standard & Poor’s updates the Case-Shiller National Home Price Index.

* Several consumer-oriented companies report earnings this week. They include electronics retailer Best Buy; food and beverage companies Brown-Forman, Campbell Soup, and Hormel Foods; and apparel maker PVH Corp. Semiconductor maker Broadcom reports among technology names.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023