The S&P 500 index closed the first week of the earnings reporting season at an all-time high. Major banks posted robust first-quarter results. Economic data reflected continued recovery from the pandemic. The yield on the 10-year Treasury bond fell, completing the picture of a goldilocks economy.

The S&P 500 index extended its winning streak to four weeks. It closed the opening week of the earnings reporting season at an all-time high. The Dow Jones Industrial Average scaled 34,000 for the first time, crossing a thousand-point marker for the fourth time in 2021.

First-quarter earnings reports helped to boost investor optimism. The nation’s biggest banks reported results suggestive of an improving economy. According to FactSet, S&P 500 members reporting earnings show year-over-year growth of 30.2% on average.

Economic data showed fiscal stimulus and rapid rollout of vaccines are accelerating the economy’s recovery from the pandemic. Retail sales, consumer sentiment, and weekly unemployment claims data were better-than-expected.

The yield on the 10-year Treasury bond declined by 0.09% to end the week at 1.57%. Investors continue to believe the uptick in inflation would prove temporary. Lower-than-expected capacity utilization also served to keep inflation fears at bay. This backdrop of falling yields helped to spur demand for technology stocks.

Strong economic growth and lower bond yields rounded out the picture of a goldilocks economy, helping stocks to stage a broad advance.

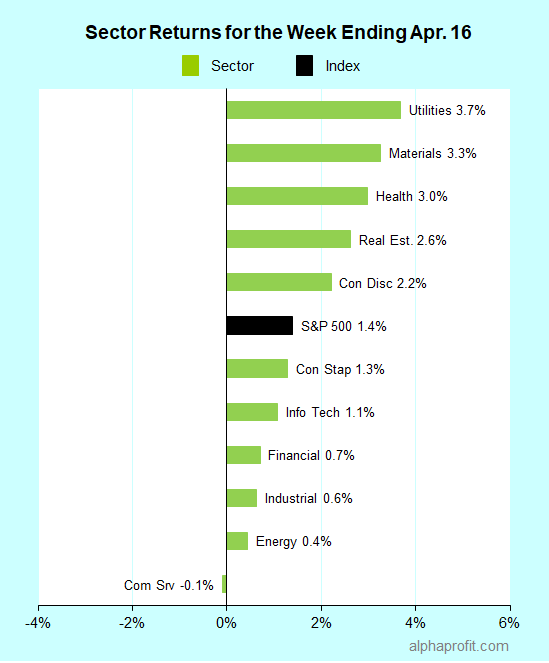

For the week ending April 16, the S&P 500 (SPY) rose 1.4%. Ten of the 11 sectors gained with communication services being the sole loser.

Utilities (XLU), materials (XLB), and health care (XLV) led the S&P 500 gaining 3.0% or more.

Communication services (XLC), energy (XLE), and industrials (XLI) lagged the benchmark.

Market breadth was strong. The number of advancing stocks in the S&P 500 beat the number of decliners by a 10-to-3 ratio.

Materials companies accounted for four of the S&P 500’s top 10 winners. Consumer discretionary, consumer staples, financial, health care, and information technology companies rounded out the top 10.

1. Materials

Freeport-McMoRan (FCX) +12% – Copper producer claimed the top spot among the S&P 500’s winners for the week as the red metal’s price rose on brightening prospects for its demand to increase from the green transition.

PPG Industries (PPG) +11% – Paint maker beat Q1 EPS expectations and issued strong guidance.

Newmont Corp. (NEM) +6% – Goldminer benefited from the yellow metal’s rally to a six-month high on lower U. S. dollar and falling bond yields.

The Mosaic Co. (MOS) +6% – Analysts at Berenberg and RBC raised the fertilizer producer’s share price targets, expecting higher phosphate & potash prices.

2. Information Technology

NVIDIA Corp. (NVDA) +11% – Semiconductor chipmaker raised first-quarter revenue and EPS guidance and was upgraded by a Raymond James analyst to Strong Buy.

3. Consumer Discretionary

Tesla (TSLA) +9% – Electric carmaker’s shares gained from higher demand for growth stocks as bond yields fell. Positive comments from Credit Suisse and Canaccord Genuity analysts helped.

Other Top 10 Winners

The S&P 500’s top 10 winners for the week included:

- Major bank Wells Fargo (WFC) +8%

- Brewer Molson Coors (TAP) 7%

- Alcoholic beverage producer Constellation Brands (STZ) 7%

- Veterinary diagnostics firm IDEXX Laboratories (IDXX) 6%

Top ETFs for the week

The following ETFs themes worked well: biotech, copper, palladium, and Russia:

- ETFMG Treatments, Testing and Advancements ETF (GERM) +8%

- Global X Copper Miners ETF (COPX) 6%

- iShares MSCI Global Metals & Mining Producers ETF (PICK) 5%

- VanEck Vectors Russia ETF (RSX) 5%

- Aberdeen Standard Physical Palladium Shares ETF (PALL) 5%

Looking ahead to the week of April 19

Earnings season gets busier. Reports from consumer discretionary, consumer staples, and industrials companies will provide investors with an opportunity to gauge inflationary pressures in the economy. Investors will focus on profit margin-related comments from companies and bond yields.

* Earnings season gets into a higher gear this week, broadening beyond the financial sector. Reporting companies include homebuilder D. R. Horton, consumer staples giant Procter & Gamble, and industrials heavyweight Honeywell. Wall Street will parse earnings reports to assess the buildup of inflationary pressures in the economy. They will focus on the impact of the higher copper, lumber, and oil prices this year on profit margins.

* The yield on the 10-year Treasury bond has trended lower in April. It stands at 1.57%, down 0.2% from its late-March high. With the economic data calendar relatively light, investors will monitor bond yields for a possible trend reversal.

* The back-and-forth switch in leadership between growth stocks and value stocks is likely to continue with the direction of bond yield changes determining the investing style in favor.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023