Producer price and service activity measures pointed to higher inflation and stronger economic growth. The yield on the 10-year bond was range-bound after investors accepted the Federal Reserve’s assurance on interest rates staying low for a substantial period. Growth stocks flourished in this milieu.

The Labor Department’s data showed the rate of wholesale inflation for the 12 months ending in March was 4.2%, the highest since September 2011. The U. S. producer-price index rose 1.0% in March, higher than economists 0.5% forecast. Supporting expectations of strong economic growth, the Institute for Supply Management’s non-manufacturing activity index jumped to a record high of 63.7 in March.

Investors stayed calm to signs of higher inflation and stronger growth. They bought into Federal Reserve Chair Powell’s assurance that the Fed is expecting a transitory spike in inflation. Powell called the recovery from the pandemic ‘uneven’, supporting the central bank’s policy to keep interest rates lower for a substantial period.

The yield on the 10-year Treasury bond closed essentially unchanged last week from its April 1 close. The range-bound bond yield helped growth stocks outperform value names.

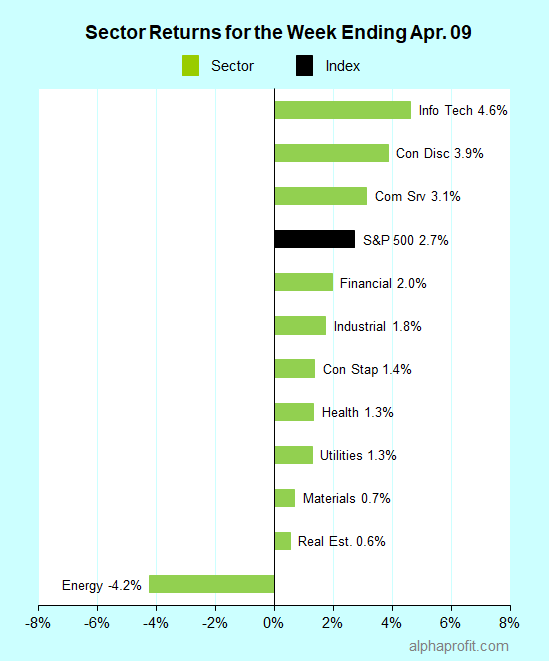

For the week ending April 9, the S&P 500 (SPY) rose 2.7%. Ten of the 11 sectors gained with energy being the sole loser.

Information technology (XLK), consumer discretionary (XLY), and communication services (XLC) led the S&P 500.

Energy (XLE), real estate (XLRE), and materials (XLB) lagged the benchmark.

Market breadth was strong. The number of advancing stocks in the S&P 500 beat the number of decliners by a 10-to-3 ratio.

Consumer discretionary companies accounted for six of the S&P 500’s top 10 winners. Communication services, health care, and information technology companies rounded out the top 10.

1. Communication Services

Twitter (TWTR) shares rose 12% to claim the top spot among the S&P 500’s winners for the week. Twitter shares benefited from the broad strength in social media shares.

2. Consumer Discretionary

Shares of cruise operators Norwegian Cruise Line (NCLH) and Carnival (CCL) rose 10% and 9%, respectively. Bloomberg reported that the Centers for Disease Control and Prevention recommended cruises could resume this summer with certain restrictions. Norwegian announced plans to resume cruises in the Caribbean and Greece in July while Carnival reported a significant improvement in future cruise bookings.

Retailer shares were strong with Tapestry (TPR), PVH Corp. (PVH), The Gap (GPS), and L Brands (LB) gaining 8-10% each. Mastercard reported robust online spending on apparel in the second half of March after Americans received their stimulus checks.

3. Information Technology

Apple (AAPL) shares were up 8%. Analysts commented on the inclination of U. S. consumers to spend their tax refunds and stimulus checks on iPhone 12 devices after its sales picked up in March. Foxconn, Apple’s contract manufacturer, reported strong year-over-year growth in sales, adding to bullishness.

Top ETFs for the week

The following ETFs were among the biggest winners last week:

- Sprott Junior Gold Miners ETF (SGDJ) +6.5%

- iShares MSCI Brazil Small-Cap ETF (EWZS) 6.1%

- HCM Defender 100 Index ETF (QQH) 5.4%

- iShares U.S. Technology ETF (IYW) 4.7%

- Vanguard Mega Cap Growth Index Fund ETF Shares (MGK) 4.6%

Looking ahead to the week of April 12

Trading gets off this week with the S&P 500 at a record high. Banks kick off the first-quarter earnings reporting season. Analysts have atypically raised first-quarter EPS forecasts ahead of the reporting season. Investors will watch consumer price and retail sales data to assess strength in inflation and economic growth.

* The first-quarter earnings reporting season starts this week. Departing from the norm, analysts have raised EPS growth estimates ahead of this reporting season. They expect S&P 500 companies to grow earnings by 24.5% in the first quarter. This is up from their forecast of 15.8% EPS growth on December 31, 2020. Financials are the first to report. Bank of America, Citigroup, JPMorgan, Goldman Sachs, and Wells Fargo report this week. Investors are likely to focus on loan demand and outlook to get a sense of the strength of the economy in 2021. Positive commentaries can give stocks another leg up.

* In the economic calendar, Wall Street’s attention is on the consumer price index and retail sales. Economists polled by Dow Jones forecast expect headline CPI and core CPI to rise 0.5% and 0.2%, respectively, in March. The CPI data have the potential to unnerve investors. One-year inflation may appear high since it is now based on the year-ago period impacted by shutdowns. Retail sales in March should reflect the impact of stimulus checks, vaccinations, and pick-up in outdoor activity. Economists forecast retail sales to gain 5.6% in March after declining 3.0% in February.

* Fed Chair Powell shares his views on the economy in a Sunday evening interview on 60 Minutes and follows it with a speech at an Economic Club of Washington event on Wednesday.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023