U. S. stocks swung by a wide margin as investors reacted to earnings reports. Facebook set a U. S. record for the highest one-day loss in market capitalization. A day later, Amazon created a U. S. record for the highest one-day increase in market capitalization. Job creation in January exceeded economists’ forecast by a wide margin. The 10-year bond yield surged to pre-pandemic levels.

The Labor Department reported the economy added 467,000 jobs in January. The number significantly exceeded economists’ estimate of 150,000. Economists had expected the omicron variant to impact job creation. Surprisingly, wages grew 5.7% year-over-year, exceeding economists’ 5.2% forecast.

The January jobs report and comments on inflation from the Bank of England and the European Central Bank boosted bond yields. The yield on the 10-year Treasury note increased 0.15% for the week. It closed at 1.93%, a level last seen before the pandemic in 2019.

Stock prices swung by a wide margin. Facebook parent Meta Platforms fell over 26% in a single day after posting disappointing quarterly results and forecasts. The decline wiped out more than $200 billion off Meta Platform’s market capitalization, the highest one-day loss in the value of a U. S. company.

On the brighter side, a robust quarterly report from Amazon helped its shares to a one-day gain of 14%. Amazon’s market capitalization increased by nearly $190 billion, the highest single-day increase in the value of a U. S. company.

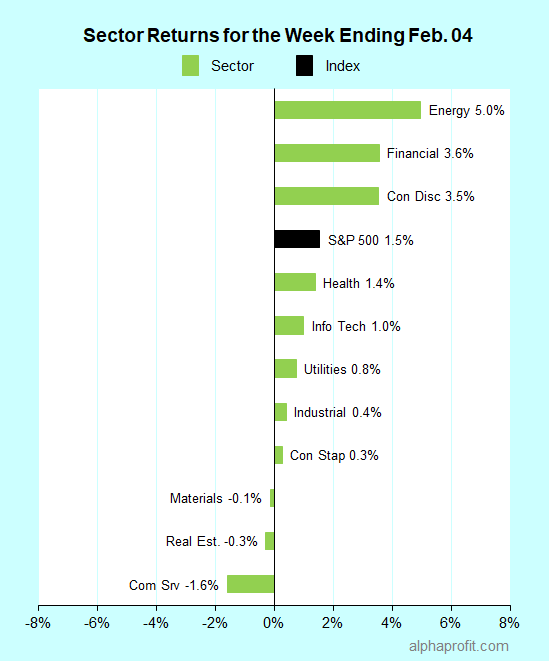

For the week ending February 04, the S&P 500 (SPY) rose 1.5%. The benchmark closed above the psychologically important 4,500 mark, regaining its hold on its 200-day moving average. Eight of the 11 sectors gained.

Market breadth was positive. The number of advancing stocks in the S&P 500 exceeded the number of decliners by a 2-to-1 ratio.

Energy (XLE), financials (XLF), and consumer discretionary (XLY) led the S&P 500, rising 3.5% or more.

Communication services (XLC), real estate (XLRE), and materials (XLB) lost ground.

The S&P 500’s top 10 winners included six information technology companies. One company from the communication services, health care, industrial, and materials sectors accounted for the remaining four.

1. Information Technology

Value-priced shares of DXC Technology (DXC) surged 21% to be the week’s top performer in the S&P 500. The IT services company reported $0.92 in quarterly EPS, a penny above analysts’ estimate. DXC also reaffirmed its fiscal year 2024 revenue growth and EPS forecasts.

Semiconductor chip makers Advanced Micro Devices (AMD) and Xilinx (XLNX) rose 17% each. AMD reported blowout revenues and EPS that beat analysts’ forecasts by 7% and 21%, respectively. The company also forecasted revenue to grow 31% in 2022. With AMD is in the process of buying Xilinx in stock, the latter’s shares rode the rally in the former.

Enphase Energy (ENPH) up 14%, SolarEdge Technologies (SEDG) up 12%, and Fortinet (FTNT) up 11% were the other three winners.

2. Industrials

United Parcel Service (UPS) + 13% – The logistics and freight titan topped analysts’ quarterly revenue and sales estimates by 3% and 16%, respectively. UPS also upped its quarterly dividend by 48% to $1.52 a share.

3. Health Care

Bio-Techne Corp. (TECH) +12% – The life sciences research instruments and reagents provider life sciences topped analysts’ EPS forecast by 5%. Bio-Techne also approved a new $400 million share buyback program.

4. Materials

Nucor (NUE) +11% – The steel maker’s shares continued their advance from the previous week when Nucor reported robust earnings. Stellar earnings from competitor Steel Dynamics (STLD) extended the rally in Nucor shares this week.

5. Communication Services

T-Mobile (TMUS) +11% – The wireless services provider posted $0.34 in quarterly EPS versus analysts $0.13 forecast. Analysts appeared unfazed with T-Mobile’s revenues and 2022 forecasts lagging expectations.

Top ETFs for the week

The following ETFs themes worked well: cannabis, carbon credits, bitcoin, blockchain, and metals. The top ETFs for the week include:

- AdvisorShares Pure US Cannabis ETF (MSOS) +10.6%

- KraneShares Global Carbon ETF (KRBN) +8.3%

- ProShares Bitcoin Strategy ETF (BITO) +7.5%

- Amplify Transformational Data Sharing ETF (BLOK) +7.1%

- SPDR S&P Metals and Mining ETF (XME) +7.0%

Top Fidelity Fund for the week

- Fidelity Select Energy (FSENX) +5.3%

Inflation and Earnings to Fuel Volatility in the week of February 7

Investors brace for more volatility this week with inflation data in focus. Earnings reports from nearly a sixth of the S&P 500 companies are due this week.

* Investors’ attention turns to inflation data this week after job creation in January surprised to the upside, leading to the possibility of the Federal Reserve aggressively raising interest rates.

* The Labor Department reports the consumer price index on Thursday. According to Briefing.com, economists expect the headline CPI to rise 0.5% in January, matching the December tally. Economists expect the CPI to rise 0.5% in January, excluding food and energy costs. In December, CPI rose 0.6%, excluding food and energy costs. The economic calendar also includes the reading from the University of Michigan’s consumer sentiment survey.

* The earnings calendar includes reports from about 80 S&P 500 members. They include Amgen, CVS Health & Pfizer from health care, Disney from communication services, and Coca-Cola, PepsiCo & Philip Morris International from consumer staples.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023