Record-breaking upside surprises in the second-quarter earnings reports and the stronger-than-expected July jobs report boosted investors’ confidence in the economy. The number of daily new COVID cases rose seven-fold in July. Stocks closed the week at record highs, while the yield on the 10-year Treasury bond nudged higher.

Corporate America’s impressive stretch of second-quarter earnings reports continued. Of the nearly 450 of the S&P 500 members reporting earnings this quarter, 87% have topped earnings expectations. According to FactSet, the second quarter is on track to be best for earnings surprises since at least 2008.

The Labor Department reported the economy added 943,000 nonfarm jobs in July compared to economists’ 845,000 forecast. Job creation in July rose 5,000 from the June tally. The unemployment rate fell from 5.9% in June to 5.4% in July, marking a 16-month low. Wage inflation showed a 4% increase over the past year.

The jobs report soothed concerns of the economy faltering from the renewed surge in COVID casts. The 10-year Treasury yield turned around to close the week at 1.29%, after hitting a low of 1.13% earlier in the week.

On the public health front, mask mandates reappeared as the 7-day average of daily new COVID cases surged past 100,000 a day, up from 13,000 at the beginning of July.

The U. S. Senate introduced a bipartisan infrastructure bill. The $1 trillion plan includes investments in roads, high-speed internet, and other infrastructure.

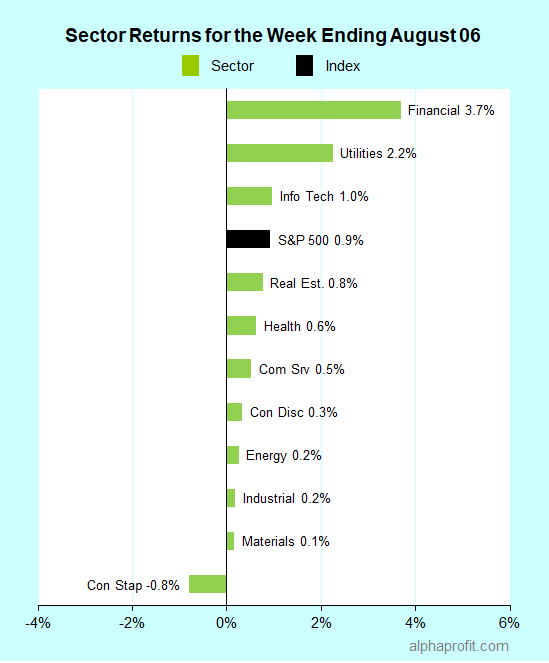

For the week ending August 6, the S&P 500 (SPY) rose 0.9%. Ten of the 11 sectors gained.

Financials (XLF), utilities (XLU), and information technology (XLK) led the S&P 500, gaining 1.0% or more.

Consumer staples (XLP), materials, and industrials (XLI) lagged the benchmark.

Market breadth was positive. The number of advancing stocks in the S&P 500 led the number of decliners by a 2-to-1 ratio.

Consumer discretionary, health care, and information technology companies accounted for eight of the S&P 500’s top 10 winners. Lithium producer Albemarle (ALB) and insurer Lincoln National (LNC) rounded out the top 10.

1. Consumer Discretionary

Under Armour (UAA) +22% – Shares of the apparel company rocketed 22% to claims honors as the week’s top performer in the S&P 500. Under Armour topped analysts’ second-quarter sales forecast by 11% and earned 24 cents a share compared to analysts’ 6 cents a share estimate. Under Armour also raised full-year sales and EPS guidance. n.

Hanesbrands (HBI) and Ralph Lauren (RL) +9% each – Shares of both apparel makers rose high single-digits after topping analysts’ quarterly sales and EPS forecasts.

2. Health Care

Moderna (MRNA) +17% – The COVID vaccine maker blew past analysts’ second-quarter sales and EPS estimates. The biotechnology company has already secured 2022 supply deals totaling $12 billion with options for another $8 billion sales. Moderna also announced its respiratory syncytial virus vaccine candidate received fast track designation from the U. S. FDA.

DaVita (DVA) +11% – The dialysis services provider topped analysts’ EPS forecast for the second quarter after widening the operating margin by 2.3% to 22.4%. DaVita also raised the mid-point of its full-year EPS guidance by 6% to $9.10 a share.

3. Information Technology

Paycom Software (PAYC) +17% – The cloud-based human resource software provider earned $0.97 a share in the second quarter, $0.14 above analysts’ forecast. Paycom bumped up its full-year sales guidance by 2%.

Fortinet (FTNT) +12% – The cybersecurity solution provider rose after UBS raised Fortinet’s share price target and Jefferies raised Fortinet’s stock rating.

Gartner (IT) +11% – The information technology market research and consulting company raised its full-year sales and EPS guidance to imply growth of 11% and 55%, respectively, after topping analysts’ second-quarter sales and EPS estimates.

Top ETFs for the week

The following ETFs themes worked well: blockchain, carbon credit, banking, semiconductor, and biotechnology. The top ETFs for the week include:

- Amplify Transformational Data Sharing ETF (BLOK) +9.2%

- KraneShares Global Carbon ETF (KRBN) +5.0%

- SPDR S&P Regional Banking ETF (KRE) +5.0%

- SPDR S&P Semiconductor ETF (XSD) +3.9%

- iShares Biotechnology ETF (IBB) +3.8%

Top Fidelity Fund for the week

- Fidelity Select Banking (FSRBX) +4.4%

Looking ahead to the week of August 09

This week is a big one for inflation and economic data. The economic calendar includes readings on inflation at the consumer and producer levels as well as consumer sentiment. The week also includes speeches from a few Federal Reserve officials. The Treasury auctions nearly $125 billion in notes and bonds this week.

* Investors will focus their attention on inflation this week after Following a better-than-expected July jobs report. The consumer price index and the producer price index come out on Wednesday and Thursday, respectively. The consumer sentiment follows on Friday. Economists polled by Dow Jones expect the core consumer price index to show a 4.3% year over year in July, a tad slower than the 4.5% rise recorded in June.

* A few Federal Reserve officials speak in the week ahead. Investors will look to their comments to help clarify the central bank’s intentions on tapering bond purchases.

* The U. S. Treasury auctions nearly $125 billion in 3-year, 10-year, and 30-year Treasuries combined. The U. S. Senate may vote on the infrastructure bill.

* Second-quarter earnings reports slow to a trickle from last week’s breakneck pace. Disney, BioNTech, Baidu, eBay, and Barrick Gold are among the companies reporting.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023