Strong earnings from technology titans and comforting comments from the Fed helped stocks maintain their uptrend even as economic data and Congress threatened to derail them. For once, the continuing increase in the COVID-19 case count appeared to slip to the backburner.

With nearly 170 of the S&P 500 members reporting last week, earnings reports played a key role in impacting stock prices. Most notably, strong earnings from Apple, Amazon, and Facebook helped the large-cap stock indexes to advance. Supporting the rally, the Federal Reserve reiterated its pledge to support the U. S. economy until the COVID-19 threat passes.

In economic data, the Commerce Department estimated the U. S. gross domestic product to have contracted at a 32.9% annualized rate in the second quarter, its steepest contraction since the Great Depression.

Congressional Democrats, Republicans, and the White House were at odds on the new coronavirus relief bill while the $600 per week enhanced unemployment benefits expired at the end of the week.

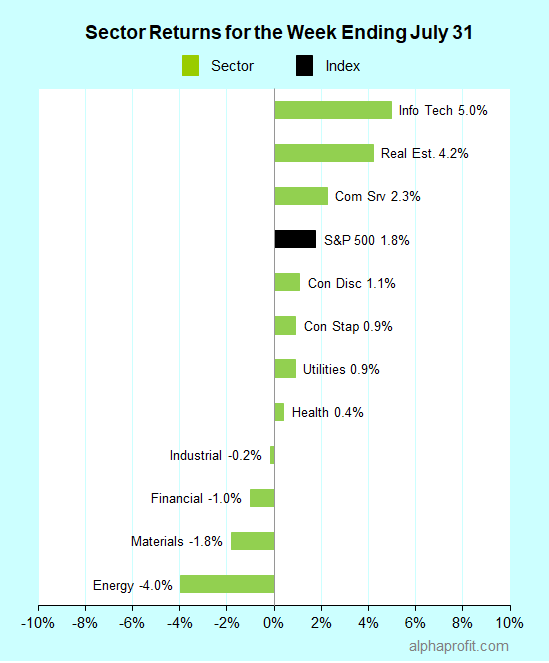

For the week ending July 31, the S&P 500 (SPY) rose 1.8%.

However, advancers in the S&P 500 edged out decliners only by a slim 7-to-6 ratio.

Seven of the 11 sectors gained.

Information technology (XLK), real estate (XLRE), and communication services (XLC) led the S&P 500 (SPY).

Energy (XLE), materials (XLB), and financials (XLF) lagged the benchmark.

As many as 17 of the S&P 500 members advanced double-digits.

With a gain of 27%, shares of apparel retailer L Brands (LB) was the week’s top performer in the S&P 500. The owner of the Bath & Body Works and Victoria’s Secret retail chains announced plans to cut $400 million in annual costs and reaffirmed its commitment to separate the Bath & Body Works and Victoria’s Secret businesses.

The S&P 500’s top 10 winners included several mega-cap companies that reported quarterly earnings.

1. United Parcel Service (UPS) up 21%

The package delivery giant benefited as demand for deliveries spiked from an increase in online shopping due to the pandemic. UPS reported $2.13 per share in second-quarter EPS on sales of $20.5 billion, beating analysts’ $1.07 per share EPS forecast on estimated sales of $17.5 billion.

2. Qualcomm (QCOM) up 19%

The smartphone chipmaker announced a settlement, as well as a new long-term, global patent license agreement with Huawei. Qualcomm also reported EPS of $0.74 a share in its fiscal third-quarter, higher than the $0.44 a share analysts’ forecast. The company’s sales guidance for the current quarter topped analysts’ estimate.

3. Apple (AAPL) up 15%

The consumer electronics titan known for its iPhones, iPads, and Macs reported $2.58 in fiscal third-quarter EPS on $59.7 billion sales. Both metrics topped analysts’ estimates, rising 18% and 11% year-over-year, respectively. While Apple did not guide for the current quarter, it announced a 4-for-1 stock split.

Other double-digit gainers in the top 10 winners included:

- Qorvo (QRVO) up 15% and PayPal (PYPL) up 14% from the technology sector

- Hologic (HOLX) up 13% and Varian (VAR) up 12% from the health care sector

- Church & Dwight (CHD) up 12% from the consumer staples sector

- Leggett & Platt (LEG) up 12% from the consumer discretionary sector

Looking ahead to the week of August 3

* Wall Street will be focused on politics next week. Investors are concerned over the delay in extending the enhanced unemployment benefits. They are watching to see if Congress can come together and approve the next stimulus package in the first week of August. The likely Democratic Presidential nominee, Biden is also expected to name his running mate in the coming week.

* While another busy earnings week is in store, it does not have the same buzz as the past one when four of the five FAANG members reported. Booking Holdings (BKNG), Bristol-Myers Squibb (BMY), CVS Health (CVS), Disney (DIS), Fiserv (FISV), and T-Mobile US (TMUS) are among the 120 S&P 500 members reporting this week.

* In economic data, the July jobs report is the big one particularly in light of recent weekly jobless claims data showing a loss of momentum in hiring. According to Refinitiv, economists estimate 1.4 million jobs to have been added in July. They expect the unemployment rate to fall to 10.7%.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023