Stocks traded choppily before ending the week with a fractional loss. Better-than-expected earnings reports and economic data lifted stocks. They, however, gave up the gains and some more, on worries of higher capital gain taxes leading to a decline in stocks.

U. S. companies continued to impress with their first-quarter earnings reports. Nearly 84% of reporting companies topped analysts’ earnings forecasts. The reporting companies on average grew their earnings by 33.8% from the year-ago period.

U. S. economic data exceeded expectations as layoffs from the pandemic subsided and housing demand improved. The number of people filing new unemployment benefit claims fell to a one-year low of 547,000. Sales of new single-family homes rose 20.7% month-over-month to 1.02 million in March.

Stocks gave up their gains for the week and then some on Thursday. News outlets reported President Biden would increase capital gains taxes on wealthy Americans to partly fund his $2 trillion infrastructure plan. The proposal would raise the capital gains tax rate to 39.6% from 20% on individuals making more than $1 million a year.

Meanwhile, Republican senators developed a counter-proposal to Biden’s infrastructure plan with a $568 billion framework for funding bridges, airports, roads, and water storage without tax increases.

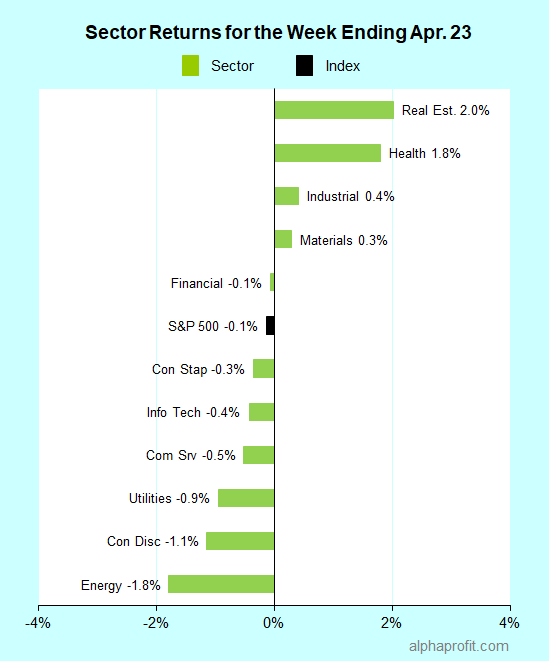

For the week ending April 23, the S&P 500 (SPY) fell 0.1%. Four of the 11 sectors gained.

Real estate (XLRE), health care (XLV), and industrials (XLI) gained to lead the S&P 500.

Energy (XLE), consumer discretionary (XLY), and utilities (XLU) lagged the benchmark.

The number of declining stocks in the S&P 500 beat the number of advancers by a 3-to-2 ratio.

The S&P 500’s top 10 winners included companies from the industrial, communication services, consumer discretionary, and information technology sectors.

1. Industrials

Equifax (EFX) +20% – The credit reporting agency reported higher-than-expected sales & EPS for the quarter and raised full-year forecasts to claim the top spot among the S&P 500’s weekly winners.

Kansas City Southern (KSU) +17% – The railroad’s shares surged after it became the target of a bidding war. Canadian National Railway offered $325 per Kansas City Southern share, topping Canadian Pacific’s $275 a share offer.

2. Communication Services

DISH Network (DISH) +12% – The satellite TV company moved closer to becoming the fourth national wireless player. DISH Network formed a partnership with Amazon Web Services to operate a cloud-based 5G network in Las Vegas.

3. Consumer Discretionary

Pool Corp. (POOL) +10% – The swimming pool distributor surprised investors, beating quarterly sales and EPS forecasts by 30% and 110%, respectively. Demand for residential pool products rose from the stay-at-home trend.

4.Information Technology

Enphase Energy (ENPH) +11% – The energy technology company’s shares rose after the U. S. doubled its emissions reduction target, pledging to cut emissions by 50-52% from the 2005 level by 2030.

Seagate Technology (STX) +9% – The data storage devices maker reported higher-than-expected sales & EPS for the quarter and raised its full-year EPS forecast.

Top ETFs for the week

The following ETFs themes worked well: Chinese stocks, solar & clean energy, lithium & battery technology. Top ETFs for the week include:

- KraneShares MSCI All China Health Care Index ETF (KURE) +9%

- Invesco Solar ETF (TAN) +6%

- Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR) +4%

- First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) +4%

- Global X Lithium & Battery Tech ETF (LIT) +4%

Top Fidelity Fund for the week

- Fidelity Select Medical Technology and Devices Portfolio (FSMEX) +2.3%

Looking ahead to the week of April 26

The last week of April is a busy one that includes earnings reports, new spending & tax proposals from the White House, and a Federal Reserve meeting. Investors will also get a read on first-quarter gross domestic product growth and inflation. Tax proposals and inflation may well have the final say in determining how stocks end April.

* Nearly a third of the S&P 500 members report earnings this week. The reporting companies include several mega-cap growth favorites such as Alphabet, Amazon, Apple, Facebook, and Microsoft. Investors will look to reports from Boeing, Caterpillar, Ford, and McDonald’s to assess the impact of rising materials & transportation costs on inflation.

* Wall Street will focus on government spending and taxes when President Biden addresses a joint session of Congress on Wednesday evening. Biden is expected to detail his ‘American Families Plan’ aimed at helping families. He is also expected to propose higher capital gains taxes on wealthy Americans to pay for this plan.

* The Federal Open Market Committee meets on Tuesday and Wednesday to discuss interest rate policy. No change is expected. The Fed is likely to continue reassuring markets on the pick-up in inflation being temporary.

* In economic data, the Commerce Department provides its first estimate for U. S. first-quarter gross domestic product growth. Economists surveyed by Dow Jones expect 6.5% growth in the first quarter. Investors will also get a read on inflation from the personal consumption expenditure report. The Fed’s preferred inflation measure is expected to show core inflation of 1.8%.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023