The S&P 500 rose 0.4% last week. Economic data points released during the past week surprised to the upside. Investors were worried that a resilient economy would give the Federal Reserve more room to raise interest rates to tame inflation. Inflation is back in the spotlight this week. The July reading of the U.S. consumer price index is due on Wednesday.

Several economic data points released last week showed the U.S. economy is holding up to higher interest rates.

The closely watched July jobs report showed the labor market added 528,000 jobs, compared to economists’ forecast of 258,000 in a Dow Jones survey. The unemployment rate ticked lower to 3.5%. Wage growth rose by a more-than-expected 0.5% in July, suggesting inflation could still be a problem.

The Institute of Supply Management’s services activity measure unexpectedly rose in July to 56.7%. Economists had expected the index to fall to 54.0% from 55.3% in June. The growth in orders was notably robust. Likewise, the ISM’s manufacturing activity slowed less than expected.

U.S. companies continued to outperform analysts’ second-quarter EPS expectations. FactSet data shows that 75% of S&P 500 companies have reported a positive EPS surprise. With 87% of the index members having reported, earnings are tracking year-over-year growth of 6.7% compared to the 4.0% expected on June 30.

The yield on Treasury securities rose against the backdrop of better-than-expected economic data. The yield on the 10-year Treasury note climbed 0.16% for the week, closing at 2.83%.

Overseas, the Bank of England raised its benchmark interest rate by 0.50% to 1.75%. The tension between China and the U.S. increased after U.S. House Speaker Pelosi visited Taiwan and China conducted military exercises in waters off Taiwan’s coast.

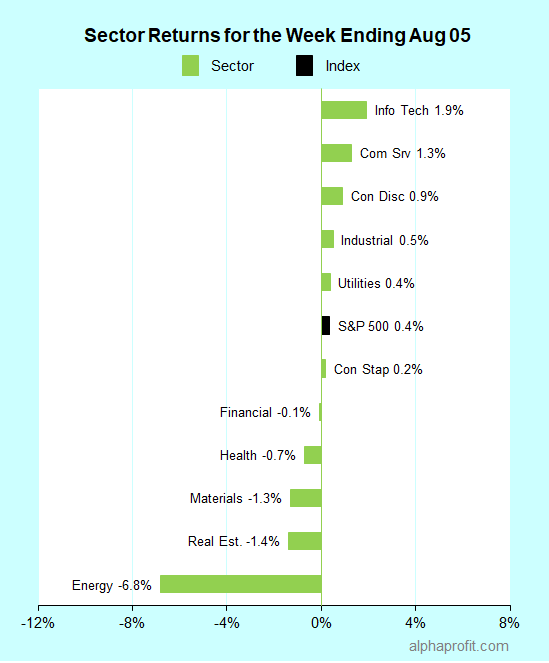

For the week ending August 05, the S&P 500 (SPY) rose 0.4%. Six of the 11 sectors advanced.

Among the S&P 500 sectors, information technology (XLK) gained the most while energy (XLE) lost the most.

The S&P 500’s top 10 winners included the following:

1. Information Technology Sector

- EPAM Systems (EPAM) +22% – The week’s top performer in the S&P 500.

- Ceridian HCM Holding (CDAY) +19%

- Monolithic Power Systems (MPWR) +15%

- Paycom Software (PAYR) +12%

- Gartner (IT) +11%

- ServiceNoW (NOW) +11%

2. Health Care Sector

- Moderna (MRNA) +14%

3. Utilities Sector

- Constellation Energy (CEG) +12%

4. Communication Services Sector

- DISH Network (DISH) +11%

5. Financial Sector

- PayPal (PYPL) +10%

Top ETFs for the week

The following ETF themes worked well: high-growth or story stocks in biotech, Internet, FinTech, and cloud computing. The top ETFs for the week include:

- SPDR S&P Biotech ETF (XBI) 13.8%

- ARK Next Generation Internet ETF (ARKW) 13.5%

- ARK Fintech Innovation ETF (ARKF) 13.4%

- WisdomTree Cloud Computing Fund (WCLD) 11.8%

- ARK Innovation ETF (ARKK) 10.9%

Focus Shifts Back to Inflation the Week of August 08

* Inflation data take center stage this week. The July consumer price index (CPI) data is due on Wednesday. Economists surveyed by Dow Jones expect the consumer price index to increase 0.3% month-over-month in July, down from 1.3% in June. Core CPI, which excludes food and energy components, is expected to rise by 0.6%. The data on inflation at the wholesale level is due on Thursday.

* Investors will monitor the response of U.S. Treasury yields to inflation data. As bond yields surged last week, the difference in yield between 2-year and 10-year securities widened further. The yield curve is now as inverted as it was in September 2000. An inverted yield curve has often preceded a recession.

* The second quarter earnings reporting season moves closer to its end. Entertainment giant Disney, utility Dominion Energy, industrial company Emerson Electric, food distributor Sysco, and insurer American International Group are due to report this week.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023