The S&P 500 fell 3.2%, its third consecutive weekly decline. Investors worried that global central banks would raise interest rates rapidly to counter inflation. The continuation of Europe’s natural gas crisis ended the rally sparked by an inline U.S. August jobs report. Trading this week is a four-day affair due to the Labor Day holiday. Apple’s annual product launch convention is the main event of the short trading week.

Stocks extended the decline from the prior week’s Jackson Hole event on fears of the Federal Reserve and other central banks raising interest rates rapidly to counter inflation.

The Labor Department reported job openings rose to 11.3 million in July, from an upwardly revised 10.0 million in June, to escalate such fears.

The August jobs report, however, brought some calm. It showed the U.S. economy added 315,000 new jobs last month, roughly in line with expectations of 318,000 jobs from a survey of economists by The Wall Street Journal.

Average hourly earnings rose 0.3% compared to economists’ 0.4% estimate. The unemployment rate roseto 3.7% from 3.5%, suggesting that the Fed’s efforts to front-load interest rate hikes were beginning to take effect.

Stocks attempted to rally after investors perceived the above as “Goldilocks” jobs data.

The rally, however, was cut short when the expected easing of the European natural gas crisis did not occur. Citing an oil leak, Russia’s Gazprom delayed the planned resumption of natural gas exports to the continent last Saturday. Gazprom did not provide a new time frame for gas exports to resume.

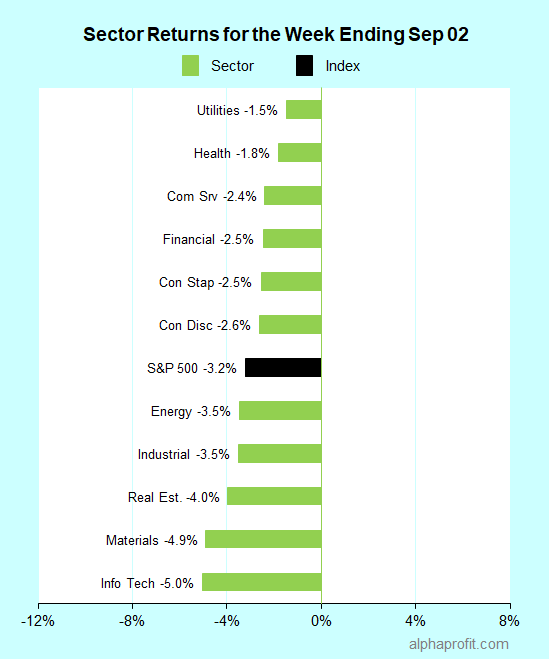

For the week ending September 02, the S&P 500 (SPY) fell 3.2%. All of the 11 sectors declined.

Utilities (XLU) fell the least, while information technology (XLK) lost the most.

The S&P 500’s top 10 winners included the following:

1. Information Technology Sector

- DXC Technology Company (DXC) +13% – The week’s top performer in the S&P 500.

2. Healthcare Sector

- Cardinal Health, Inc. (CAH) +5%

- Gilead Sciences, Inc. (GILD) +2%

- McKesson Corporation (MCK) +2%

3. Consumer Discretionary Sector

- Bath & Body Works, Inc. (BBWI) +4%

- Ulta Beauty, Inc. (ULTA) +3%

4. Consumer Staples Sector

- Dollar General Corporation (DG) +3%

- Target Corporation (TGT) +2%

5. Utilities Sector

- The AES Corporation (AES) +2%

6. Financial Sector

- MarketAxess Holdings Inc. (MKTX) +2%

Top ETFs for the week

The following ETF themes worked well: uranium, U.S. dollar, India, floating rate debt, short duration debt. The top ETFs for the week include:

- Sprott Uranium Miners ETF (URNM) 3.6%

- Invesco DB US Dollar Index Bullish Fund (UUP) 0.9%

- iShares MSCI India ETF (INDA) 0.6%

- WisdomTree Floating Rate Treasury Fund (USFR) 0.1%

- Invesco Ultra Short Duration ETF (GSY) 0.1%

Will Apple Turn the Market Around the Week of September 05

* Apple’s annual convention is the main event of the week. This year’s conference is on Wednesday is titled “Far Out.” Apple is expected to unveil several new products, including the iPhone 14 series.

* The Institute of Supply Management updates its U.S. service activity measure. Economists surveyed by Dow Jones expect the index to dip to 55.5 from 56.7 in July. The Federal Reserve releases its “Summary of Commentary on Current Economic Conditions,” also known as the “Beige Book.”

* The European Central Bank (ECB) holds its interest rate policy meeting. Economists expect the ECB to raise benchmark interest rates by at least 0.50%. The ECB is under pressure to raise rates by larger increments from rising inflation and a falling euro. Eurozone’s inflation rate hit a new all-time high of 9.1% in August.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023