Stocks moved choppily this week. Investors worried that high inflation, a tight job market, and resilient consumer spending would prompt the Fed to pursue a restrictive interest rate policy. The President’s Day holiday on Monday shortens this trading week. The highlight of this short week is the update on the Fed’s preferred inflation measure for January.

U.S. stocks moved choppily this week as economic data gave investors angst.

Inflation in consumer as well as wholesale prices topped economists’ forecasts. The U.S. core consumer price index, which excludes food and energy components, rose 0.4% in January, marking a 5.6% increase from a year ago. Economists surveyed by Dow Jones expected increases of 0.3% and 5.5%, respectively.

The U.S. producer price index, which tracks inflation in wholesale prices, rose at the highest rate in seven months. The PPI rose 0.7% in January, topping economists’ forecast for a 0.4% increase.

Meanwhile, other economic reports showed that consumer spending is strong, and the labor market is tight. The Commerce Department reported that retail sales surged 3.0% in January, compared to economists’ 1.9% growth forecast. The Labor Department showed that the initial claims for unemployment benefits dipped by 1,000 to 194,000 for the week ending February 11.

Several Fed officials expressed concern that inflation is not subsiding quickly enough, implying the central bank needs to continue hiking interest rates.

Market participants raised their expectations for the terminal interest rate to the 5.25–5.50% range. They also upped their forecasts for interest rates to remain high through 2023.

The yield on the 10-year Treasury note rose by 0.09% to close the week at 3.83%.

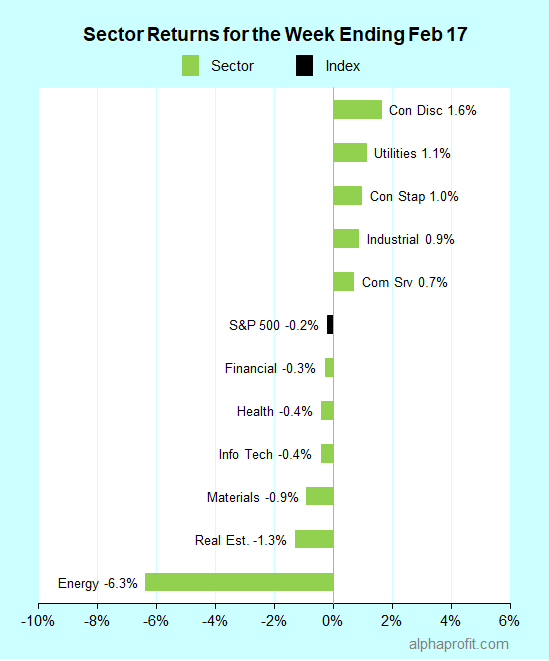

For the week ending February 17, the S&P 500 (SPY) fell 0.2%. Five of the 11 sectors gained. Consumer discretionary (XLY) gained the most, while energy (XLE) lost the most.

The S&P 500’s top 10 winners included the following:

1. Healthcare Sector

- West Pharmaceutical, (WST) +16% – The week’s top performer in the S&P 500.

- Zoetis (ZTS) +9%

- Illumina (ILMN) +8%

2. Materials Sector

- Ecolab (ECL) +11%

3. Communication Services Sector

- Paramount Global (PARA) +10%

- Warner Bros. Discovery (WBD) +9%

4. Industrial Sector

- Generac Holdings (GNRC) +9%

5. Consumer Discretionary Sector

- Norwegian Cruise Line Holdings (NCLH) +9%

6. Information Technology Sector

- Analog Devices (ADI) +8%

- Cisco Systems (CSCO) +7%

Top ETFs for the week

The following ETF themes worked well: cryptocurrencies, bitcoin, high-growth companies, innovation, fintech, foreign stocks, Mexico, and France. The top ETFs for the week include:

- ProShares Bitcoin Strategy ETF (BITO) +14.6%

- ARK Innovation ETF (ARKK) +6.9%

- ARK Fintech Innovation ETF (ARKF) +4.3%

- iShares MSCI Mexico ETF (EWW) +4.0%

- iShares MSCI France ETF (EWQ) +3.1%

Inflation To Stay in Focus This Week

* The Bureau of Economic Analysis (BEA) will release the Personal Consumption Expenditures (PCE) Price Index for January on Friday. Economists surveyed by Dow Jones expect inflation to continue trending lower. They expect the core PCE price index, which excludes food and energy costs, to rise 4.3% year-over-year in January, down from 4.4% in December.

* The fourth-quarter earnings reporting season is coming to an end. The S&P 500 members reporting this week include a mix of consumer, healthcare, and technology names such as Walmart, Home Depot, Booking Holdings, Medtronic, Moderna, NVIDIA, and Intuit.

* Minutes from the Federal Reserve’s recent interest rate policy meeting are due on Wednesday. The Fed raised the federal funds’ benchmark interest rate by 0.25% to the 4.50-4.75% range after this meeting ended on February 1.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023