Stronger-than-expected economic data helped stocks to rally broadly last week. A slowdown in daily new COVID-19 case count also helped the cause. While the NASDAQ Composite made the headlines after claiming a new milestone, small-cap stocks gained more.

Employment data surprised to the upside. The U. S. economy added a higher-than-expected 1.76 million jobs in July. The unemployment rate fell to 10.2% from 11.1% in June. Reversing recently increases, the number of weekly jobless benefit claims fell to a three-week low of 1.19 million.

The daily number of new COVID-19 cases in the U. S. trended lower for a second straight week after peaking at over 78,000 on July 24. The 7-day average of this metric dropped to 55,000 at the end of last week, down from about 65,000 a week ago.

The effort to approve a new COVID-19 stimulus plan fell apart in Washington. The extension of the $600 a week enhanced federal unemployment benefits provided to be a sticking point. Democrats wanted to extend the benefit at the same amount while Republicans wanted a lower weekly rate.

U. S. stocks had their best August start since 2009. The technology-heavy NASDAQ Composite index crossed the 11,000 milestone for the first time. Yet, small-cap stocks were the leaders in last week’s rally. The small-cap Russell 2000 gained 6.0% while the NASDAQ Composite gained 2.5%.

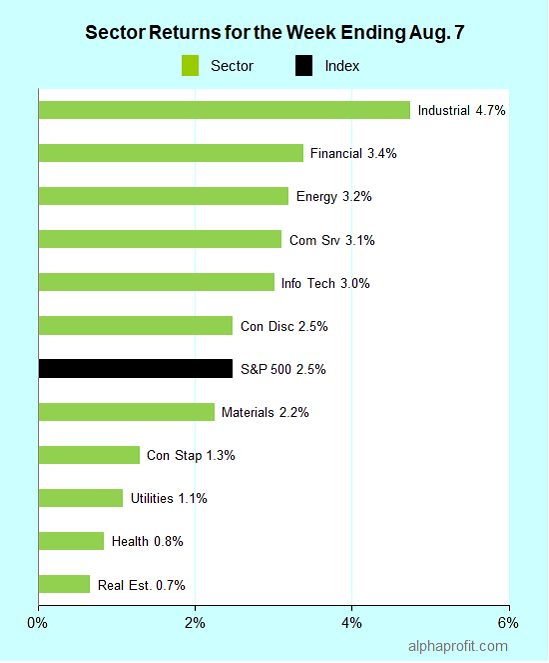

For the week ending August 7, the S&P 500 (SPY) rose 2.5%.

Advancing stocks in the S&P 500 outnumbered decliners by a wide 7-to-2 ratio.

All of the 11 sectors gained.

Industrials (XLI), financials (XLF), and energy (XLE) led the S&P 500.

Real estate (XLRE), health care (XLV), and utilities (XLU) lagged the benchmark.

As many as 24 of the S&P 500 members advanced double-digits.

The S&P 500’s top 10 winners also had a smaller market capitalization tilt for a change. Nine of them had a market capitalization below $10 billion. The top 10 winners included stocks from the materials, healthcare, and industrials sectors.

1. Materials – Mosaic (MOS) up 28% and Sealed Air (SEE) up 14%

Shares of Mosaic (MOS) were the week’s top performer in the S&P 500. The fertilizer producer surprised investors reporting $0.11 a share in the second-quarter profit compared to analysts’ forecast for $0.01 a share loss. Mosaic provided a confident assessment for the remainder of 2020, saying N. American sales volumes have improved and COVID-19 has had a limited impact on its business.

Packaging products maker Sealed Air (SEE) reported $0.76 in EPS compared to analysts’ $0.55 a share forecast. The Bubble Wrap maker also raised its full-year EPS forecast by 9%.

2. Health care – Varian Medical Systems (VAR) up 22%

The U. S. maker of cancer treatment equipment & software received a buyout offer from Germany’s Siemens Healthineers. The $16.4 billion offer translates to $177.50 per Varian share, a 24% premium.

3. Industrials – American Airlines (AAL) up 17%, Quanta Services (PWR) up 16%, and Howmet Aerospace (HWM) up 15%

American Airlines (AAL) and other airline stocks rallied after President Trump voiced his support for a bipartisan effort in Congress to provide an additional $25 billion to the struggling air carriers.

Engineering & construction firm Quanta Services (PWR) and jet engine components maker Howmet Aerospace (HWM) reported EPS above analysts’ forecasts. The former raised its full-year EPS guidance while the latter lowered it.

Other double-digit gainers in the top 10 winners included:

- MGM Resorts International (MGM) and Kohl’s (KSS) from the consumer discretionary sector up 18% and 16%, respectively

- Devon Energy (DVN) from the energy sector up 15%

- Assurant (AIZ) from the financial sector up 14%

Looking ahead to the week of August 10

* Wall Street has the first opportunity to react to President Trump’s executive orders when trading opens on Monday. On Saturday, August 8, Trump signed four orders one of which provides as much as $400 a week in enhanced unemployment benefits. The others provide payroll tax relief, extend an eviction moratorium, and allow student loan payment deferrals.

* Investors are waiting to see if the nationwide count of daily new COVID-19 declines for a third straight week. They are also awaiting China’s response to Trump’s executive orders barring U. S. companies from doing business with the Chinese social media companies Tencent (TCEHY) and ByteDance after September 20.

* The second-quarter earnings reporting season continues to taper down. Applied Materials (AMAT) and Cisco Systems (CSCO) are among the S&P 500 names that will garner investor attention. Duke Energy (DUK), Marriott International (MAR), and Sysco (SYY) report as well.

Stay on top of the stock market with ‘Looking Back, Looking Forward’

Sign up free to receive Looking Back, Looking Forward in your Inbox.

Learn more:

How AlphaProfit's investment strategy minimizes your risk

How AlphaProfit keeps your fees and expenses low

Performance of model portfolios & recommendations in AlphaProfit's Premium Service investment newsletter

AlphaProfit's free and premium investment newsletters

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

Sick buying high & selling low? Fed up of the fees you pay? Tired researching investments? End your financial pain now. You have the opportunity to

DEC. 1993 to DEC. 2023

DEC. 1993 to DEC. 2023